Thursday May 30: Five things the markets are talking about

Euro equities are trading a tad higher along with U.S futures following a mixed session in Asia overnight as investors continue to assess all the warning signals for global growth amid the latest trade developments.

This Thursday, China has ramped up trade rhetoric aimed at Washington. Vice Foreign Minister Zhang Hanhui indicated that provoking trade disputes is “naked economic terrorism” and that they “opposed a trade war but are not afraid of a trade war.”

U.S Treasury yields are steady but do trade atop of their two-year low yields. The much-watched yield gap between U.S 3-month T-Bills and 10’s is sending a warning signal of impending recession now that it slid to a 12-year low yesterday.

Note: It’s a Bank holiday (Ascension Day) in Switzerland, Germany and France and market volumes are expected to be lower.

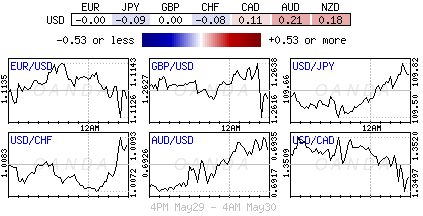

In FX, the ‘big’ dollar continues to trade near its five-month high, while the EUR and GBP are steady.

Crude prices have had a difficult week as Sino-U.S trade tensions reached the highest levels with China lining up their response to the additional tariffs from the U.S. Oil prices have been dragged down by growing expectations that OPEC+ may fail to agree upon when to meet next, and more importantly if they can agree on continuing productions, while filling the void from sanctioned stricken countries.

Today’s U.S revised GDP (08:30 am) should provide further clues on the health of the U.S economy while on Friday, the Fed’s preferred measure of inflation, core PCE Price Index, is released (08:30 am).

On tap: CH, Fr. & DE bank holiday, US preliminary GDP & CNY manufacturing PMI (May 30), CAD GDP & U.S core PCE Price Index (May 31).

1. Stocks mixed results

In Japan, the Nikkei share average closed at a 3-1/2-month low overnight, on growing anxiety that the Sino-U.S trade dispute will be prolonged and damaging to the economy. The Nikkei fell -0.29%, its lowest close since mid-February, while the broader Topix also slipped -0.29%.

Down-under, Aussie shares closed lower, led by commodity firms and weighed by fresh exchanges in the Sino-U.S. trade war that has hurt global investor appetite. The S&P/ASX 200 index finished -0.7% lower. The benchmark has lost -2% since it scaled a decade high last week. In S. Korea, the Kospi index rebounded from its -1.3% fall in the previous session to close higher on Thursday. The index ended up +0.77% higher.

In China, equities remained under pressure as trade war fears heightened after Beijing stepped up its rhetoric against Washington. The blue-chip CSI300 index fell -0.6%, while the Shanghai Composite Index lost -0.3%. In Hong Kong, stocks hit a four-month closing low as trade woes gather sentiment. The Hang Seng index ended down -0.4%, its lowest closing level since January 24, while the China Enterprises Index closed up +0.6%.

In Europe, regional bourses have rebounded after yesterday steep losses, following higher U.S futures in a quieter day as certain European nations observe Ascension Day.

U.S stocks are set to open small in the ‘black’ (+0.31%).

Indices: Stoxx600 +0.35% at 371.82, FTSE +0.24% at 7,202.60, DAX +0.50% at 11,896.48, CAC-40 +0.47% at 5,246.75, IBEX-35 +0.79% at 9,151.85, FTSE MIB +0.37% at 20,074.50, SMI n/c, S&P 500 Futures +0.31%

2. Oil higher on declining U.S stocks, but trade war worries linger

Oil prices are small better bid after U.S inventory reports showed a bigger-than-expected decline in crude stocks, although concerns that the Sino-U.S trade war will trigger a global economic downturn is capping gains.

Brent crude futures are at +$69.85 per barrel, up +40c, or +0.6%, from yesterday’s close. Brent fell nearly -1% on Wednesday. U.S West Texas Intermediate (WTI) crude futures are up +48c, or +0.8%, at +$59.29 a barrel.

