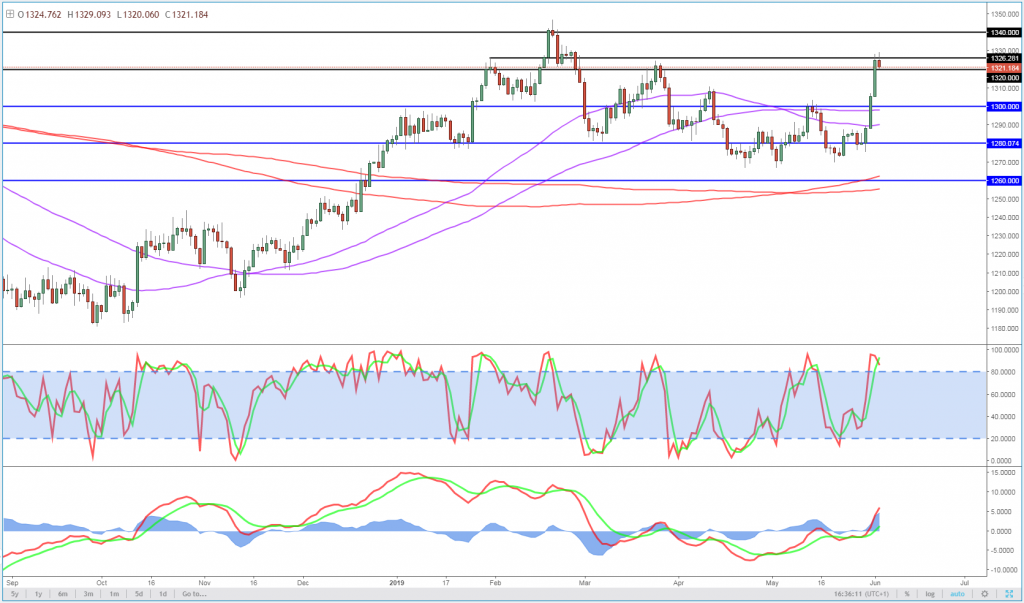

Gold takes breather after Fed hints at rate cuts

Gold is relatively stable today after a strong three day run that’s seen is gain around 3.5% and burst back above $1,300.

The yellow metal is now trading back around three month highs and looking in a strong position, especially if central bank easing is going to become the theme for the rest of the year. The dollar, as ever, will play a big role in how far this will go and it is looking vulnerable.

Gold Daily Chart

OANDA fxTrade Advanced Charting Platform

The dollar index has found support today around the May lows but I’m far from confident that will hold for long and a break could be the trigger for another sizable drop. This should naturally be good news for gold, which typically benefits when the greenback is struggling. There is plenty of potential resistance ahead for gold though but a weaker dollar would clearly help.

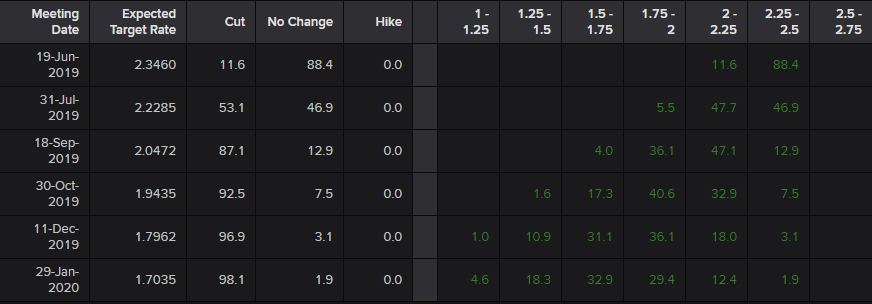

Time will tell whether markets are getting too carried away with various Fed comments but it seems traders are convinced that a rate cut is in the offing. With traders responding so strongly to these hints, there’s little reason to believe we won’t see more in the coming weeks.

This all puts more focus on the US jobs report this Friday, with a bad set of numbers likely further convincing traders that a cut is coming and warranted. What’s more, a June hike is still not priced in – only 10% according to Reuters Eikon – and a poor report on Friday could change that.

Fed Interest Rate Probability

Source – Thomson Reuters Eikon

There’s still plenty of resistance above for gold, most notably this year’s high but even just above here, gold has struggled around $1,360 over the last few year. This will likely be challenging for gold bulls again but if they can break above, it could be the catalyst for another big push.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.