Europe pares losses but recession fears linger

European stocks are off to a decent start on Tuesday, paring some of Monday’s losses on the back of another woeful batch of PMI readings.

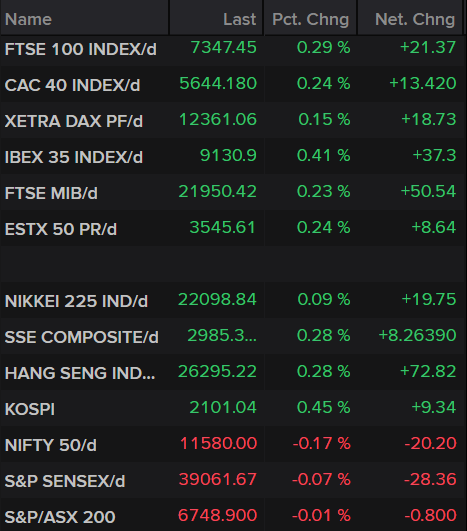

Source – Thomson Reuters Eikon

Recession fears resurfaced on the back of the data from the euro area, as manufacturing slipped further into contraction territory and services decelerated, suggesting the weakness is spreading throughout the economy.

Manufacturing has been contracting all year, with Germany being hit particularly hard. If the services industry starts to get hit as well, recession alarm bells are going to be ringing loudly across the currency block, and beyond. This morning’s IFO release may make for some more bad reading for the blocks largest economy.

Sterling awaits Supreme Court ruling

Recession fears may have receded in the UK for now but with a possible no-deal Brexit a little over a month away, they won’t be going very far. The Supreme Court ruling on Boris Johnson’s prorogation of Parliament is due this morning which will certainly make some headlines, even if it doesn’t actually really change anything.

Even if the court rules against Johnson, it has been suggested he’ll simply suspend Parliament again immediately, if it is forced to return. Sterling will likely be sensitive to the ruling, even if it possibly changes very little. The real battle will likely be around the law that was passed forcing Johnson to request an extension, something he’s repeatedly refused to do.

Sign up for our next webinar with Ed Moya on 24 September below

Gold stumbles around key resistance

Gold is steady in early trade today, having stumbled around the $1,525-1,530 region at the start of the week. The yellow metal clearly still has plenty of fans but is struggling to gain any upward momentum following a fantastic summer rally. It continues to look vulnerable to a break below $1,480, which could trigger a sharper correction, although a break above $1,530 may change that. This would draw attention back to $1,560 where gold has run into substantial resistance so far.

Gold Daily Chart

OANDA fxTrade Advanced Charting Platform

Risk premium remains priced in

Oil prices are a little lower this morning after staging a small comeback on Monday but broadly speaking they are relatively steady and have been for most of the last week. Prices have settled more than 6% above pre-Saudi attack levels, factoring in the heightened risk premium associated with conflict in the region and risk of further strikes on these facilities. We’re yet to see an escalation, thankfully, but it’s still early days.

Brent Daily Chart

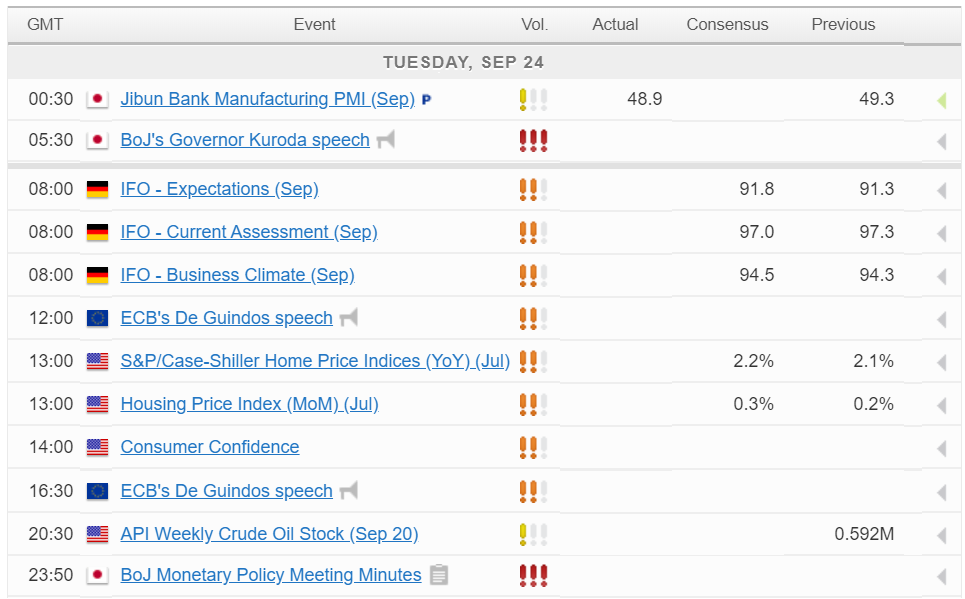

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.