Crude prices saw earlier gains wiped away as a deterioration in trade talks dealt a damaging blow to not just global growth, but expectations Chinese demand for US oil will continue to plummet. Oil’s earlier rally stemmed from the sabotage attack on two Saudi Arabian tankers that suffered significant damage. Two other vessels, a Norwegian registered one and a UAE ship were also subject to subversive acts, escalating worries that we could actually see the Strait of Hormuz closed, something that did not even happen during the prolonged military conflict between Iran and Iraq during the 1980s. A closure would put a strangle on roughly 20% of the oil that is consumed globally. Regardless, costs could rise significantly for continued passage through it if we see continued sabotage acts.

Oil prices were also softer Russia reportedly delivered on their oil output in early May. The nation that is feared to be the least compliant member of OPEC +, is currently delivering a cut of 255,000 barrels, better than the promised 228,000 promise, but likely to be attributed to the contamination of the Druzhba pipeline, which is said to be back to normal.

Trade talks have hit a rough patch, but the base case is for some progress to be reached to avoid a further escalation in tariffs. If we do not see a total collapse of talks, a refusal to return to the discussion table, we should geopolitics keep oil supported.

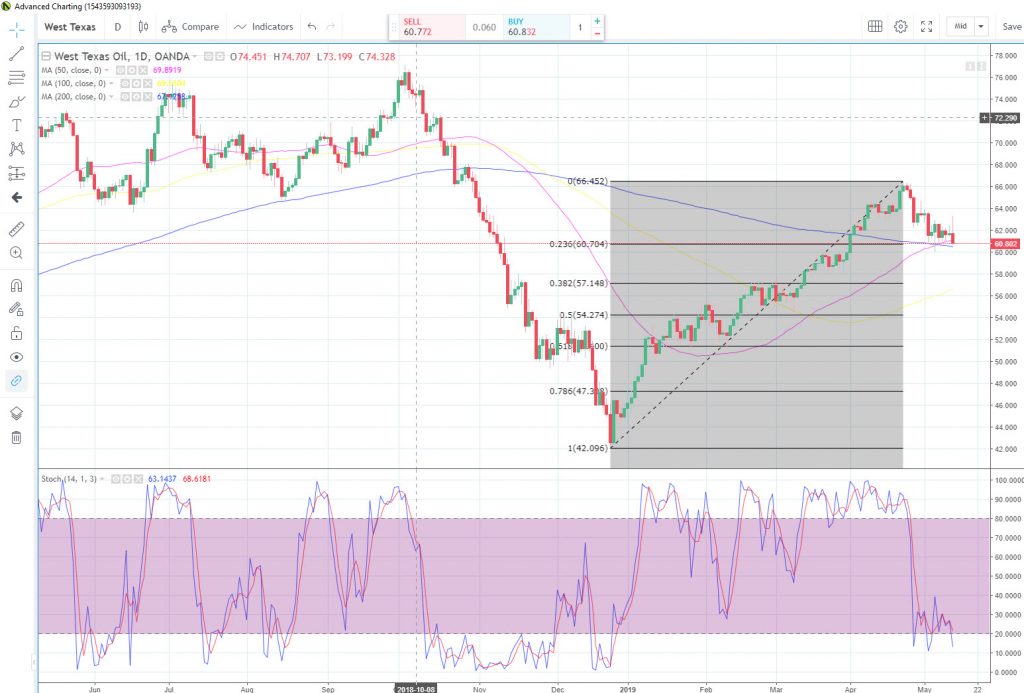

Price action on the West Texas Intermediate crude daily chart is tentatively finding support from the 200-day SMA, which currently trades at $60.72. If we see further downward momentum, support may fall at the 100-day SMA at $56.62.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.