Cans kicked but for very different reasons

It would appear that what was shaping up to be a pivotal week for the US and UK has seen the can kicked down the road before it even got underway.

From the US perspective, this is a positive move as it prevents tariffs being increased on Friday and indicates that we’re seeing very encouraging progress in the negotiations. I think both countries wanted to avoid further tariffs at this point with the global economic environment at the start of 2019 looking very different to when the conflict started.

The greatest benefit to Trump’s series of tweets on the extension has unsurprisingly been felt in China, with the Shanghai composite up more than 5% on the day. What may be surprising is that other regional bourses are lagging well behind. Obviously China was most at risk but the pain would be felt outside of its borders. Europe is expected to open marginally higher this morning, again not seeing any benefit from the announcement, with it having arguably been priced in amid all the speculation last week.

To extend or not to extend……..

May gambles on Parliament not taking back control on Wednesday

Theresa May’s decision to kick the can down the road and delay a vote on her deal until 12 March, at the latest (heard that before), is not quite receiving the same reception. May has long been accused of running down the clock as close to Brexit day as possible in order to leave MPs with a choice of no deal, no Brexit or her deal, which was heavily defeated in January.

This is only further evidence of that and suggests that the PM believes she has the numbers to defeat any amendments that seek to take control of the process away from her, including demanding an extension to article 50. That voting will still take place on Wednesday in what could be one of the more fiery sessions in Parliament that we’ve seen for quite some time. I wonder if May will bother to show up to this one.

Trump wins best trade Oscar with early morning Tweet

Gold moves modestly higher as momentum fades

Gold is not quite seeing the boost from Trump’s tweet than you might have expected, although outside of China, where is? It seems that this is very much one of those events that has been priced in over the weeks and the announcement effectively confirmed what we already knew, all the risk prior to that was to the downside.

Gold Daily Chart

OANDA fxTrade Advanced Charting Platform

Still, it continues to look bullish with $1,320 having provided adequate support late last week. My one concern now is the declining momentum on each rally which can be a sign of exhaustion in the move, near term. A correction may be on the cards.

Oil remains bullish but for how long?

Oil has also shrugged off the good news which may be more surprising that others given that China is a major consumer and this has great impact potential for its economy. It has been on a great run since late last year but has oddly run out of steam having just broken major resistance.

Oil (WTI and Brent) Daily Chart

We’re now back in consolidation mode which remains bullish but the momentum behind another rally – if we see one – may tell us a lot about its near term potential.

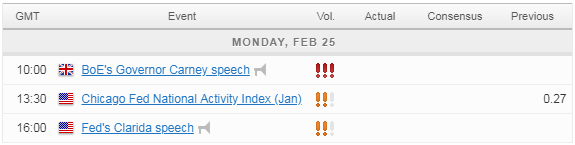

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.