Markets cautious ahead of the Fed

We’re seeing some cautious trade at the open in Europe as traders sit back in anticipation of this evenings Fed event.

Source – Thomson Reuters Eikon

It’s been hard to look past the US interest rate decision given that investors seem so hung up on it. The Fed has become the only game in town, arguably now joined by other central banks including the ECB, but it’s very much the most important at the moment. The stock market seems to hinge on the Fed to cut interest rates to a satisfactory degree while signaling more to come in the near future.

While it would be easy for the Fed to deliver, I’m still not convinced they will. There has been a significant reluctance to cut rates until now, probably in part because it acknowledges that December’s hike was a policy mistake and because it gives the impression that they’re caving to pressure from the White House. Unfortunately, that is not going away and they are running out of excuses to cut. Although, the economy is still very strong.

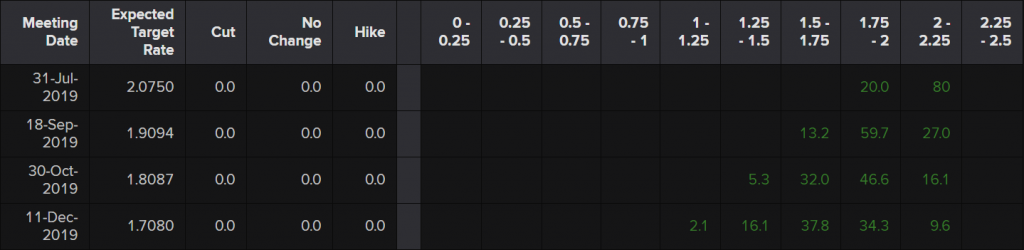

US Interest Rate Probability

Source – Thomson Reuters Eikon

While a rate cut is almost guaranteed tonight, I fear the markets will be disappointed by the lack of a clear laid out path for more cuts in the coming months as expectations are very aggressive. This may not bode well for the rest of the summer.

Sign up for our next webinar on 6 August below

Sterling remains vulnerable

The pound has fallen hard in recent days, as Boris and his team have stepped up no-deal preparations and embarked on full-on PR campaign. It’s clear that Boris does not want to give Brussels the impression for one second that he is not serious about their willingness to leave on 31 October without a deal, with the threats of his predecessor having clearly not been taken too seriously.

That has walloped the pound over the last few days, although this has helped the FTSE outperform the rest of the market so every cloud…. While Boris is insisting that this is not the outcome they want, sterling traders are only interested in the risk and clearly they see plenty of it. The pound is seeing some reprieve today but continues to look very vulnerable.

GBPUSD Daily Chart

OANDA fxTrade Advanced Charting Platform

Apple eyes $1 trillion landmark after encouraging earnings report

Apple managed to positively surprise investors on Tuesday despite reporting a decline in iPhone sales, with the services side of the business continuing to see improvement. This is the side of the business Tim Cook is hoping to aggressively expand as consumers upgrade their phones less frequently forcing the company to brag about something else as it prepares to become the latest $1 trillion company.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.