Gold fails to capitalize on USD weakness

A softer dollar over the last 24 hours has given some reprieve to gold, which slipped below $1,300 last Thursday as the greenback benefited from weakness across a variety of other currencies.

The euro was quite slow to respond to the PMI data but it seems an improvement in overall risk appetite as the morning has progressed has seen it play catch up. This has put further pressure on the dollar, which was already being weighed on by gains in the pound on the back of Theresa May’s attempts to salvage Brexit with the help of the opposition, a move that could see Parliament form a majority around a softer exit.

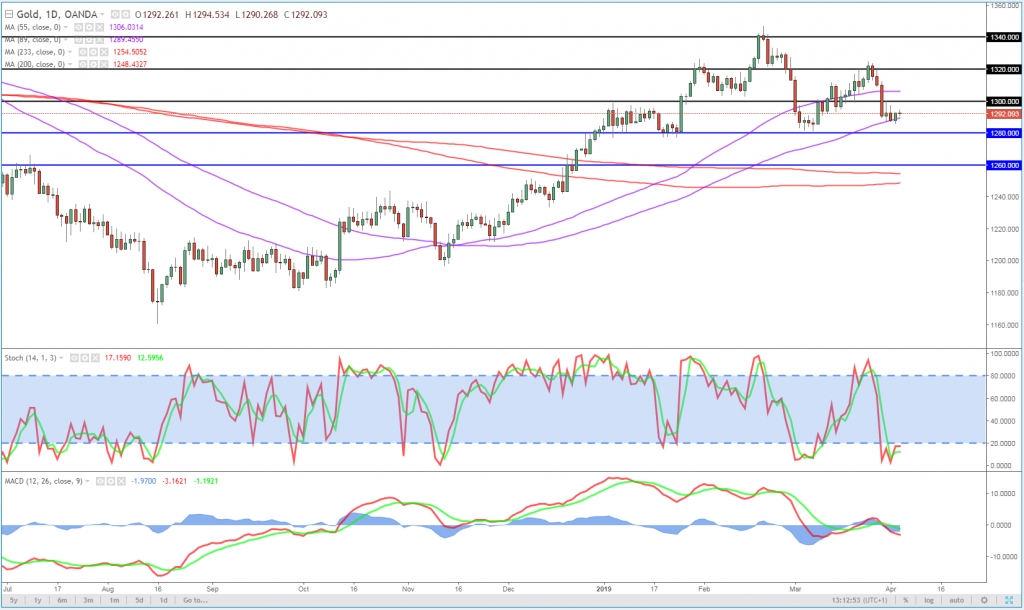

Gold Daily Chart

OANDA fxTrade Advanced Charting Platform

This reversal of fortune for the dollar has done little to lift gold, which remains quite flat on the day. Perhaps the improved risk appetite is undoing any good that a softer dollar may otherwise have brought, or maybe recent price action has just made gold bulls a little more apprehensive, with the price having broken back below $1,300, with $1,280 now offering the next major test.

There have been numerous supporting factors for the yellow metal, although with risk appetite returning and the dollar remaining strong it remains challenging for bulls.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.