Monday February 25: Five things the markets are talking about

Global equities are starting this new trading week better bid, along with the Chinese yuan, after President Trump yesterday postponed the March 1st date for hiking tariffs on Chinese imports as he sees progress in U.S-China trade talks.

This is certainly development, however, be forewarned, China sees the final stages of trade talks as possibly ‘harder.’

On the geopolitical front, sterling (£1.3073) is still afloat as U.K PM Theresa May pushed back the deadline for Parliament to vote on her Brexit deal by two-weeks to mid-March. It’s a gamble she hopes will buy more time for negotiations – on the flip side, she risks fuelling another revolt.

There are whispers that Article 50 could be extended to avoid a hard Brexit on March 29. The U.K are talking two-months, while Brussels is supposed to be leaning towards two-years!

On Tuesday, President Donald Trump and North Korea leader Kim Jong Un are expected to meet for a second summit.

On the central bank front, Fed Chair Powell will deliver his semi-annual testimony on monetary policy and the state of the U.S economy over two days (Feb 26/27) to House and Senate committees. In addition, several of his colleagues will also be speaking this week.

On tap this week: U.K inflation hearings & U.S consumer confidence (Feb 25), CAD CPI, U.K Parliamentary Brexit vote, ANZ business confidence & AUD private capital expenditure (Feb 27), U.S advanced GDP (Feb 28), CAD GDP & U.S ISM manufacturing PMI (Mar 1).

1. Stocks get the green light

In Japan, the Nikkei rallied to a 10-week high overnight on news that President Trump confirmed he would delay a planned tariff increase on Chinese imports. The Nikkei share average rallied +0.48%, while the broader Topix rose +0.7%.

Down-under, Aussie resource shares ended higher overnight on China trade optimism. The S&P/ASX 200 index rose +0.3% at the close of trade. The benchmark firmed +0.5% on Friday. In S. Korea, the Kospi index closed +0.9% higher.

In China, stocks posted their biggest single-day gains in more than three-years overnight after “productive” Sino-U.S trade talks. China’s Shanghai Composite index surged +5.6%, while the blue-chip CSI300 index also posted its biggest one-day rise, closing out +5.9% higher.

Note: SCI fell -11% in Q4, 2018, however ytd the index is up +18.7%, while the CSI300 has rallied +23.4%.

In Hong Kong, investors reaction was a tad more muted, with the Hang Seng index +0.5% higher, while the Hang Seng’s China Enterprises index was +1.9% higher.

In Europe, regional bourses trade higher across the board following a strong session in Asia and higher U.S futures. Investors await trade talks signal.

U.S stocks are set to open in the ‘black’ (+0.35%).

Indices: Stoxx600 +0.22% at 371.0, FTSE +0.13% at 7185, DAX +0.36% at 11455, CAC-40 +0.31% at 5213, IBEX-35 +0.49% at 9212, FTSE MIB +0.91% at 20256, SMI +0.2% at 9354, S&P 500 Futures +0.35%

2. Oil dips on U.S exports, but trade talks offer support, gold higher

Oil prices have eased a tad, weighed down by plentiful supply as U.S exports soar. However, providing support on pullbacks is investor optimism that the U.S and China would soon resolve their trade disputes that have hurt global economic growth.

Brent crude oil futures are at +$66.94 a barrel, down -18c, or -0.3%, from Friday’s close. U.S West Texas Intermediate (WTI) crude futures are at +$57.15 per barrel, down -11c, or -0.2%, from their last settlement.

U.S. crude oil production has hit a record +12M bpd, an increase of more than +2M bpd since early 2018. Exports hit a record +3.6M bpd this month. These record numbers are forcing other producers, especially in the Middle East, to start offering their crude at discounts.

Note: OPEC+ led cuts as well as U.S sanctions against Iran’s and Venezuela’s oil exports helped push oil prices to new 2019 highs last week.

Ahead of the U.S open, the ‘yellow’ metal has edged higher as the ‘big’ dollar comes under pressure vs. G10 and the yuan after President Trump said he would delay an increase in tariffs on Chinese goods. Spot gold has rallied +0.2% to +$1,330.26 per ounce, while U.S gold futures are steady at +$1,332.70.

Note: A stronger yuan (+0.2% to ¥6.689) makes bullion cheaper for China, the world’s leading consumer.

3. Italy’s BTP’s rally after Fitch rating

Italian government bonds are outperforming their broader euro zone bond partners this morning, rallying up to -11 bps after ratings agency Fitch affirmed Italy’s credit rating at BBB.

Italy’s 10-year BTP yield is down -11 bps to +2.74% percent, pushing its spread over higher rated Germany to a three-week low of +259.5 bps.

Note: The rally in Italian debt reverses last Friday’s sell-off ahead of Fitch’s review of Italy’s credit rating. They affirmed Italy’s BBB credit rating with a “negative,” nothing that it reflects “the extremely high level of general government debt and the absence of structural fiscal adjustment” as well as “uncertainty arising from the current political dynamic.”

Elsewhere, productive trade talk comments from President Trump is also giving a lift to riskier assets – German Bund yields have pulled away from last week’s lows and have backed up +0.025% to +0.122%, while the yield on 10-year Treasuries is little changed at +2.66%.

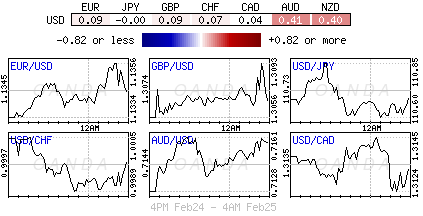

4. Sterling finds some support, EUR little changed, Yuan higher

The pound has rallied slightly on the news of U.K PM Theresa May accepting that March 12 will be the final day her Brexit withdrawal deal will be put to the test. The pound is up by +0.2% at $1.3081. EUR/GBP is flat at €0.8682. The relief comes from hopes that the Article 50 deadline (Mar 29) “will likely be extended given that the vote could take place just 17 days before the U.K. is officially due to exit the European Union.”

EUR/USD continues to hover atop of €1.13, largely unmoved by the delay in higher U.S tariffs on Chinese imports. Last week, data from both sides of the Atlantic came in soft and both the ECB and Fed members stressed the risks of slowdown in their own economies. EUR/USD is last up +0.2% at €1.1352.

Overnight, China held the yuan roughly flat, though the PBoC did set its latest strongest fix since Feb. 1. The PBoC put the dollar’s trading midpoint at ¥6.7131 vs. Friday’s ¥6.7151. In the offshore market, it strengthened outright on Trump’s comments, rising +0.3% to ¥6.6878.

5. Kiwi retail sales for December beat expectations

Data on this week’s open down-under from Stats New Zealand showed that Kiwi retail sales volumes rose more than expected in Q4 2018, supported by spending on pharmaceuticals, duty-free goods, and food services.

Retail sales volumes rallied a seasonally adjusted +1.7% in Q4 from a revised +0.3% gain in Q3, 2018 – market expectations were looking for a +0.5% headline print.

According to analysts, helping retail sales top expectations were lower retail-fuel prices, a tight labor market, continued government-spending support and higher producer incomes.

Stats NZ indicated that strong spending in Q4 led to 11 of the 15 retail industries recording higher sales volumes – for instance, they grew a record +8.2% for pharmaceutical, while food and beverage services jumped +4.2%.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.