Fed high continues into seventh day

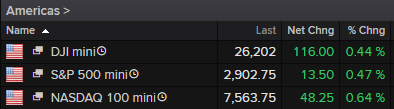

The stock market run looks set to continue on Tuesday, with Europe trading comfortably in positive territory and US futures signalling a similar session on Wall Street.

Source – Thomson Reuters Eikon

Safe to say, the changing expectations for interest rates is the primary reason for such a strong rebound in the markets that didn’t look particularly likely at the start of last week. Once again, it’s central banks that are left to fill the economic void, easing investor fears over trade wars and a global slowdown.

Of course, should the G20 meeting between Trump and Xi at the end of the month reach a successful conclusion, that balance may shift while also likely being favourable for stock markets. It may not entirely remove concerns about the outlook for the global economy but this is widely regarded as being the greatest risk.

There may well be some hangover from a large number of months of disruption and uncertainty which acts as a continued drag on the outlook. Not to mention the fact that Trump is unlikely to end the tariff offensive with China, with the EU and Japan being next in the firing line. We also have other issues to contend with including Brexit and a slowdown in Europe.

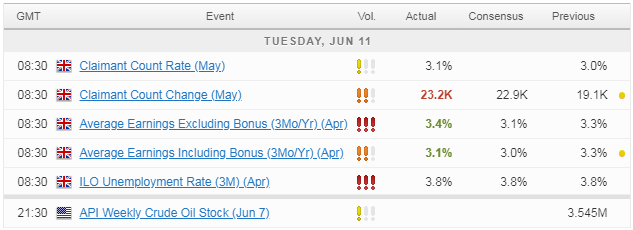

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.