API data yesterday showed that U.S. crude inventories fell by -5.3M barrels in the week to May 24 to +474.4M barrels. Expect dealers to take directional clues from today’s official data from the EIA release (10:00 am ET).

Ex-U.S, oil prices remain supported by output cuts from OPEC+ as well as falling supplies from Iran. Data this week showed that Iranian May crude exports dropped to less than half of April levels at around +400K bpd. Crude exports remain Iran’s main source of income.

Market consensus still believes that OPEC+ cuts will be extended in a meeting to be held either late June or early July, especially since Saudi Arabia wants to prevent oil prices from falling back to levels seen seven-months ago when Brent slumped to +$50 per barrel. Since OPEC+ started withholding supply in January, oil prices have risen by about +30%.

For the crude ‘bears,’ concerns that the trade dispute between the U.S and China will trigger a global economic downturn and a slowdown in fuel consumption is capping any significent gains for now.

Ahead of the U.S open, gold prices have fallen to one-week low overnight as sovereign bonds have rallied and the ‘big’ dollar trades atop a five-month high, offsetting support for the ‘yellow’ metal from an increasingly bitter Sino-U.S trade dispute. Spot gold is down -0.3% at +$1,275.59 per ounce, while U.S gold futures have edged -0.5% lower to +$1,274.70 an ounce.

3. Sovereign yields edge a tad higher

As month end approaches, investors seem content to square up some positions. German Bund yields have climbed for the first time in four days having hit record lows.

Despite the Ascension Day holiday in many countries in Europe, the 10-year Bund yield continues to trade rather close to its all-time lows of -0.20% as global growth fears prevail. Currently, the 10-year Bund yield trades at -0.156%, up about +1.5 bps.

Elsewhere in Europe, the wide spread level between 10-year Italian BTP’s and German Bund yields continues to reflect the pending clash with the E.U over Italy’s budget deficit. With both Italian deputy prime minister Salvini and the E.U eager to honor their respective mandates, has caused the spread to widen in recent days, albeit still way off levels which repeatedly triggered reconciliation nine-months ago. The 10-year BTP-Bund spread trades at +281 bps.

Note: Money Markets are now pricing in roughly two U.S rate cuts by the Fed at the start of next year and the European Central Bank (ECB) is set to turn on its “money taps” again next month as trade worries weigh on the global economy.

Stateside, the yield on 10-year Treasuries has increased +2 bps to +2.28%, the largest climb in more than a week, while the yield on two-year notes also rose +2 bps to +2.13%.

4. Dollar trades at five-month highs

As we head to the U.S open the WSJ Dollar Index, which tracks the dollar against a basket of 16 currencies, is flat, however, the ‘big’ dollar continues to trade at its five-month highs outright.

EUR/USD trades flat at €1.1136, close to the lowest level it has seen so far this year – it reached last week at around €1.1107. Techies believe the ‘single’ unit’s sentiment would have to worsen significantly for the EUR to break below psychological €1.11 handle with any momentum. There is little in the way of economic data releases today that could push EUR/USD either way. Expect risk sentiment to remain the main driver.

GBP/USD (£1.2635) is also trading lower, continuing its slow grind towards the psychological £1.26 handle. With nothing new being said, just usual comments about Brexit and no data, £1.26 is expected to create worthy support in the short term.

Down-under, AUD (A$0.6931) is keeping to its tight range, but with a mild rebound overnight. Support has come despite a weak set of data which might encourage the RBA to commit to easing rates. Private capital expenditure fell -1.7% in Q1, missing market forecasts of a +0.5% reading.

5. China puts U.S soy purchases on hold as tariff war escalates

According to a Bloomberg report this morning, China, the world’s largest soybean buyer, has put purchases of American supplies on hold after the trade war between Washington and Beijing escalated.

It’s believed that state-grain buyers “have not received any further orders to continue with the so-called goodwill buying and don’t expect that to happen given the lack of agreement in trade negotiations.”

U.S Government data indicates China bought about +13M metric tons of U.S soybeans after the countries agreed to a truce in December, in a move that showed goodwill toward getting the trade dispute resolved.

However, in February U.S Agriculture Secretary Sonny Perdue said that China had pledged to buy an additional +10M tons of soy – it’s believed those purchases have now stopped.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.