Upcoming G20 meeting continues to dominate

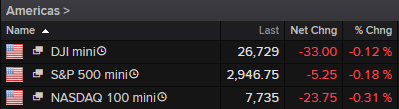

Stock markets are trading slightly in the red on Tuesday but we’re not seeing any moves of real substance, as traders continue to focus on events later in the week.

Source – Thomson Reuters Eikon

It’s never ideal when the headline act is so late in the week as we can often spend the rest of it sitting idly by trying to feign interest in the supporting cast. Barring another flare up in the Gulf of Oman or another unexpected event, that is always how this week was likely to pan out and so far, that’s exactly what we’re seeing.

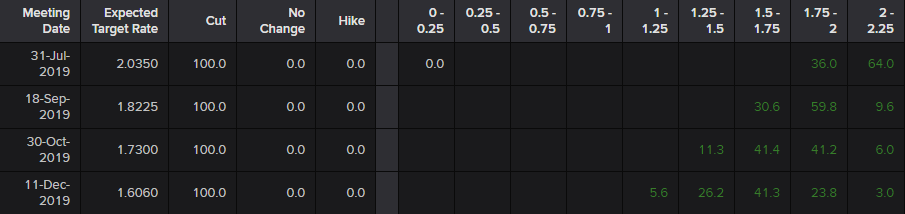

It doesn’t help that this G20 meeting has the potential to be a game changer. Clearly investors expectations are either quite low or they just don’t think it makes any difference to what interest rates will do on the back of it. As it stands, a US interest rate cut is 100% priced in for July, with markets pricing a 38% chance that it’s 50 basis points. Moreover, three rate cuts is more than 70% priced in by year-end.

Fed Interest Rate Probabilities

Source – Thomson Reuters Eikon

Should Trump and Xi surprise us all and find a compromise that both accelerates negotiations and averts the need for further tariffs in Osaka, I would be very surprised if these odds don’t change significantly. They seem far too pessimistic based on inflation and a slight weakening in the data, alone. I can’t imagine the consumer confidence or manufacturing data will change anything, although Powell and Bullard’s speeches later on may be interesting, especially if they signal that markets have gone too far.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.