Monday May 13: Five things the markets are talking about

This week begins again with global equity markets on the back foot, sovereign debt in demand, and the risk averse go-to positioning investors primary trade. Bets on a Fed rate cut are also now gaining momentum.

Currently, U.S and China remain some distance away from agreeing any kind of trade deal. While waiting for China’s retaliatory counter punch, it seems more obvious than before, any short-term prospect of a deal occurring is a figment of one’s imagination.

On the data front, it’s an intense packed Tues-Thurs calendar, starting with Germany’s CPI where strength is expected, followed by the UK’s labour market report and Eurozone industrial production (May 14). The mid-week session will be focused on China which will release fixed asset investment, industrial production and also retail sales data for April. Next up, German GDP, as well as U.S retail sales and U.S industrial production (May 15), both of which are expected to show a mix of flat to respectable results. Thursday’s U.S manufacturing report from the Philadelphia Fed could show some clues on U.S tariff actions.

On tap: GBP average earnings index & AUD wage price index (May 14), CAD CPI, U.S retail sales & AUD employment change (May 15), AUD Parliamentary Elections (May 17).

1. Stocks slow burn lower

Capital markets are bracing itself for the promised ‘counter-measures’ from China in retaliation for Presidents Trump’s tariff increase late last week on +$200B worth of Chinese goods.

In Japan, the Nikkei saw red as most cyclical sectors lost ground after the Sino-U.S trade war escalated. The Nikkei share average ended -0.7% lower, the lowest closing since March 28, while the broader Topix shed another -0.5%.

Note: In 2018, equity losses were sharper when Trump first imposed tariffs on imports from China.

Down-under, Aussie shares ended lower overnight, pressured by disappointing Bank earnings, although losses were offset by gains in healthcare and gold stocks. The S&P/ASX 200 index closed down -0.2%. The benchmark rose +0.3% on Friday. In S. Korea, the Kospi index (-1.38%) closed out at its lowest since January 15 on anxiety over whether Washington and Beijing could make headway in their trade talks.

In China, shares tumbled, with the benchmark Shanghai Composite and the blue-chip CSI 300 shedding -1.3% and -1.8%, respectively, while in Hong Kong, financial markets were closed for a Bank holiday.

In Europe, regional bourses trade lower across the board tracking sharply lower U.S indices and weaker Asian indices as trade tensions continue.

U.S stocks are set to open deep in the ‘red’ (-1.23%).

Indices: Stoxx600 -0.63% at 375.14, FTSE -0.05% at 7,199.89, DAX -0.78% at 11,966.36, CAC-40 -0.51% at 5,300.30, IBEX-35 -0.27% at 9,092.44, FTSE MIB -0.77% at 20,714.50, SMI -0.64% at 9,412.50, S&P 500 Futures -1.23%

2. Oil prices rise as Middle East tanker attack increases supply concerns

Oil prices start the week on firmer footing on dealer concerns about supply disruptions in the Middle East and this despite market worries over global growth prospects amid a standoff in the Sino-U.S. trade talks.

Brent crude futures are at +$71.00 a barrel, up +38c, or +0.5%, from Friday’s close. U.S West Texas Intermediate (WTI) futures are at +$61.73 per barrel, up +7c, or +0.1%, from their previous close.

Supply disruptions

Providing a market bid was the Saudi’s indicating this morning that two Saudi oil tankers were among vessels targeted by a “sabotage attack” off the coast of the UAE – the Saudi’s and UAE are the third-largest producers in OPEC+.

Expect the crude ‘bulls’ to continue to rely on rising geopolitical tensions in the Middle East, coupled with declining oil supplies from Venezuela and Iran, to remain bullish for medium term black gold prices.

OPEC-led production cuts since Jan 2019, has certainly contributed to higher crude prices. There is market consensus that OPEC+ will extend their six-month output-cut agreement when they meet in June. However, any intensification in the Sino-U.S trade war should convince crude ‘bears’ to keep a lid on prices.

