Optimism ahead of Fed decision

The Fed meeting on Wednesday promises to be the highlight of the week, particularly in light of the events of the last 24 hours.

Source – Thomson Reuters Eikon

Between Trump announcing that he will hold a prolonged meeting with Xi next week, piling more pressure on the Fed to cut rates and criticizing the ECB President for hinting at further stimulus, the attention on today’s Fed meeting has only increased.

The central bank is now under considerable pressure, with the White House so unhappy at the job that Powell is doing that it has reportedly considered demoting him, despite Trump having been the one to hire him in the first place. These tactics didn’t work too well for the President last year, with the Fed raising interest rates four times despite huge pressure being publicly applied.

Will they do the same again and reassert their independence or will the memory of the previous policy mistake force their hand, calling into question how much influence the President is having on their judgement and decision making. One thing is clear, the current relationship is not healthy and is likely to lead to more bad policy decisions and questions around its independence.

Fed Interest Rate Probability

Source – Thomson Reuters Eikon

The announcement regarding the meeting next week may buy the Fed some breathing space today but that puts even more scrutiny on the language of the text, the press conference and the economic forecasts.

The Fed will likely indicate a willingness to cut interest rates if necessary but will it hint at doing so next month? And what will the dot plot say about their plans for the rest of the year? Not that we can read too much into them given how much hands on trade talks between the US and China.

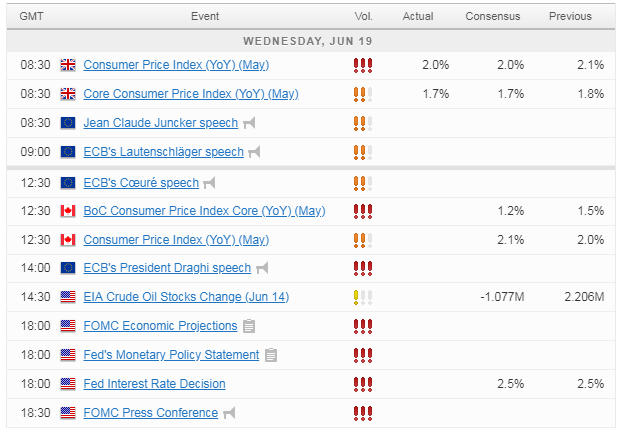

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.