A big week for uncertain gold market

Gold is trading a little lower at the start of the week, perhaps a sign of early profit taking after the yellow metal popped higher on the back of the US first quarter GDP data.

It may have been surprising to see gold rallying in the aftermath of the data – given that the economy grew 1% more than markets were expecting – but the underlying numbers were far less impressive and pointed to weaker data in the quarters ahead.

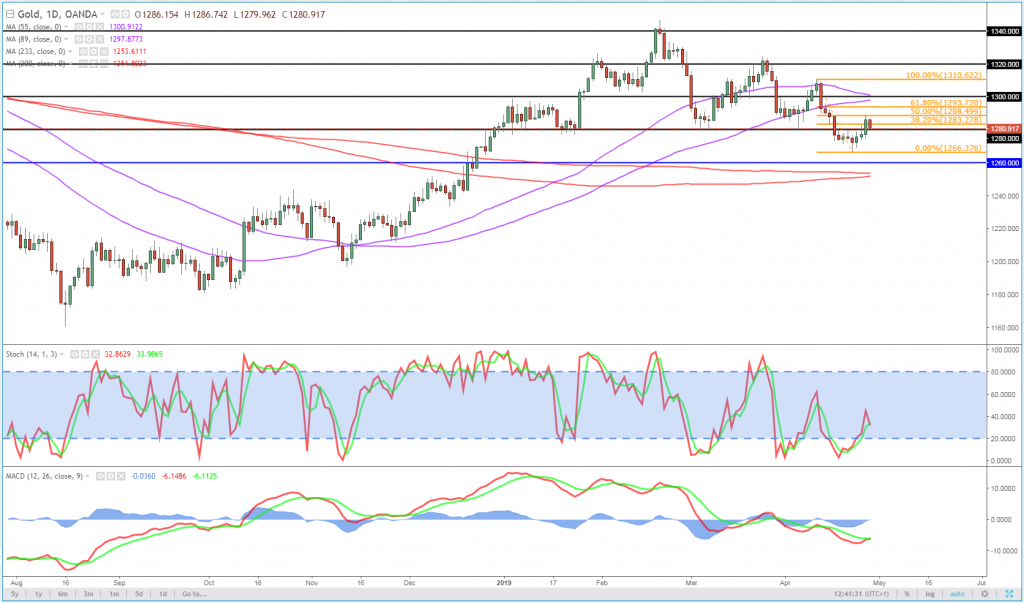

We remain in a very uncertain period for gold though. On the one hand, the environment is primed for gold to come under more pressure – dollar is strong, US equity markets around record levels, earnings season outperforming – but when we broke through $1,280 two weeks ago, any downside momentum quickly faded. Not an encouraging sign for those that saw a break of a four month support level as a bearish signal.

Gold Daily Chart

OANDA fxTrade Advanced Charting Platform

That said, the dollar is relatively flat today and yet gold is off around a quarter of one percent. Profit taking on the back of such a brief jump higher could be a sign of weakness. It also came around the 50% retracement from the April peak to trough, which could key a bearish technical signal for gold. In a very interesting week for the dollar and therefore gold, we may not have to wait long to find out.

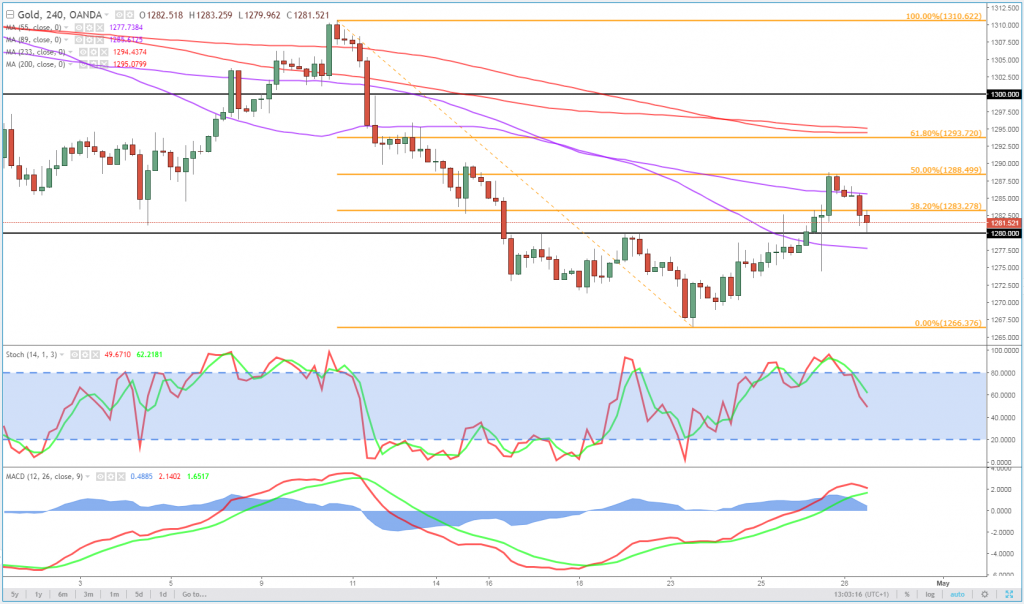

A look at the 4-hour chart only adds to the confusion and suggests bears should not get too excited yet. A rotation off the 50-fib can be a nice signal but it can also bring premature optimism. That’s not to say that I don’t think gold remains bearish, just that the corrective move may not have played out.

Gold is finding support around $1,280 from above and nothing about price action suggests the recent rally has finished. Momentum remains positive – most recent peak made on higher stochastic and MACD – which suggests further gains may come. That will make the next peak – should we see it – all the more interesting. The 61.8 fib looks a very interesting level, especially if it’s achieved on lower momentum.

Gold 4-Hour Chart

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.