AUD/USD near six-week high

An apparent thawing in trade relations between the US and China, after US President Trump announced a delay to the imposition of the latest round of additional tariffs to October 15 from October 1, has lifted risk appetite during the Asian session. US indices climbed between 0.43% and 0.67%, in many cases extended the current bullish run to a seventh day. The US30 index touched the highest since July 25 during the Asian morning.

US30USD Daily Chart

On the currency front, the risk-beta Australian dollar rose across the board, gaining 0.22% versus the US dollar and 0.27% against the Japanese yen. AUD/USD is hovering just below yesterday’s high, which was the highest since July 31. USD/JPY rose 0.26% to touch the 100-day moving average at 108.154 for the first time since May 22. It also hit the highest since August 1

China Receives An Early Birthday Present

The ECB ease

Markets are widely expecting the European Central Bank to deliver some form of easing at today’s rate meeting. It could come in the form of lower interest rates or a rekindling of quantitative easing. All will be revealed at 11.45 GMT today. In addition, the central bank is expected to lower its forecasts for both growth and inflation for this year and next, with some commentators suggesting growth could struggle to reach 1%.

US consumer prices on tap

The rest of the data calendar will mostly feature US consumer prices. CPI is seen rising 0.1% m/m in August, a slower pace than the 0.3% recorded in July, and could offer the Federal Reserve more wiggle room when it comes to considering further rate cuts.

Final German consumer prices for August are also on the bill, with no change expected from the first estimate, according to the latest survey of economists. Euro-zone industrial production has been a bit dismal of late, and is expected to post a second straight month of contraction in July, surveys suggest.

The full MarketPulse event calendar can be viewed at https://www.marketpulse.com/economic-events/

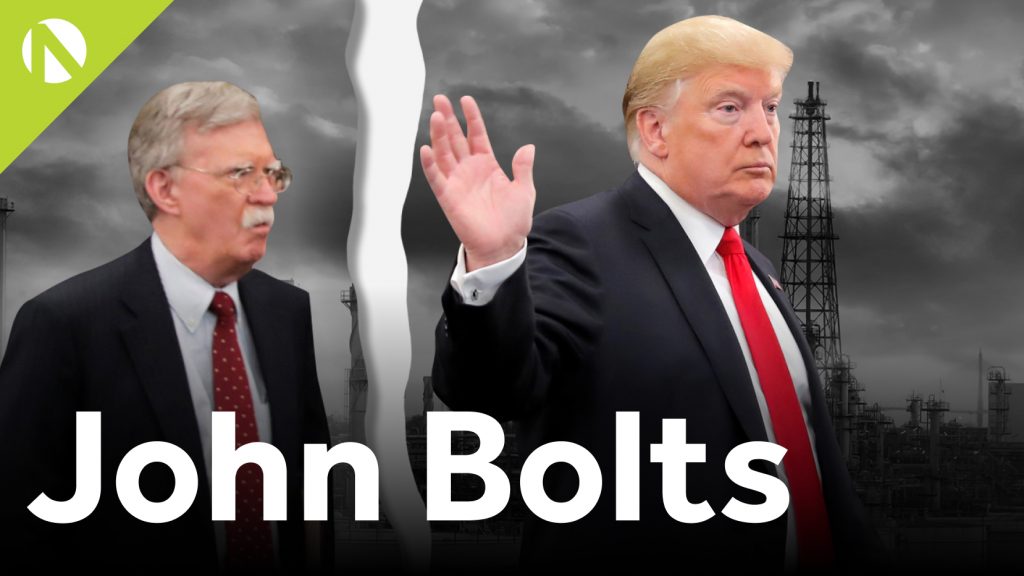

John Bolts (video)

OANDA Senior Market Analyst Craig Erlam discusses the resignation of John Bolton as Donald Trump’s National Security Adviser and its importance to oil prices. He also discusses the API and EIA inventory releases.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.