Gloomy growth and trade troubles hit sentiment

Equity markets remain in the red heading into the final day of the week, building on Thursday’s sizeable losses as a raft of negative headlines unsurprisingly took its toll on investor sentiment.

Thursday really was a bad news day, with the European Commission and Bank of England both sharply revising lower their growth expectations for 2019, with the latter forecasting the worst year since the financial crisis. This comes amid a global growth slowdown and a huge amount of Brexit uncertainty that’s having a disproportionate impact on the UK.

Growth 2019 #ECForecast:

🇲🇹5.2

🇮🇪4.1

🇸🇰4.1

🇷🇴3.8

🇧🇬3.6

🇵🇱3.5

🇭🇺3.4

🇨🇾3.3

🇸🇮3.1

🇱🇻3.1

🇨🇿2.9

🇪🇪2.7

🇭🇷2.7

🇱🇹2.7

🇱🇺2.5

🇬🇷2.2

🇪🇸2.1

🇫🇮1.9

🇳🇱1.7

🇵🇹1.7

🇦🇹1.6

🇩🇰1.6

🇪🇺1.5

🇸🇪1.3

🇫🇷1.3

🇧🇪1.3

🇬🇧1.3

🇩🇪1.1

🇮🇹0.2

Learn more → https://t.co/VBy3qmh5nB— European Commission 🇪🇺 (@EU_Commission) February 7, 2019

Theresa May was back in Brussels on Thursday trying to convince her increasingly frustrated – see Tusk’s comments for reference – counterparts to agree to provide the necessary legal assurances on the backstop to get her deal over the line. The meeting went as well as she could have hoped, with both sides agreeing to work together and meet again at the end of the month. Of course, this calls into question the point of the vote on 14th February in Parliament and will lead to further suggestions that May is simply running down the clock again and gambling on her deal being backed to avoid no deal.

Aussie drops as RBA downgrades growth forecast

This was followed by reports that there will be no meeting between Trump and Xi this month, casting doubt on whether enough has been achieved in talks to avoid further tariffs being imposed. As ever with these negotiations, it can be difficult to discern actual breakdowns from brinkmanship, especially when the narrative change from week to week.

USD lifted by trade reports but gold remains resilient

Not only did these reports take their toll on equity markets, they also triggered a rebound in the dollar. The greenback was favoured throughout the escalation of the trade war and has softened since talks began, on hope that an agreement can be found. The latest setback reversed the trend earlier in the session and saw the dollar trading back around 2019 highs.

Naturally this isn’t great news for gold which typically performs worse when the dollar is appreciating. Interestingly though, as we’ve seen a lot recently, while gold is rallying well on periods of dollar weakness, the inverse is not true to the same extent. So while gold is a little lower on the day, it’s still comfortably off the lows it tested yesterday when it came within touching distance of $1,300 before rebounding. This remains a bullish signal.

Gold Daily Chart

OANDA fxTrade Advanced Charting Platform

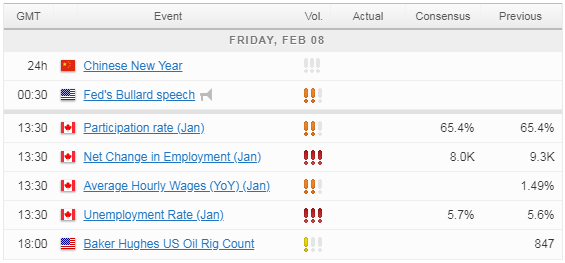

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.