Will labour market data justify Fed’s patient stance?

The US jobs report on Friday will cap off what has been an action packed week in the markets, one that perhaps will leave investors feeling a little more optimistic about the near-term outlook.

The Fed on Wednesday urged patience on interest rates, offering a less dovish assessment than what markets were expecting and certainly less than what Donald Trump would like to hear.

Its policy response this year has gone a long way to stabilising markets and alleviating the pressure on the yield curve that had everyone speculating about the possibility of a recession.

-

- Are markets too pessimistic?

- What’s the most important number in the report?

- How will the dollar respond?

While the labour market data has been rather volatile during that time – likely due to the government shutdown at the start of the year – the trend has remained positive and paints the picture of a healthy, if not thriving, economy. Certainly not one that requires a drastic policy response.

We’re expecting another very strong report for April, with unemployment remaining at 3.8%, 180,000 new jobs being added and, arguably most importantly, wages rising by 3.4%.

Can wage growth maintain positive momentum?

Inflation may have slipped slightly in recent months but if these kinds of wage increases continue or even improve given the trend of the last 18 months, the Fed may well decide a more hawkish policy approach and even further tightening is warranted, not quite the rate cut that Trump would like.

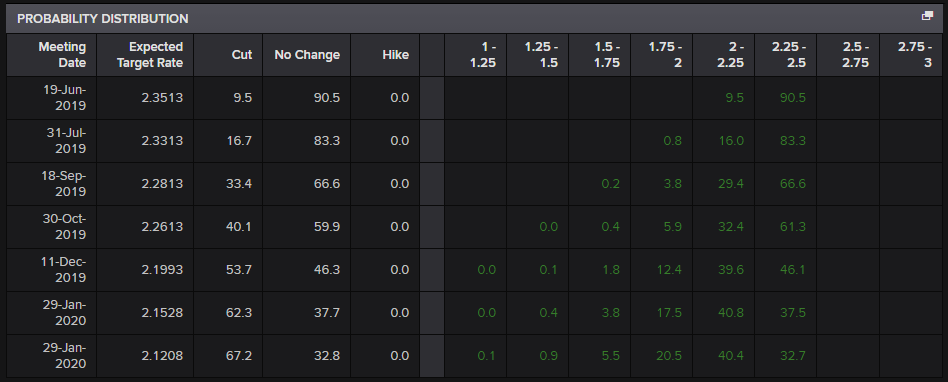

The markets would very much be behind the curve in this scenario, with a rate cut in December now perceived as being more likely than not and a hike being entirely priced out this year.

Fed Interest Rate Probability Distribution

Source – Thomson Reuters Eikon

That could make for a very interesting rest of 2019 as markets are very pessimistic at the moment. Well, as pessimistic as they can be when equity markets are around record highs.

Coming back to the jobs report, there is often more focus on the wage growth component as this will ultimately likely be the main driver of sustainably high inflation that may convince the Fed to start hiking again. Any upside surprise could well provide another lift for the dollar.

That said, markets still have a tendency to react initially to the headline non-farm payrolls figure so this is something we should be aware of. These have been quite volatile this year, to say the least, although we did get something that closer resembles normal last month which may suggest the effects of the shutdown, or whatever else contributed, may have passed.

How will the dollar respond to the report?

Well the typical belief is that the dollar responds positively to a good report and negatively to a bad one but that isn’t always the case. And with there being so many components to it, the level of the beat or miss on each will have its own say in how the dollar responds.

We’re also in a period of relative dollar strength right now so a strong economy is largely priced in. It may take a very strong report to really get dollar bulls excited. A weak report may be what gets the most attention, especially coming on the back of a resistant Fed statement and period of dollar strength.

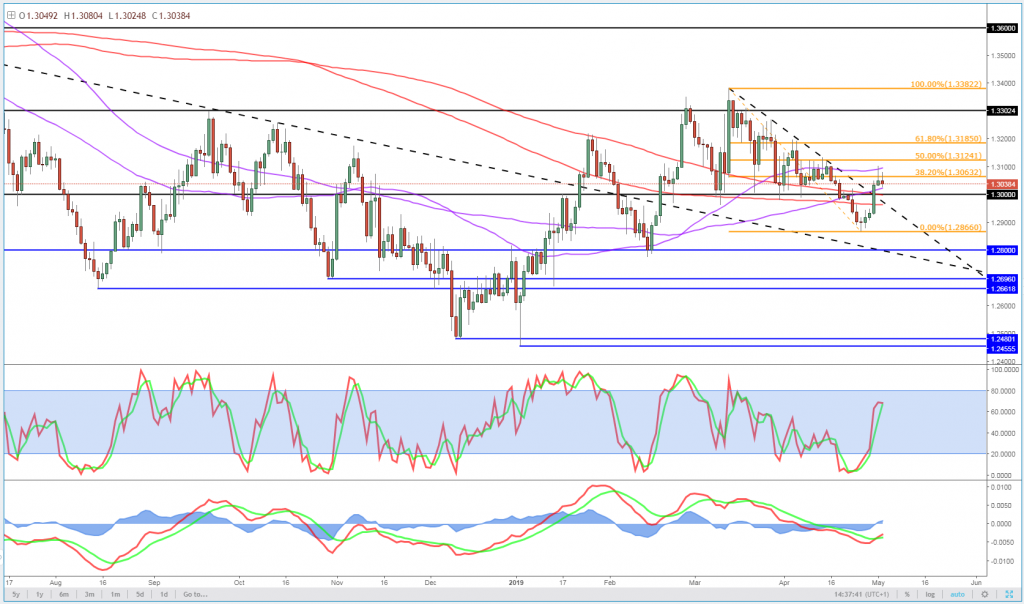

EURUSD Daily Chart

GBPUSD Daily Chart

OANDA fxTrade Advanced Charting Platform

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.