Leaders in deal-making mood

It promises to be another fascinating week in the markets following some promising developments on trade and Brexit last week, the details of which may become more clear in the coming days.

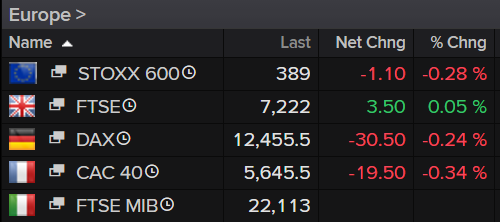

Source – Thomson Reuters Eikon

Last week was clearly one of the more encouraging that we’ve experienced this year, with the US and China agreeing to the terms of “phase one” of a deal that will avert tariff increases this month and Boris Johnson and Leo Varadkar finding a “pathway to a possible deal” on Brexit, striking a more optimistic tone in the Northwest of England.

The only problem with both of these is that they are deliberately light on detail, which isn’t necessarily a bad sign but stops anyone getting too excited as it’s difficult to judge whether they’ll prove to be the start of something much greater or more broken promises and empty words.

The EU are pushing Boris for further concessions ahead of the EU Council meeting later this week, at which a deal is hoped to be agreed. A crucial few days lie ahead. The pound ended the week on a strong note, rising more than 3.5% against the dollar as optimism about a possible deal spread. Sterling is paring gains in early trade ahead of what is likely to be an extremely volatile week.

Sign up to our Brexit Special webinar on 15 October below

Gold slips on Brexit and trade war talks

Gold has rebounded off Friday’s lows but is once again looking vulnerable to the downside. Last week’s trade war and Brexit gains were bad news for safe haven gold and saw it temporarily break below $1,480 again having previously been taking a run at $1,520.

The result of this is that it has now failed to break its previous peak once again which further reaffirms the negative outlook for the yellow metal. Of course, with central banks once again embracing the easing cycle, any downside may be temporary for gold which has previously thrived in these conditions.

Gold Daily Chart

OANDA fxTrade Advanced Charting Platform

Oil buoyed by “phase one”

Oil prices were naturally buoyed by “phase one” of the trade deal which represented the first major de-escalation in the trade war and laid the groundwork for a more comprehensive agreement in the months ahead. This remains the greatest threat to the global economy and oil prices will remain vulnerable to developments.

Brent Daily Chart

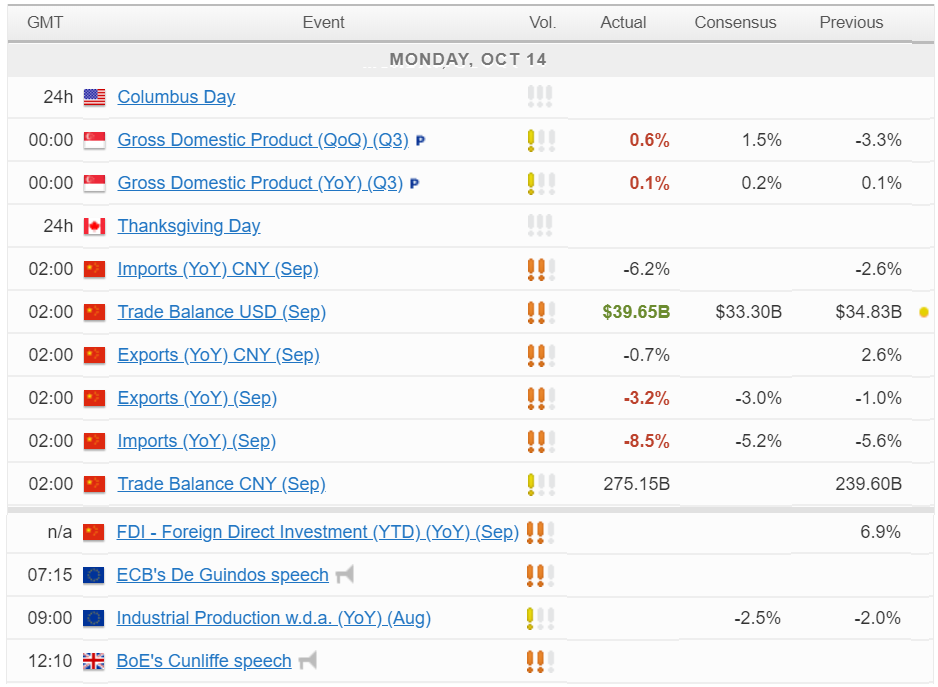

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.