Earnings Off to a Decent Start

Europe is poised for a strong start to trading on the final day of the week, buoyed by another rally on Wall Street which surged back into record territory on Thursday.

Source – Thomson Reuters Eikon

US earnings season is off to a decent start, with attention in these early days on the financial institutions, with all of the big players reporting. It may not have been a perfect start but its good enough and there’s plenty more to come over the next month or so. It’s also coincided with some encouraging numbers on the economy over the course of this week, more than making up for the pockets of weakness that we have seen so far.

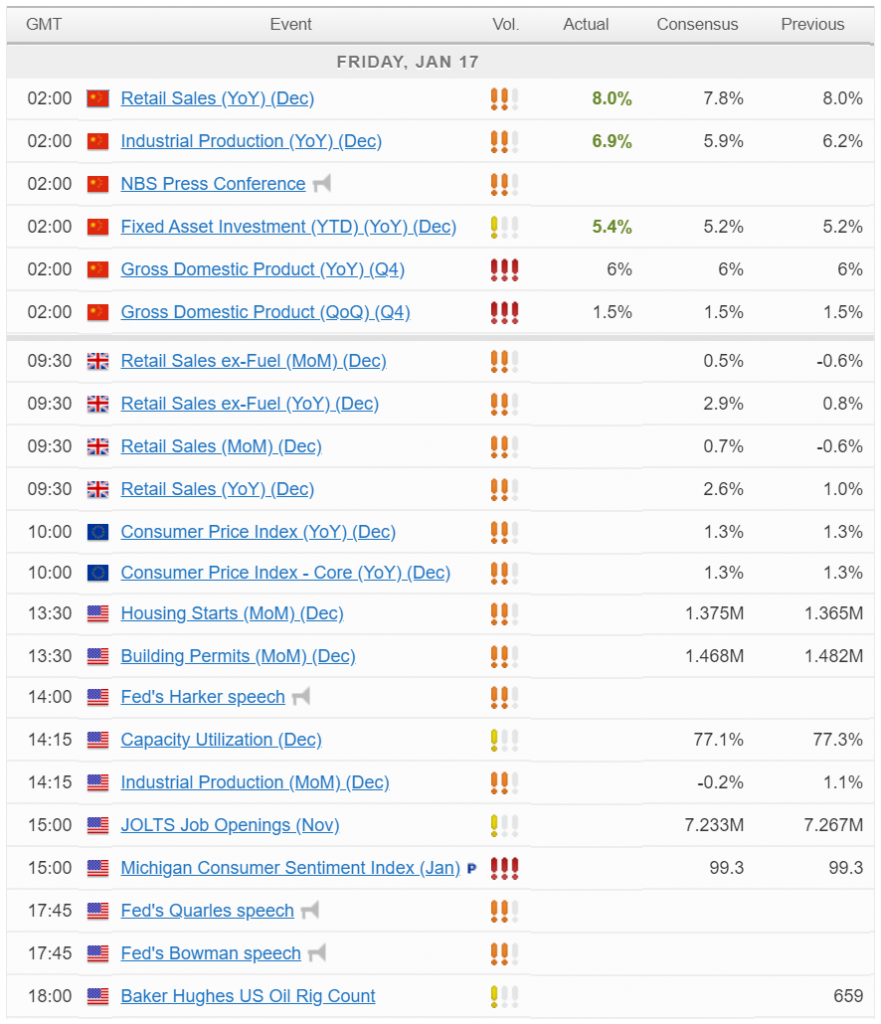

Chinese data offers cause for optimism

Chinese data overnight offered some cause for optimism, with industrial production, retail sales and fixed asset investment all comfortably beating market expectations. The phase one trade deal with the US has partially lifted the cloud of uncertainty hanging over the economy, although numerous tariffs remain in place. If these numbers are anything to go by, 2020 could be a far more productive year for the world’s second largest economy.

