Big risk factors in focus this week

It’s shaping up to be another big week for the US, with the government on the verge of another shutdown and trade talks continuing with China.

This week the US team will travel to Beijing for what is increasingly looking like deal-saving negotiations. An acknowledgement from Trump that no meeting is planned with Xi later this month has been widely taken as a signal that a deal is unlikely to be achieved, with best hopes now being that enough progress is made to warrant an extension to the deadline and avoid further tariffs. An agreement was always going to be very difficult within the 90 day period so if an extension is agreed on the back of promising progress then it’s still encouraging.

It’s the negotiations at home where Trump appears to be making the least progress, as Democrats refuse to back down on funding for the border wall. With the blame for the previous shutdown having been levied at the President, the Democrats will likely feel comfortable seeing this through. Trump has been very good at the PR side of politics previously but this may be a challenge too far.

The pound finds itself back in negative territory this morning following a raft of poor economic data, which comes as the country prepares to exit the European Union. The uncertainty caused by the exit – more specifically, the lack of a deal – has quite clearly taken its toll. Unlike the last couple of years, the rest of the world around the UK is also going through a challenging period and so there’s nothing to paper over the cracks.

Trade talks, shutdown and Brexit eyed this week

UK data weakening as Brexit day nears

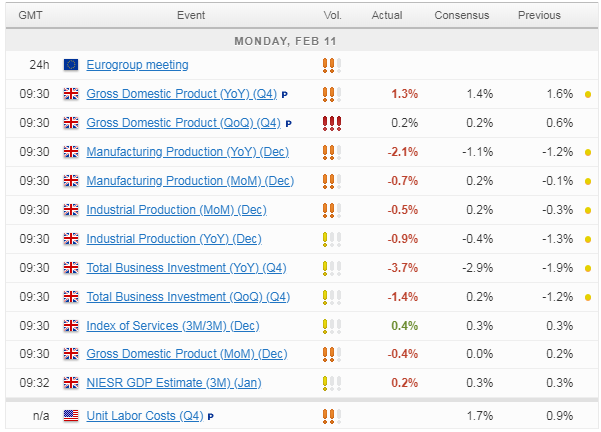

Growth in the final quarter was very soft, bringing the annual rate of GDP to only 1.3%. This includes a dreadful December, when the economy contracted by 0.4% from a month earlier. Despite this, the UK is not yet facing recession like Italy or the possibility of one like Germany. The first quarter could be weak again though and business investment – which contracted by 3.7% year on year in Q4 – is likely going to be a big contributor to this.

It’s another big week for the UK, with another Brexit vote in Parliament later in the week – albeit not on Theresa May’s deal which is still being negotiated in Brussels. This will likely leave us with a series of indicative votes on various amendments, including further attempts to delay exit day, among other things. There’s also a lot more data to come this week as well as another appearance from BoE Governor Mark Carney on Tuesday.

GBPUSD Daily Chart

OANDA fxTrade Advanced Charting Platform

The pound is off around 0.4% against the dollar but this is partly being driven by the greenback itself which continues to be well supported in the face of struggling negotiations with China. Gold’s rally is continuing to stall on the back of the dollar’s resurgence although we are seeing some strong resilience, with the yellow metal holding above $1,300 having not really properly tested it yet.

Swiss franc in (another) mini flash crash

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.