Trump resists the urge to invoke emergency powers

US futures are a little lower ahead of the open as we head into the quieter period of the week, following Donald Trump’s State of the Union Address a day earlier.

Trump’s speech on Tuesday wasn’t much of a market mover, more a reminder of the President’s priorities and determination to get various initiatives over the line. The border wall and trade talks with China were the primary focus for investors and in both cases, nothing new was learned. Trump continues to resist the temptation to invoke emergency powers for now which means another government shutdown on 15th of this month remains a possibility.

The recent labour market data we saw may put investors at ease about the prospect of another prolonged stalemate in Washington but it’s the political cost that is likely to be of greater concern ahead of next year’s election, which could mean we avoid a repeat of January. If Trump accepts, as he appears to have, that he was faring worse as a result of the shutdown in January then he’ll surely want to avoid another rather than hope that next time will be different.

He’s been very good at the PR side in the past but completely changing the narrative around responsibility in a matter of weeks is surely a huge ask and therefore a massive risk. As ever though, Trump is very unpredictable and doesn’t lack the self-confidence to engage on a PR offensive in the hope that the pendulum swings in his favour and allows him to deliver on a big campaign promise without the need for emergency powers.

Oil inventory data eyed after API reports another build

Oil is trading lower early in European trade, a move that actually started prior to the release of inventory figures on Tuesday that showed a larger than expected rise. Today we’ll get a similar and more widely followed report from EIA, which is also expected to confirm that stocks rose for a third consecutive week that could put further near-term pressure on WTI and Brent crude.

The declines that we’re seeing in recent days is very much counter trend this year, with the oil around 20% up from its lows just before the end of 2018. There are a number of factors feeding into the more bullish view in the market, from the sell-off in the fourth quarter being well overdone to begin with, to risk appetite improving, the outlook being less gloomy than it seemed, the dollar being softer and US oil rigs falling, which should take its toll on US output.

Oil (WTI and Brent) Daily Chart

OANDA fxTrade Advanced Charting Platform

This is before we even consider the OPEC+ output cut agreement, Venezuela outages and Iranian sanction, once the waivers expire, all of which could be bullish for prices. Right now though, key resistance continues to hold around $55 in WTI and $65 in Brent.

Quiet midweek eyed ahead of May’s Brussels visit

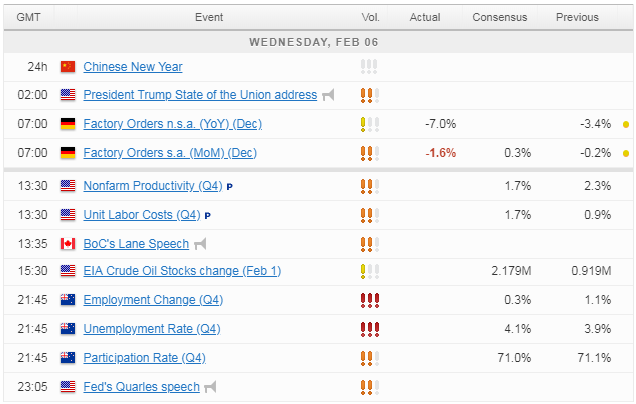

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.