Rebound already running out of steam

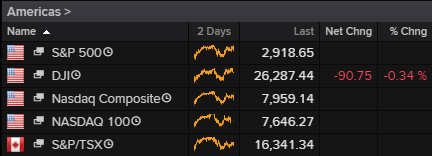

US futures are trading a little in the red at the start of the week, as European indices turned flat after earlier gains in light trade.

Source – Thomson Reuters Eikon

Everyone is focused on the various political issues this week, despite there being some notable economic releases that will obviously command some attention. None of these will be released today and there’s a few weeks now until the next meeting of a major central bank so it could go a little quiet on that front, especially with various officials no doubt on their holiday’s.

One may expect a similar political calendar but this is not your typical summer. Between Matteo Salvini wanting to bring lawmakers back from summer recess for a vote of no confience in the government and the UK fast running out of time ahead of the current Brexit deadline, the political calendar is anything but empty.

And that doesn’t even take into account the ongoing trade war which has escalated in recent weeks and continues to be a major point of concern for the markets. Central banks have been cutting rates recently as the risks mounted, threatening the relative stability we’ve enjoyed for so long in the global economy.

Sign up for our next webinar on 13 August below

Is gold at risk of being a overcrowded trade?

Gold is thriving in the current environment of central bank easing, risk-aversion, recession risks, low inflation and even a slightly softer dollar this month. It’s already soared back above $1,500 for the first time in more than six years and it’s not yet losing momentum. It could be argued that the trade is looking a little crowded but until momentum starts to wane, there’s every chance it will continue to thrive. Especially if central banks continue to facilitate it with more easing heading into year-end.

Gold Daily Chart

OANDA fxTrade Advanced Charting Platform

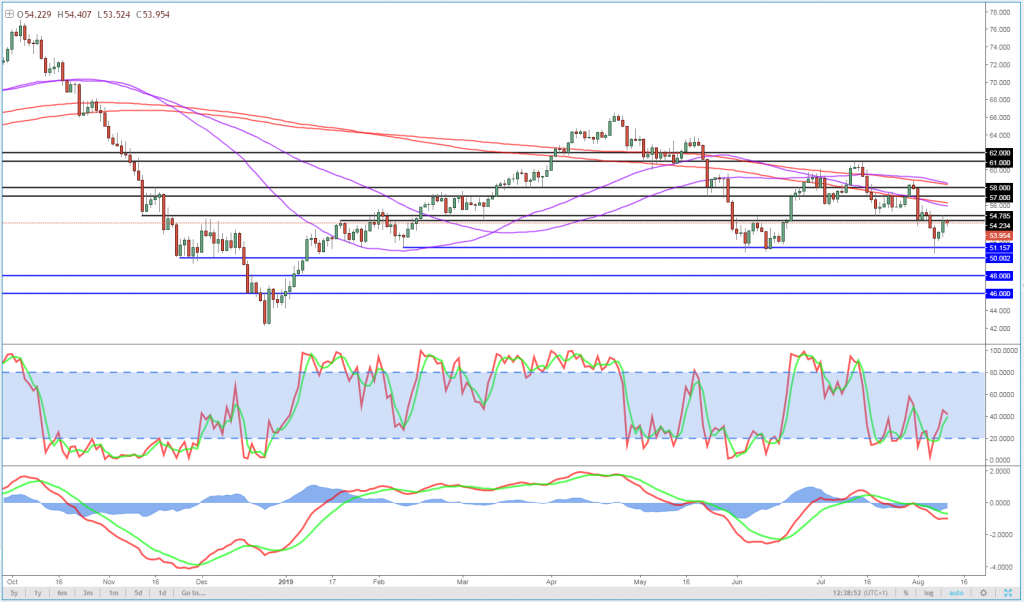

Oil looking vulnerable after brief rebound

Oil is naturally struggling in the current environment. The conversation has very much changed from one of supply-related risks to prices to the demand side, as traders increasingly price in the risk of recessions around the globe. We’ve already seen repeated downgrades to demand growth forecasts and I think few are optimistic this will change in the near-term. WTI challenged the $50-51.50 area last week but the level was supported for now. A brief rebound looks to already be running into trouble though which makes that support look very vulnerable.

WTI Daily Chart

$11,000 could be key for bitcoin, near-term

We’ve seen some consolidation in bitcoin over the last week or so following an impressive rebound in the cryptocurrency. Bitcoin survived the bearish onslaught which risked taking down $9,000 in the process and has since rebounded quite strongly. It is running into a little difficulty though, once again a little shy of it’s recent peak which could be a sign of weakness. That said, the consolidation in recent days doesn’t suggest the bears are pouring back in yet, although a break below $11,000 may change that.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.