Brexit and Trade Talks Buoy Investors

We’re enjoying a much more uplifting end to the week as traders see cause for optimism in the two painful negotiations that have gripped markets in recent years.

Source – Thomson Reuters Eikon

Let’s be honest, expectations were remarkably low at the start of the week that either set of meetings would yield a positive outcome, let alone both, but Thursday could go down as a turning point in both cases. I may be getting carried away there and come Monday, the US may be announcing new tariffs and the UK facing up to no deal again but we should enjoy it while it lasts.

In both cases, we have huge meetings today that will convert optimism into euphoria or leave us feeling silly for getting carried away in the first place. No big deal. Trump welcomes Chinese Vice Premier Liu He to the White House after productive talks with his trade team on Thursday in what could be the first step towards de-escalating the trade war that has plagued the global economy for the last year.

Boris has always been good with words but traders were delighted at the joint statement from Johnson and Varadkar, in which they agreed that they could see “a pathway to a possible deal”. This could prove to be nothing more than empty words but it does at least sound more positive, although the DUP may be a little more apprehensive.

Sterling soared 2% on the joint statement and is adding to these gains today. Despite the threat of no-deal there has been bullish pressures building in the pound which perhaps indicates that traders either don’t buy Johnson’s warnings and expect an extension, or they think his efforts will bear fruit. They leapt at yesterday’s news though.

Sign up to our Brexit Special webinar on 15 October below

Oil jumps on tanker attack

Oil prices are up around 2% today following reports of an attack on an Iranian oil tanker in the red sea. Traders may not be concerned about lost output in this case but the suggestion is that the missiles came from Saudi Arabia which could represent an escalation in the region after a period of calm following the attack last month.

Once again though, traders seem reluctant to price in increased geopolitical risk, instead fully engrossed in the global growth narrative and the pressure that will put on crude prices. Oil had already been given a lift by progress in Washington yesterday as traders celebrated the perceived reduced risk of recession.

Brent Daily Chart

OANDA fxTrade Advanced Charting Platform

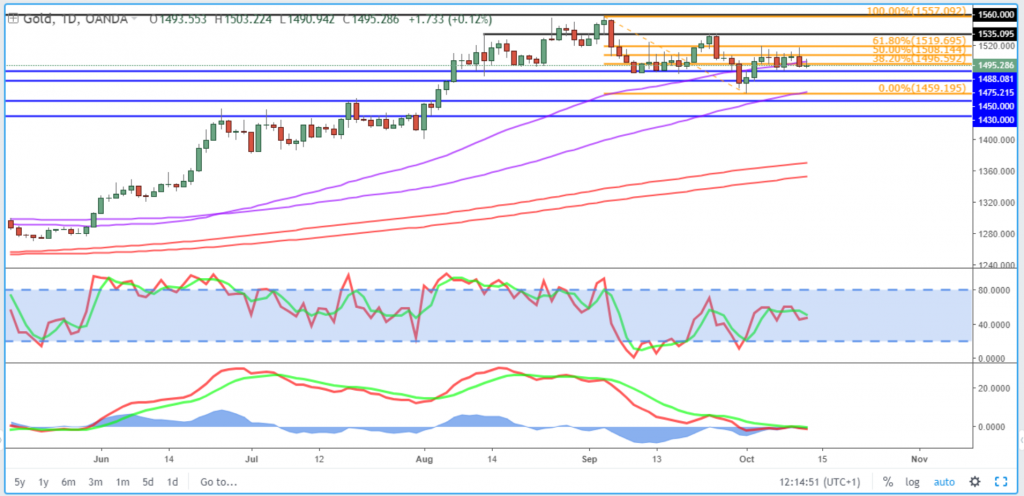

Gold vulnerable as Brexit and trade talks progress

Gold prices are recovering a little this morning on the back of the Iranian oil tanker attack to trade around $1,500. They had slipped back to $1,490 on Thursday on the back of the positive developments on the trade war and Brexit. If both of these can maintain their positive momentum on Friday, gold could come under some serious pressure and $1,480 will once again look very vulnerable. $1,460 is the next test for gold, with it having found support here earlier this month but further downside could be on the cards.

Gold Daily Chart

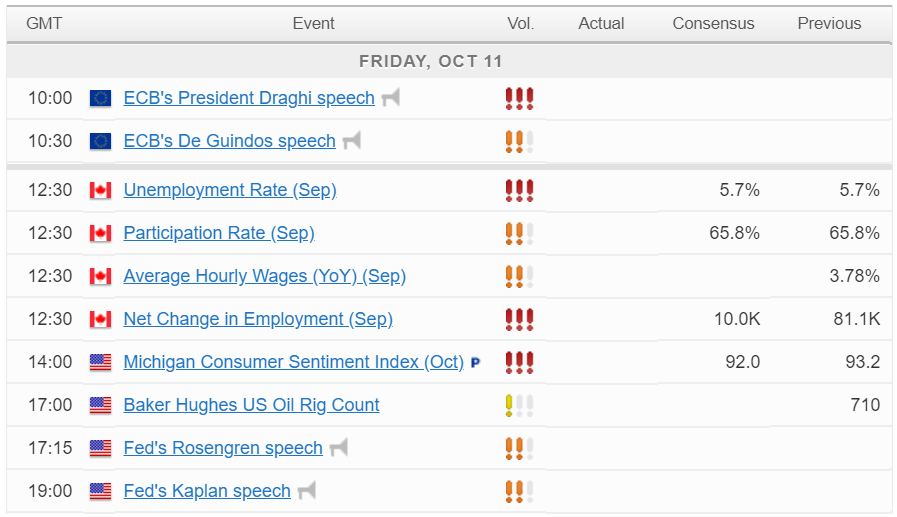

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.