Ahead of the U.S open, gold prices are steady as trade talks between the U.S and China hit a wall, raising investor doubts over whether the two world’s largest economies would be able to reach a deal, thereby lifting demand for safe-haven assets. Spot gold gained +0.1% to at +$1,286.59 per ounce, while U.S gold futures are steady at +$1,287.90 an ounce.

However, ongoing Sino-U.S trade tensions will eventually weigh heavily on China’s yuan, which will making the ‘yellow metal’ much more expensive for buyers in world’s largest consumer – China.

3. U.S yield curve inverts again

The U.S Treasury bond yield curve between three-month and 10-year rates has inverted again for the second time in the past week, pressured by escalating trade tensions raising dealer concerns that the U.S economy could fall into recession.

The yield of 3’s have backed up to +2.45%, +3 bps higher than U.S 10’s, which are trading at a six-week low of +2.42%.

Currently, the market is waiting for the other shoe to drop, China’s retaliation to Trump’s tariff increase last Friday on +$200B worth of Chinese goods. The tariff spat is expected to hit the U.S economy which is seeing the impact of fiscal stimulus fade.

Elsewhere, in the Eurozone, bond yields trade only marginally higher but this week’s key data releases – German ZEW business sentiment index on Tuesday, German and eurozone Q1 GDP data – and policy makers’ speeches have the potential to move them more significantly.

Investors can expect the various central bank speeches from U.S Fed and ECB representatives and the EU and euro-area finance minister meetings at the end of the week to dominate this week’s rate agenda.

The 10-year Bund yield trades at -0.044%, up +0.5 bps.

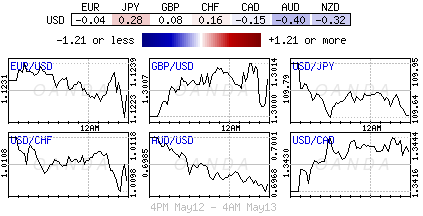

4. Risk aversion positioning dominate proceedings

A number of major currencies remain at the mercy of Sino-U.S trade disputes. With the markets in a risk-off mood, investors can expect the NOK, AUD, SEK, NZD & CAD to underperform. Even the EUR could be expected to come under renewed pressure if there is a possibility that the trade conflict could spread to Europe. For now, the EUR continue to hover within a tight range around the €1.12 level.

UK PM May said to be promising to reopen Brexit talks with EU to take the UK out of the bloc by summer in order to keep cross party negotiations with Labour alive. PM to explore with the EU this week how to rewrite outline political agreement on future customs ties.

GBP/USD (£1.3022) is steady just above the psychological £1.30 level with focus on tomorrow’s U.K Cabinet meeting. PM May said to be under pressure from her ministers to set a timetable for indicative votes by MP’s after the European elections. To date cross-party talks between the Tories and Labour have yet to lead to anything.

USD/JPY (¥109.67) is lower by -0.3% as the JPY currency remains the safe-haven currency of choice.

Bitcoin (BTC) has climbed above $7,000 to $7,094 as the recent gains in cryptocurrencies extended over the weekend.

5. Aussie home loans fall

Data overnight showed that Australian home loan lending fell heavily again in March, driven by declines to both owner-occupiers and investors.

According to figures released by the Australian Bureau of Statistics (ABS), the total value of new loans fell -3.2% to A$16.937B after seasonal adjustments, leaving the decline on a year earlier at -18.4%.

Note: The decline in March followed a smaller +2% increase in the value of new home loans in February, resuming the downtrend that’s now been in place for well over a year.

New lending to owner-occupiers fell -3.4% from February to A$12.396B, reversing the +2.8% increase reported one month earlier.

“There were large falls in the value of lending for owner-occupier dwellings in seasonally-adjusted terms in both New South Wales and Queensland in March, after rises in both states the previous month” said Bruce Hockman, chief economist at the ABS, in an accompanying statement.

From a year earlier, the total value of new owner-occupier home loans nationally slumped 15.2%.

The ABS said total new loans to owner-occupiers fell -2.8% after adjusting for seasonal patterns, leaving the number down -13.8% y/y.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.