Mixed markets as we head into the business end of the week

Markets in Europe are once again mixed, with US indices eyeing a similar open as we head into the business end of the week.

Source – Thomson Reuters Eikon

Earnings season remains a key focal point for investors and Monday got us off to a slow – albeit disappointing in the case of Alphabet – start but this should pick up in the coming days. The Fed begins its two day meeting today with the policy decision and press conference following on Wednesday, while the jobs report is also due on Friday to bring a heavy week to a close. We’re probably seeing some caution right now in anticipation of these, particularly as we’re now back at record highs in the case of the S&P 500 and Nasdaq.

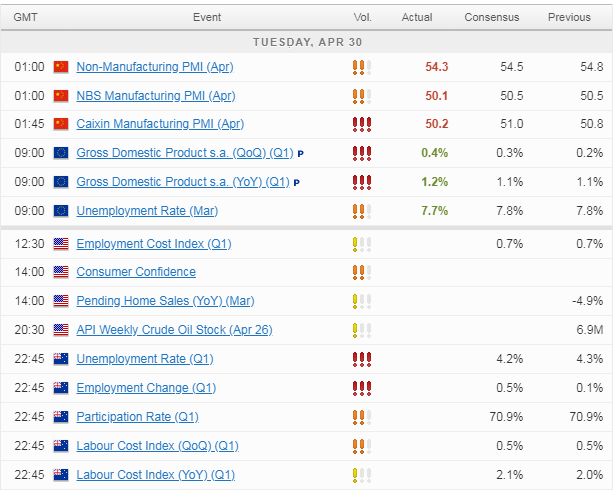

The Chinese PMIs overnight won’t have spread much optimism, only a month after that very data led many to question whether they had become too pessimistic about the world’s second largest economy. It’s important to note that the manufacturing PMI remained in growth territory – just – but this was undoubtedly a setback. This is probably a sign of what we can expect in the near-term, mixed data that’s volatile from month to month.

Data from the eurozone has provided some positivity – against the backdrop of a broadly negative environment, it’s worth pointing out – with first quarter growth and unemployment figures both exceeding expectations. I don’t think anyone is kidding themselves after this data – 7.7% unemployment is still not good enough and 1.2% annual growth certainly isn’t but at a time when the data seems to be deteriorating month on month, we have to take what we can get.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.