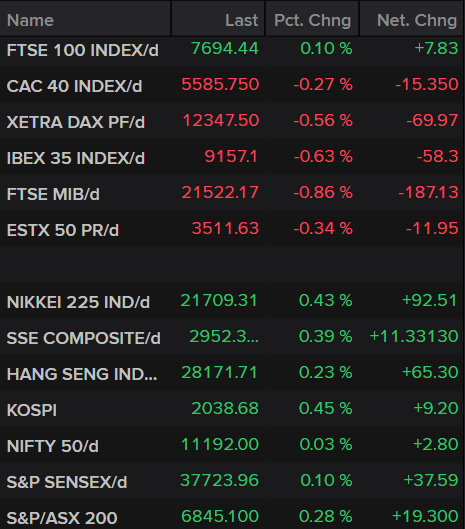

Markets flat as FTSE outperforms

Another steady start expected across Europe on Tuesday, as investors wait in anticipation of events later in the week that could shake things up.

Source – Thomson Reuters Eikon

Of course, there is an anomaly here and that is the FTSE 100 which hugely outperformed the rest of the market on Monday, driven in part by a flurry of M&A reports but primarily by the plunging pound which continues to trade under pressure today. Already this morning, the pound is testing the March 2017 lows and sterling bulls are not putting up much of a fight so far.

GBPUSD Daily Chart

OANDA fxTrade Advanced Charting Platform

As ever, Brexit is to blame for the latest tumble in the pound as traders increasingly price in a higher likelihood of no-deal. Interestingly, the weakness in the pound is a reflection of the fact that Boris Johnson’s plan is working. He wants his no-deal threats to be taken seriously by the EU in the hope that it forces them to re-engage on the backstop, clearly he has traders convinced.

Ultimately, May failed to convince anyone that no-deal was ever an option, despite repeated warnings that it was better than a bad deal. Boris Johnson is determined not to make the same mistake and it now remains to be seen whether the EU will take his threats as seriously as the market is. Traders are currently not optimistic but it’s still early days. For now, the currency may remain under severe pressure.

Sign up for our next webinar on 30 July below

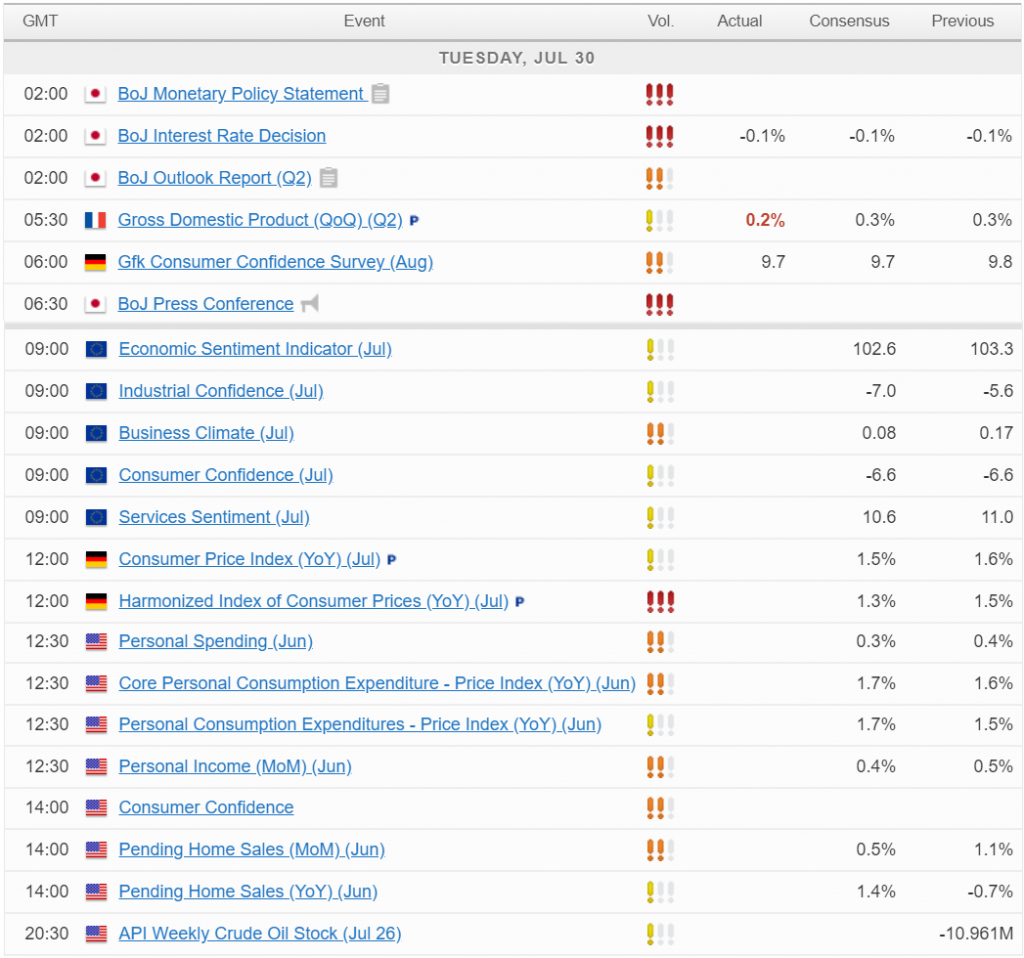

BoJ stands ready to ease further

The Bank of Japan got things underway this week for central banks, although this was never going to be the highlight. The BoJ left the interest rate unchanged and signaled that it will adopt more easing without hesitation if momentum towards hitting its inflation target is lost. After all these years it would be fair to ask what momentum they’re referencing but ultimately, despite fighting talk, markets largely shrugged it off.

Trade talks and earnings also eyed

While this week is primarily about the Fed meeting on Wednesday, there’s plenty of other things that investors are focused on. Trade talks between the US and China restart in Shanghai, which will naturally attract a lot of attention, albeit with expectations now relatively low. Earnings season also continues, with Apple reporting after the close in the US.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.