Inventory data weighs heavily on crude prices

Crude prices have also been given some reprieve over the last few days, albeit to a lesser extent, with a large inventory build once again weighing on Wednesday.

Safe to say, the 6.8 million barrel increase reported by EIA came as quite a surprise prompting a more than 4% drop in WTI over the following hour or so. This was almost double the build API reported a day earlier and far exceeded expectations.

Both WTI and Brent did bounce back from the setback, aided by the stronger performance in the stock markets on the back of comments from various Fed officials including Chair Powell, not to mention a weak ADP number. WTI now finds itself around 1.3% off the pre-release levels.

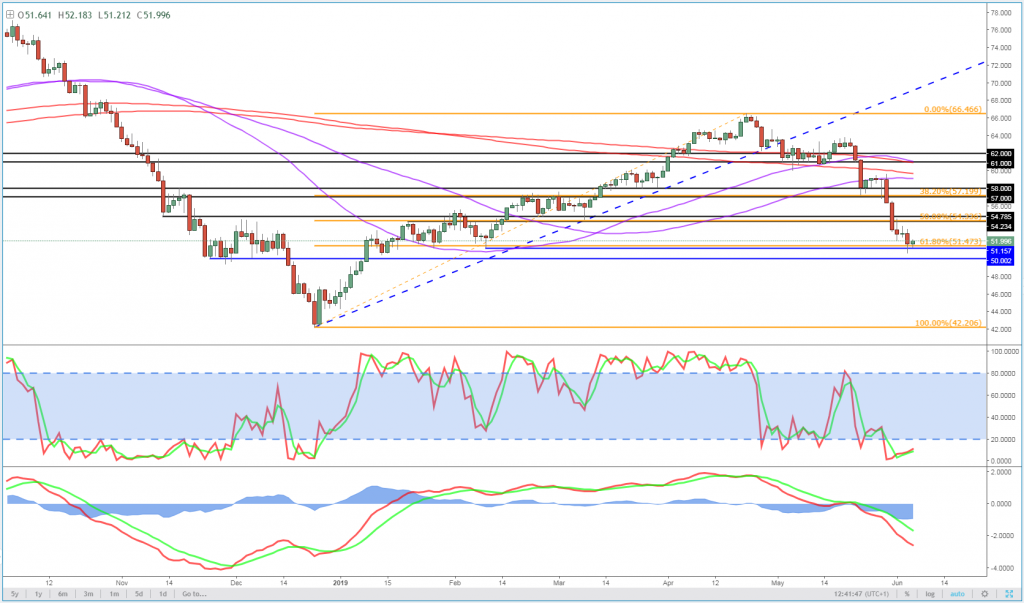

WTI Daily Chart

OANDA fxTrade Advanced Charting Platform

The question now is whether the improved sentiment will be sustained to support a rebound in oil prices, or whether $50 will come under pressure earlier than some may have expected. And if $50 does come under pressure, how well supported will it remain? It’s clearly a major support level, having already held, but also representing prior support and roughly the 61.8% retracement from the end of December lows to this year’s highs.

Should this level break, it would be both psychologically and technically significant which could make the following price action very interesting. Further support below may be found around $48 and $46, having been notable levels earlier in the year.

WTI 4-Hour Chart

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.