Markets Flat as Trade War Boost

We may be facing up to the reality of recession but optimism continues to flow through the veins of investors following comments from the Chinese Commerce ministry on Thursday.

Source – Thomson Reuters Eikon

Markets are looking a little flat at the start of play on Friday but this comes on the back of a strong rebound a day earlier. As yet, there’s no sign of investors giving back any of these gains, despite the rally itself being arguably driven by nothing more than hot air, the kind of which we’ve heard plenty of this year.

Tariffs speak louder than words and as yet, there’s little to suggest either side is backing down on a pledge to implement more this weekend. I would say there’s hope that those penciled in for the middle of December could be pushed back again as they’ll likely be most harmful to both sides but then, both clearly believe the long term benefits outweigh any near-term pain.

As long as the lines of communication are open, there is hope, but there seems to be little sense of urgency from either side. As far as Trump is concerned, stock markets, jobs and his polls are good, there’s no incentive to compromise. For China, the is facing an election next year, if they hold out, they may unseat him. So all this hot air about talks doesn’t fill me with the same optimism it does other investors.

Sign up for our next webinar below

Correction red flags appearing in gold

Gold has pulled back from its highs once again as risk appetite picked up on Thursday. Once again, the rally is showing some signs of weakness, having failed to top its previous high and displaying softer momentum. This may change, it’s hard to find anyone that’s not bullish gold longer term but correction red flags are popping up here and there. The yellow metal is relatively flat on the day so far, like everything else, but it is sensitive to shifts in risk appetite which does have a tendency to change throughout the day.

Gold Daily Chart

OANDA fxTrade Advanced Charting Platform

Oil on the verge of a breakout

Oil is pulling back a little from its highs on Thursday, following a decent run this week on improving risk appetite and large inventory drawdowns. Brent is back trading around $61-62 a barrel, a level where it failed to surpass on two occasions this month and that was key support in July. A break above here could represent a bullish rotation in oil following months of steady declines.

Brent Daily Chart

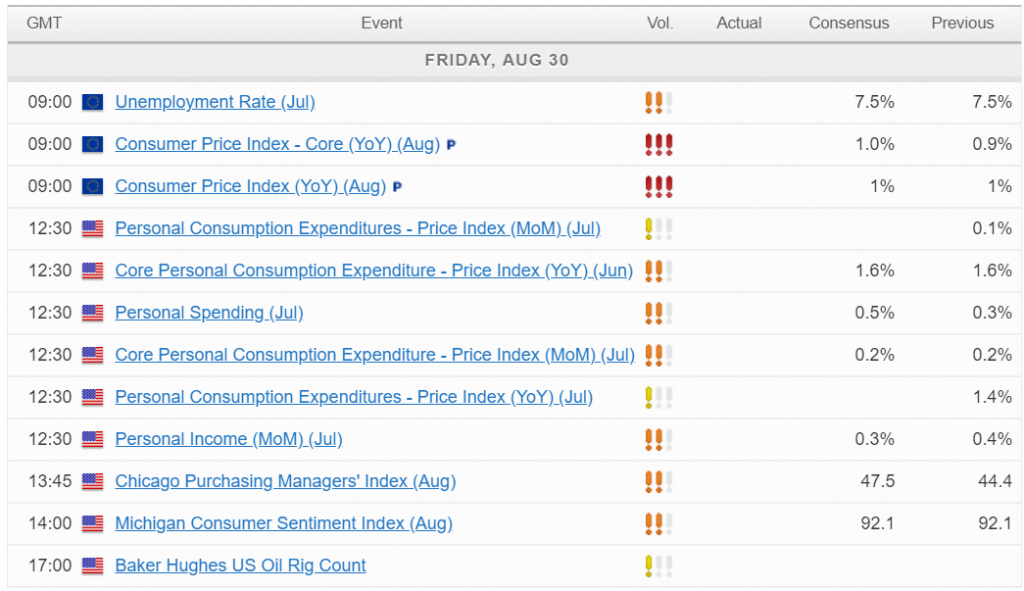

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.