Europe Free of Contagion, For Now

We’re seeing a slightly softer start to trading on Thursday, much more moderate than the losses seen in parts of Asia ahead of the Chinese New Year.

Source – Thomson Reuters Eikon

The outbreak of the coronavirus has come at the worst possible time in China, just as hundreds of millions of people prepare to travel across the country and join their families for the New Year. It was therefore important for Beijing to act rapidly and drastically in order to both contain the virus and offer comfort that we are not seeing a repeat of the Sars fiasco 17 years ago.

Safe to say, quarantining more than 10 million residents of Wuhan certainly ticks both of these boxes. The measures may prove unpopular with those unable to celebrate the New Year with their families but it will be reassuring to everyone else as an immediate response.

The efforts did little to reassure investors though, who fled Chinese stocks ahead of the holiday, during which exchanges will be closed for more than a week. That’s to be expected though, a lot can happen in that time, during which investors could be heavily exposed. A little caution seems quite sensible at times like these.

The virus may have spread a little, with cases confirmed in various countries including the US, but there’s no contagion yet in stock markets. Europe is a little lower today but we can’t really attribute that to the spread of the coronavirus just yet.

Attention shifts from Davos to Frankfurt

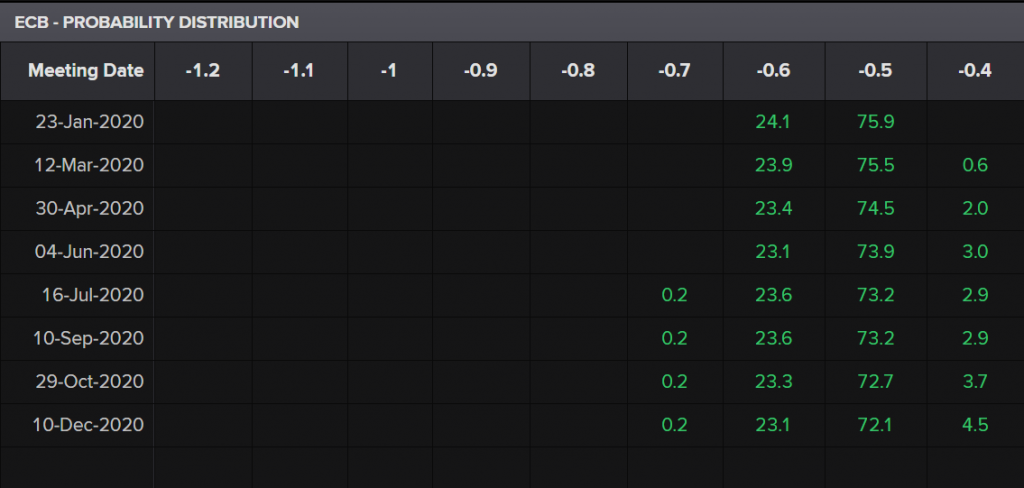

Much of the focus this week has been on Europe, more specifically the mountains of Davos where the best and brightest are gathered for the World Economic Forum. Attention will shift briefly today though to Frankfurt, where the ECB will meet and announce its latest policy decision.

While no change is expected, with Draghi’s final bazooka still working its way through the system, traders will be tuning in to hear President Christine Lagarde’s press conference and their latest assessment of the economy. We’ve seen an improvement in some survey’s recently which the board may find encouraging although this is coming from a very low base.

Source – Thomson Reuters Eikon

Gold rallies brief despite safe haven appeal

Gold may be seeing some safe haven appeal in Asia following the outbreak but at the same time, it continues to look a little overvalued so rallies have been brief and possibly even viewed as selling opportunities. Should the number of cases and fatalities spike then this may change but for now, the near-term outlook for gold still looks a little negative. A break of $1,540 could see the pace of selling pick up, although I wouldn’t be surprised if we saw further consolidation for now.

Gold Daily Chart

OANDA fxTrade Advanced Charting Platform

Brent finds temporary support

It’s been a rough few days for oil prices after peaking early this week on the back of an outage in Libya. It such a well supplied market, outages just aren’t the problem they once were and this has been highlighted by just how aggressively the initial spike was sold into. Since then, prices have spiraled, with the break of the previous January low just exacerbating the move, with stops likely being taken out along the way. Brent has seen some reprieve around $62 but this may prove temporary with $60 looking an interesting test.

Brent Daily Chart

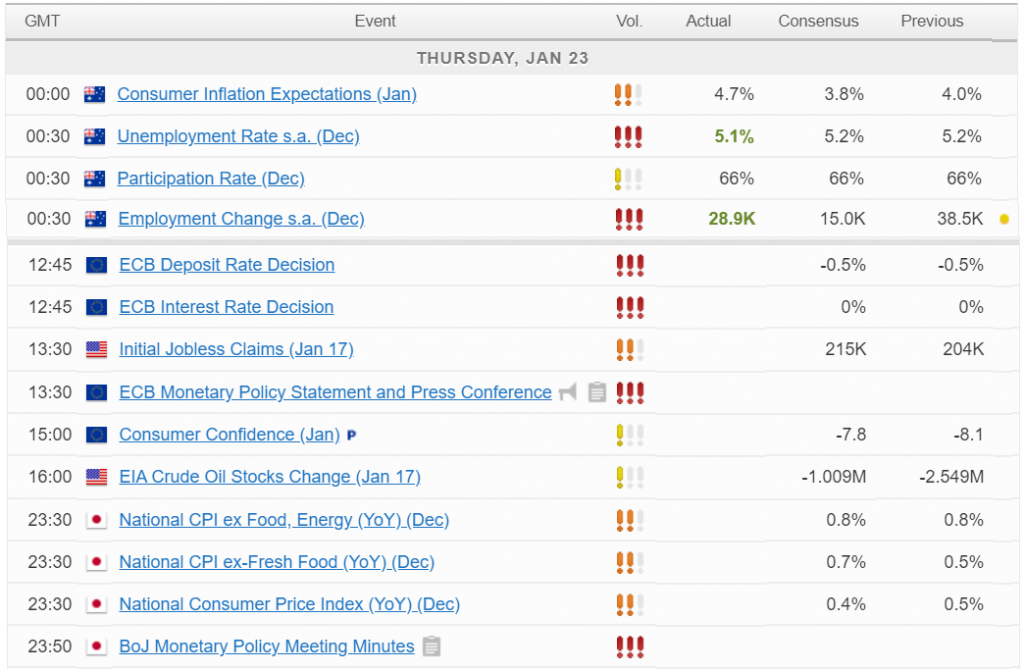

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.