It’s Brexit, stupid

It’s been a long night but not necessarily one of too many surprises, with results closely reflecting what the exit polls told us at 10pm on Thursday.

If that wasn’t clear, just take a look at the pound which was tucked up in bed shortly after the exit poll while the rest of us stayed the course, on the off-chance that British politics had one more surprise in store for us.

On this occasion, the biggest surprise is that the election has gone as all the polls predicted. In fact, the Conservatives are on course to get an even greater majority than expected and at no point through the course of the night has that looked in doubt.

The feeling of fatigue is nothing new for those of us that has followed British politics over the last four years but there is a sense that we’re finally seeing the light at the end of the Brexit tunnel and that’s what we’re seeing reflected in the pound.

GBPUSD Daily Chart

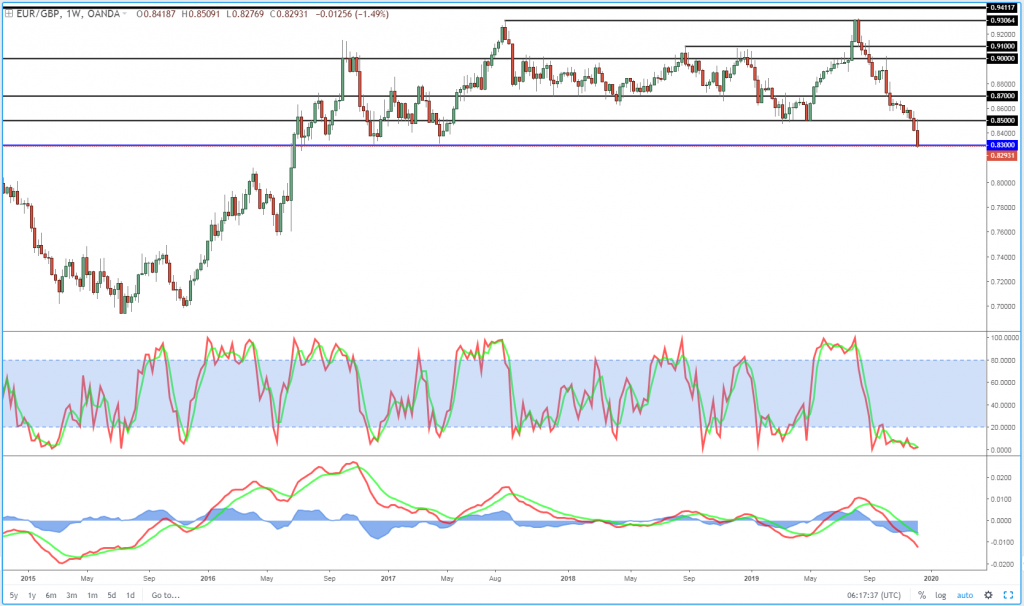

EURGBP Weekly Chart

UK 100 (FTSE 100)

It’s interesting that, while the pound hasn’t continued to march on higher – give it time – it hasn’t really pared gains either. It remains up more than 2% and has hit an 18-month high in the process. The UK 100 (FTSE 100) is making small gains

Whatever you think of the result, it’s clear that this result partially lifts the cloud of uncertainty that’s held back the currency and the economy for so long. As the old adage goes, the markets hate uncertainty. As we know, they’re not too fond of Brexit either, but that’s a discussion for another day.

It’s been debated throughout the night why the Conservatives have made gains in so many traditional Labour strongholds, with everything from Corbyn to his socialist agenda coming in the firing line. While both of these may be major contributing factors, there’s one thing that’s clearly been the driving force behind the Conservatives victory and Labours shambolic performance.

It’s Brexit, stupid!

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.