Traders cautiously optimistic on Brexit

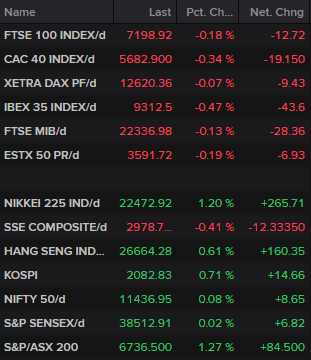

A relatively flat start to trading in Europe on Wednesday as UK and EU officials work tirelessly to secure a deal ahead of the EU Council meeting tomorrow.

Source – Thomson Reuters Eikon

It’s long been said that a deal needs to have been agreed by today if the UK is going to leave at the end of the month. Of course, these deadlines are often penciled in and, it seems, never met, but officials are now working into the night in an attempt to meet this one.

There’s quite a strange feeling of cautious optimism in the markets, despite the fact that those closest to the talks are repeatedly suggesting that there just isn’t enough time to secure an agreement and that an extension will be necessary. With Johnson insisting the UK will leave on 31 October, I imagine we’ll be treated to a few surprises in the coming days.

An extension still looks the most likely outcome at this moment, given the time constraints and existence of the Benn Act, but that will be much easier for Boris and others to stomach if the outline of an agreement is at least in place. Of course, he’ll most likely refuse to technically request it himself to avoid embarrassment during an election campaign.

Sterling reached a five month high against the dollar on deal optimism and these gains could pale in comparison to those we could see if one is confirmed today. One way or another, it could be an explosive day, albeit one that runs late into the night ahead of the meeting tomorrow. Sterling will be extremely volatile.

Gold hanging in there, just

Gold is hanging on in there around $1,480 but support around this level is looking increasingly vulnerable as downside pressures build and rallies get sold into earlier and earlier. The yellow metal is slightly higher today but struggling to gather any real momentum. Should $1,480 fall then $1,460 becomes the next notable level of support, with the $1,440-1,450 region below that looking interesting. This may not be the limit of the decline though following a very strong rally earlier in the summer.

Gold Daily Chart

OANDA fxTrade Advanced Charting Platform

Oil slides again as IMF downgrades growth forecasts

Nothing much has changed as far as oil markets are concerned. Prices remain under pressure and are hovering around the summer lows, with Brent still holding up around the $55-57 region. Naturally this wasn’t helped by the IMF’s downward revision to this year’s growth forecast to the lowest since the financial crisis, with traders being particularly concerned about falling oil demand in the face of a slowdown. Oil inventory today from API may be notable albeit unlikely to have any major impact on the broader trend.

Brent Daily Chart

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.