US GDP to see us out this week

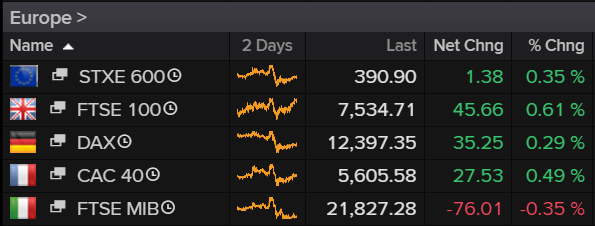

It seems the heat isn’t the only thing that’s taken it out of investors on the final day of the week as markets show signs of fatigue following a busy few days.

Source – Thomson Reuters Eikon

The killer blow came from Mario Draghi on Thursday who wasn’t his usual dovish self, or more accurately, failed to live up to the high level of expectation that the market has set. I fear this is going to be a recurring theme as central banks try to appease markets while at the same time trying not to be pushed into easing at a faster rate than they’re comfortable with.

Investors appear to have got this impression yesterday as well, with there being plenty of suggestions that we could see a repeat from the Fed next Wednesday. Investors have been very stubborn with the Fed and refuse to accept what is right in front of them. There have been repeated efforts to pare back expectations but they’re still falling on deaf ears a little, with markets pricing in an 18% chance of a 50 basis point cut.

US Fed Interest Rate Probabilities

Source – Thomson Reuters Eikon

This number could rise as well today if we get a bad second quarter GDP reading. It seems investors are quite pleased to see weaker data at the moment as it further builds the case for aggressive rate cutting. I can’t see today’s GDP release changing much though, unless it’s a really shocking number, for example one that opens up the possibility of recession in three months time.

Central banks building a bullish case for gold

It’s clear that traders will be paying close attention to the GDP release today and that means we could see some big moves in the dollar, especially if we see a decent miss or beat given how jittery traders are at the moment. The dollar has recovered strongly recently as traders have pared back expectations but that could change quickly, traders are all too keen for more cuts.

This has taken some of the shine off gold but it hasn’t fallen too far which suggests there’s more at play here than just the dollar. With central banks around the world exploring additional easing and the ECB looking at bond buying again, gold is becoming increasingly attractive compared to the growing list of debt yielding negative returns. It came as low as $1,410 yesterday but has once again found support at a higher level than it did previously, possibly a bullish signal for the yellow metal.

Gold Daily Chart

OANDA fxTrade Advanced Charting Platform

Oil steady even as news keeps flowing

Oil looks a little lost at the moment as it continues to hover around the mid-point of the range it’s traded in since early June. There’s no shortage of factors driving price at the moment, be it downbeat global growth outlook, record US output, tensions in the Persian Gulf, outages in the Gulf of Mexico to name just a few. But all of this has contributed to the stagnation rather than spur volatility with traders perhaps thinking everything is now reasonably priced in.

Brent Daily Chart

Bitcoin taking a break after weeks of intense scrutiny

Bitcoin is trading back below $10,000 after settling down a little over the last week or so. Cryptocurrencies have been very much back in the headlines in recent months and bitcoin has definitely been one of the big winners of this. It’s also come under increased scrutiny from officials that are quite hostile to the prospect of something that aims to usurp the US dollar. It’s been much quieter over the last week though which has brought a little calm back to price action. I doubt that will last.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.