Investor optimism waning

European stocks are off to a mixed start on Thursday, with Chinese data overnight highlighting the struggles in the world’s second largest economy.

Source – Thomson Reuters Eikon

There’s never a shortage of analysts monitoring Chinese economic figures but when the country is engaged in a trade war with the US, it;s going to receive extra scrutiny. Misses on retail sales, industrial production and fixed asset investment does little for investor sentiment, especially at a time of uncertainty over the trade deal with the US.

Trump got a little ahead of himself last month when he claimed a phase one agreement had been reached and recent comments from both sides makes a signing ceremony this year increasingly unlikely. Investors have put a lot of stock on a partial deal between the two countries, should it not materialize we could see a swift reversal in the markets.

What German recession?

Good news for Germany this morning as the economy did not fall into recession in the third quarter despite it at times looking such a foregone conclusion that people were effectively talking about it in the past tense.

The bad news, of course, is that this technicality doesn’t actually change anything, the economy is still in dire straits and the number is subject to revision so all may change in the coming months. I’m sure I’ve probably missed an opportunity at a witty song reference there, much to the despair of my colleague, Jeff, who is particularly talented in this area.

Ultimately, Germany is fighting economic battles on multiple fronts and while there has been some improvement in the data in recent weeks, we’re coming from a low base and many of the fundamental vulnerabilities are unchanged.

Gold rebound may be short-lived

Gold is enjoying a third day of gains, although coming on the back of a 4.5% decline since the start of the month, we shouldn’t get too excited. The yellow metal may have got over the first hurdle, $1,460, but $1,480 will be a much tougher test should it get to those levels. Powell made it clear on Wednesday that the Fed is in no rush to cut interest rates again which could weigh on gold in the near-term.

Gold Daily Chart

OANDA fxTrade Advanced Charting Platform

Oil prices buoyed by inventory data

Oil prices are a little higher today despite mixed sentiment in the markets and softer Chinese data, after API reported a surprise decline in inventories on Wednesday. Brent popped higher following the release and is building on these gains today. The EIA number today will now be eyed with expectations prior to the API release being for a 1.5 million barrel build.

Brent Daily Chart

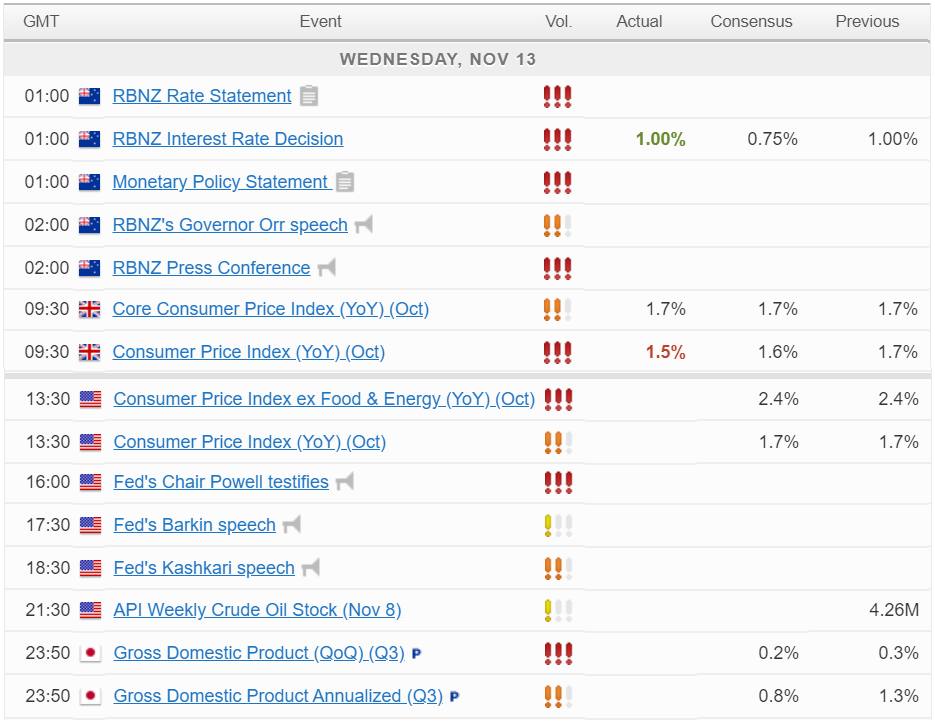

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.