Yield curve panic settles for now

European markets opened slightly higher on Thursday but I’m not expecting a particularly calm session after panic spread across the markets on Wednesday.

Source – Thomson Reuters Eikon

It seems everyone is an expert in yield curve inversions these days. Apparently a trade war, economic slowdown and Brexit, among other things, are not reason to panic but the moment the 10-year yield drops below the 2-year, all hell breaks loose.

I’m in no way playing down the risk of recession, the data has been warning about the risks for some time and equity markets have been in denial as they’ve continued to scale new highs. It’s often said that the bond market is a step ahead which is why the panic has set in but I do believe we read too much into trends at times at the 2-10 year fear certainly falls into this bracket.

Sign up for our next webinar on 20 August below

Markets look a little steadier at the start of trading today but days like today can be like the good old British weather, sunny in the morning and storms by lunch time. In these markets, I wouldn’t be surprised to see a rollercoaster of a day and there’s plenty of data coming throughout to provide the catalyst.

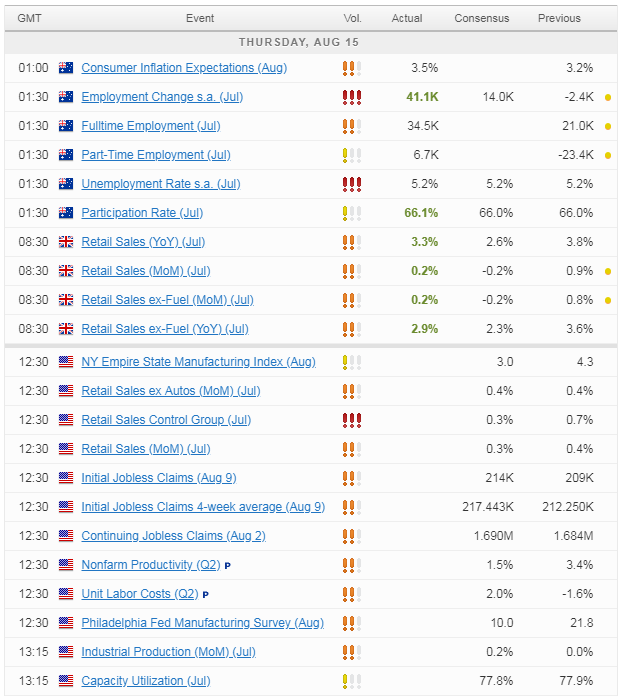

UK retail sales this morning will obviously be of interest, following the contraction in the second quarter, and this will be followed by a whole host of releases from the US later on to really shake things up. Also expect plenty more on the trade war and yield curves, which means much attention on the President’s Twitter account.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.