EUR/USD Double-Top Formation could be short-lived

The euro has benefited from trade optimism and the growing unlikelihood that we will see a no-deal Brexit. While macro risks have weighed on risk appetite, this recent run of positive news could continue if we see the slowdown in Germany ease. The upcoming round of factory and industrial production data could help drive home the point that the bad news is bottoming out.

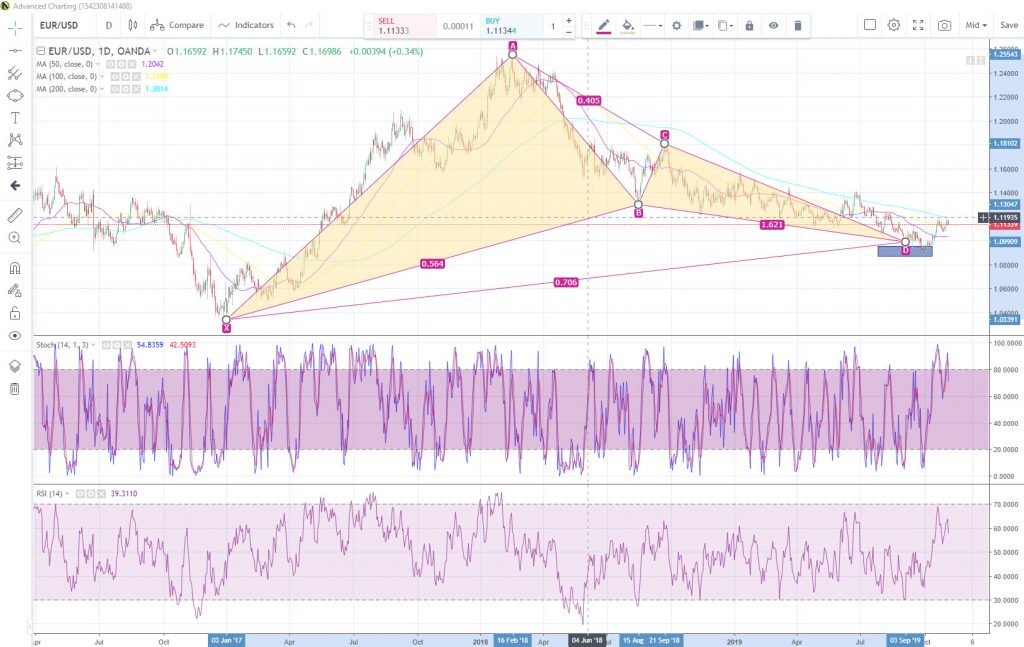

EUR/USD is tentatively respecting a double-top pattern, that could see buyers defend the 1.11 handle. If the pullback deepens, major support will come from the 1.1040 region. If the bullish trend reasserts itself, a breakout above the psychological 1.1200 handle could target the 1.1240 level. A lot would need to go right for the euro to rally toward the next major resistance objective of 1.1400, but we should not be surprised if we see fresh cycle highs as a plethora of bullish signals emerge. The daily chart is highlighting a longer-term bullish Gartley pattern that could see price target the 1.1450 level early next year.

USD/JPY – Strong Underlying Support Remains in Place

When compared to massive swings we have seen with Treasuries, the Japanese yen has underwhelmed despite a whirlwind of trade tensions and global growth concerns. The overall risk appetite rally that has helped take US equities to fresh record highs however is seeing dollar-yen struggle somewhat. It seems the Fed is on hold for at least a couple meetings and the BOJ potentially on hold throughout next year. With both central banks saving their ammunition it seems the global recession concerns are easing.

Dollar-yen has rebounded strongly from 108.00 support and is still tentatively forming an inverted head-and-shoulders pattern. Price has still not fully recovered from the Halloween selloff that stemmed from Chinese skepticism that a longer-term deal will not be reached with the Trump administration. If bullish momentum is able to breakout above the “neckline”, which also coincides with the 200-day SMA, we could see price target the 110.00 region. The next major resistance objective would be the April high of 112.39. To the downside, 107.70 provides key support, followed by 107.25 level.

AUD/USD – Upside Momentum Fading Ahead of 200-day SMA

The Australian dollar is getting a boost from a steady flow of constructive updates in the US-China trade war and expectations the RBA could be on hold for the next several meetings. With unemployment appearing stable and inflation approaching the medium-term target, the RBA could be on hold until the summer.

AUD/USD bullish rebound is tentatively stalling ahead of the 200-day SMA, indicating a potential consolidation pattern could emerge before we see the uptrend resume. To the upside, traders could see initial resistance at the noted 200-day SMA, which also coincides with a potential bearish butterfly pattern around the 0.6950 level. If the bearish momentum takes over, we could see price initially stabilize around 0.6850, followed by deeper support from mid-October low of 0.6710.

Key events to follow this week:

Monday, November 4th

3:45am-4:00am EUR Major European Final Manufacturing Data

4:30am GBP Construction PMI: No est v 43.3 prior

4:30am EUR Sentix Investor Confidence: No est v -16.8 prior

10:00am USD Factory Orders M/M: -0.4%e v -0.1% prior

8:45pm China Caixin PMI Services M/M: 51.5e v 51.3 prior

10:30pm AUD RBA Interest Rate Decision: Widely expected to keep rates steady

Tuesday, November 5th

4:30am GBP UK Services PMI: 49.8e v 49.5 prior

8:30am USD Trade Balance: -$53.0Be v -$54.9B prior

8:30am CAD Int’l Merchandise Trade: No est v -0.96B prior

10:00am USD ISM Non-Manufacturing PMI: 53.5e v 52.6 prior

10:00am UDS Jolts Job Openings: No est v 7051 prior

4:45pm NZD Unemployment Rate: 4.1%e v 3.9% prior

7:30pm JPY Japan Final PMI Services: No est v 50.3 prelim

Wednesday, November 6th

2:00am EUR Germany Factor Orders M/M: -0.1%e v -0.6% prior

3:45am-4:00am EUR Major European Services PMI data

5:00am EUR Euro Zone Retail Sales M/M: 0.0%e v 0.3% prior

8:30am USD Prelim Nonfarm Productivity Q/Q: 0.8%e v 2.3% prior

10:00am CAD Ivey PMI: No est v 48.7 prior

10:30am Crude Oil Inventory Report

7:30pm AUD Trade Balance (A$): 5.1Be v 5.9B prior

Thursday, November 7th

2:00am EUR German Industrial Production M/M: -0.5%e v +0.3% prior

3:30am EUR German Construction PMI: No est v 50.1 prior

4:00am EUR Italy Retail Sales M/M: No est v -0.6% prior

4:00am EUR ECB Economic Bulletin

5:00am EUR EU Commission Economic Forecasts

6:00am ZAR South Africa Manufacturing Production M/M: -0.2%e v +1.3% prior

7:00am GBP BOE Interest Rate Decision: No changes in policy expected

8:30am USD Jobless Claims: No est v 218K prior

Friday, November 8th

CNY China Trade Data

2:00am EUR German Trade Balance: No est v €16.2B prior

2:45am EUR France Industrial Production M/M: 0.0%e v -0.9% prior

8:15am CAD Housing Starts: No est v 221.2K prior

8:30am CAD Employment Change: No est v 53.7K prior

10:00am USD Prelim University of Michigan Sentiment: 96.0e v 95.5 prior

8:30pm CNY China CPI Y/Y: 3.0%e v 3.0% prior

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.