Mixed picture across Europe

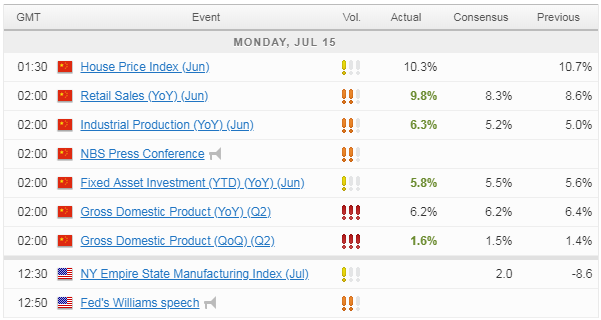

Its been a mixed start to trade on Monday, with Chinese data initially giving a boost to the basic resource sector and sentiment on the whole.

Source – Thomson Reuters Eikon

The data was a mixed bag which may explain why it took a little time to settle in. On the one hand, the country has experienced it’s slowest quarter of growth in 27 years, on the other we saw some encouraging beats on the accompanying releases.

This was particularly true of the industrial production number which was more than 1% higher and is giving a boost to basic resource stocks. Ultimately, the trade war is clearly taking its toll but importantly, the slowdown is being managed well at the moment which is perhaps a relief. Of course, things could still get better before they improve so we have to bear that in mind.

Earnings recession to add to Q2 gloom

Stock markets may be at record highs in the US but there’s a very different feeling going into this earnings season than we’ve experienced the last few years. After a year of incredible earnings growth, we’re now facing down the barrel of an earnings recession, with a drop of almost 3% expected.

That will only further support the case for rate cuts from the Federal Reserve, especially if second quarter growth turns out to be as bad as people fear. We kick things off with focus on the banks this week which should offer some great insight into the economic outlook and impact of lower interest rates to come on earnings.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.