How long will rebound last?

A relatively quiet start to the week is music to the ears of investors who may have otherwise fretted about what the weekend could have brought.

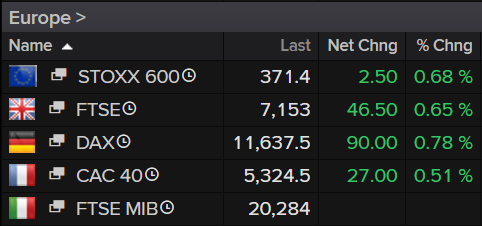

Source – Thomson Reuters Eikon

Well, no news is certainly good news and helped support the bounce in Asia overnight while European markets are expected to get off to a slightly positive start as well. Risk appetite remains extremely fragile though so more whipsawing this week would come as no surprise.

Chinese stocks look to have been buoyed by a reform, announced by the PBOC on Saturday, that aims to lower real lending rates for businesses. This comes as the country is locked in a trade war with the US and is seeking to support many of the non-state owned businesses that will now be feeling the heat.

Trump’s team appear to be in denial about the impact of the trade war on the US and in the case of Larry Kudlow, the risk of recession after markets freaked last week when the 10-year yield fell below the 2-year. Bizarrely, Peter Navarro went one step further and claimed it wasn’t inverted at all, but flat, due to the very strong economy.

One positive to come was the prospect of tariff funded tax cuts but I’m not sure how viable that would be in the longer term if businesses, as Trump predicts, move to non-tariffed countries. Who funds the tax cuts then?

Sign up for our next webinar on 20 August below

Gold ready for correction?

Gold remains above $1,500 this morning and is only a little off its highs even as the dollar has recovered and risk appetite improved. While gold bulls are clearly very reluctant to let the momentum slip, the yellow metal didn’t rally too strongly during the mid-week freak out although perhaps that’s a sign that risk appetite is not the biggest driver right now.

Still, the recent highs are not being confirmed by momentum and it has been on an unbelievable run in recent months so it may be due a correction of some kind. If it does start to pull back then $1,500 and $1,480 could offer some support and provide a test of whether the run is over, just yet.

Gold Daily Chart

OANDA fxTrade Advanced Charting Platform

Oil finding some relief from rebound in equities

Oil prices are enjoying the relief from the bounce late last week in equity markets. While this isn’t exactly driven by a belief that all is not as bad as it seemed, rather it’s not got any worse, it is allowing prices to bounce off their lows.

Brent found support around $58 before bouncing which had been a notable support zone back in June, with $56 being key below here, as it was earlier this month.

Brent Daily Chart

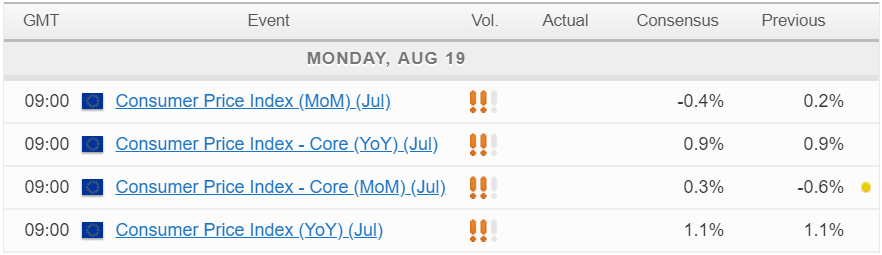

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.