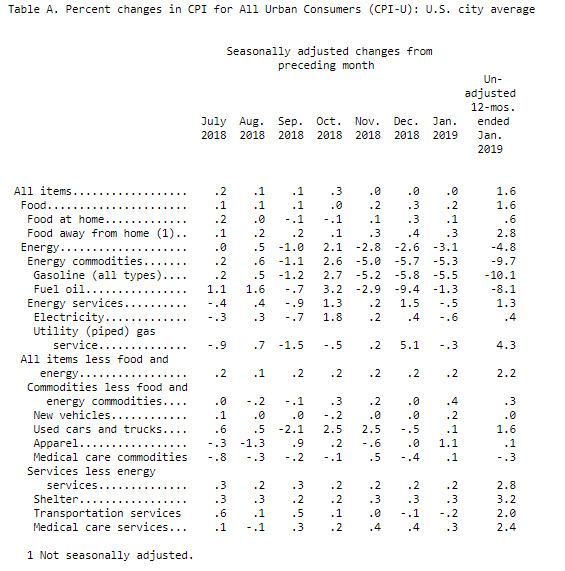

The Consumer Price Index for All Urban Consumers (CPI-U) was unchanged in January on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 1.6 percent before seasonal adjustment. The energy index declined for the third consecutive month, offsetting increases in the indexes for all items less food and energy and for food. All the major energy component indexes declined in January, with the gasoline index falling 5.5 percent. The food index increased 0.2 percent, with the index for food at home rising 0.1 percent and the food away from home index increasing 0.3 percent. The index for all items less food and energy increased 0.2 percent in January for the fourth consecutive month. The indexes for shelter, apparel, medical care, recreation, and household furnishings and operations were among the indexes that rose in January, while the indexes for airline fares and for motor vehicle insurance declined. The all items index increased 1.6 percent for the 12 months ending January, the smallest increase since the period ending June 2017. The index for all items less food and energy rose 2.2 percent over the last 12 months, the same increase as the 12 months ending November and December 2018. The food index rose 1.6 percent over the past year, while the energy index declined 4.8 percent.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.