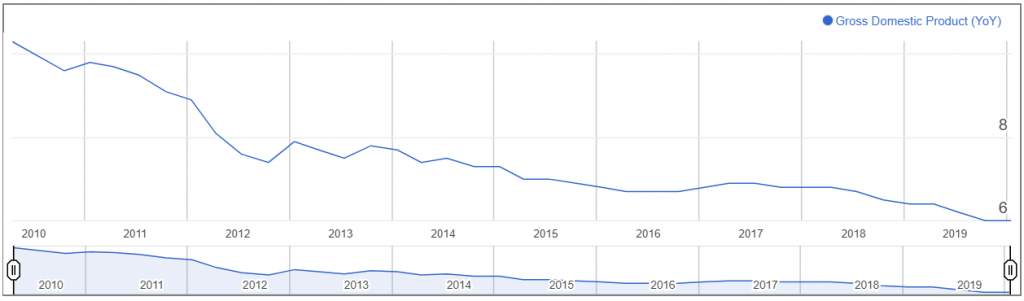

This comes after a year in which the economy grew at the slowest pace in almost 30 years, so the bar is set low (crazy to say when referencing 6.1% growth, I know, but this is China after all). It’s clear that the trade war has taken its toll on China’s already decelerating economy and the deal that was signed this week may enable it to find some form, again.

Chinese GDP

UK economy bobbing around like a drunk person stumbling home

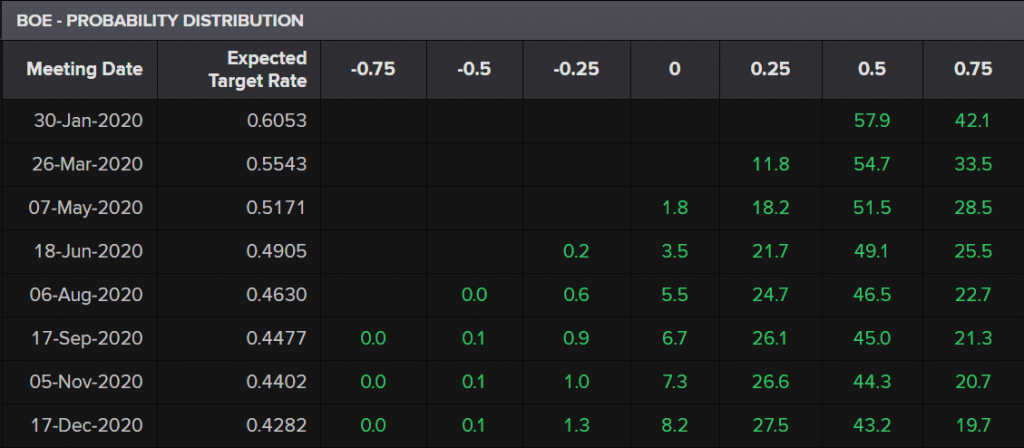

The UK has not been quite so fortunate on the data front this week. Disappointing readings of inflation, manufacturing and services, combined with dovish commentary from some BoE policy makers weighed heavily on the pound earlier in the week, while a January rate cut odds spiked to above 60%. With retail sales to come today, the trend is not good and the rebound we’re seeing may be short-lived.

Source – Thomson Reuters Eikon

I still think all of the talk of a rate cut is a bit ridiculous. I’m not saying the economy isn’t bobbing along like a drunk person stumbling home after a night out, kebab in hand, it is. But it has been for more than a year and the latest data captures a period that had enormous political and Brexit uncertainty, much of which has since passed. Should we not wait a few months to use some of the limited ammunition we still have?

Gold pulls back on improved market morale

What more is there to say about gold? On Thursday we saw it pulling back from the upper end of its tight range – $1,540-1,560 – as the rally on Wall Street supported a rebound in the dollar and took away some of the appeal of the traditional safe haven. But we’re still very much in that range and the countering forces of the deal – which has weighed on the greenback – and improved market morale isn’t helping.

Gold Daily Chart

OANDA fxTrade Advanced Charting Platform

Oil settled in the mid-60’s

Oil is becoming less interesting by the day. Crude appears to be suffering from exhaustion after a frantic start to the year. Brent has settled in the mid-60’s, having found support around $64 earlier this week. We had a very clear message around $70 at the height of the geopolitical uncertainty – you shall not pass – and since then everything has settled in the middle of the range. The inventory data this week briefly sparked some excitement but it seems oil traders have had just enough excitement for one month, thank you.

Brent Daily Chart

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.