Earnings and Fed give markets a bump

Stock markets received a combined earnings and Fed boost on Wednesday but that has already faded ahead of the open this morning, with futures only slightly in the green.

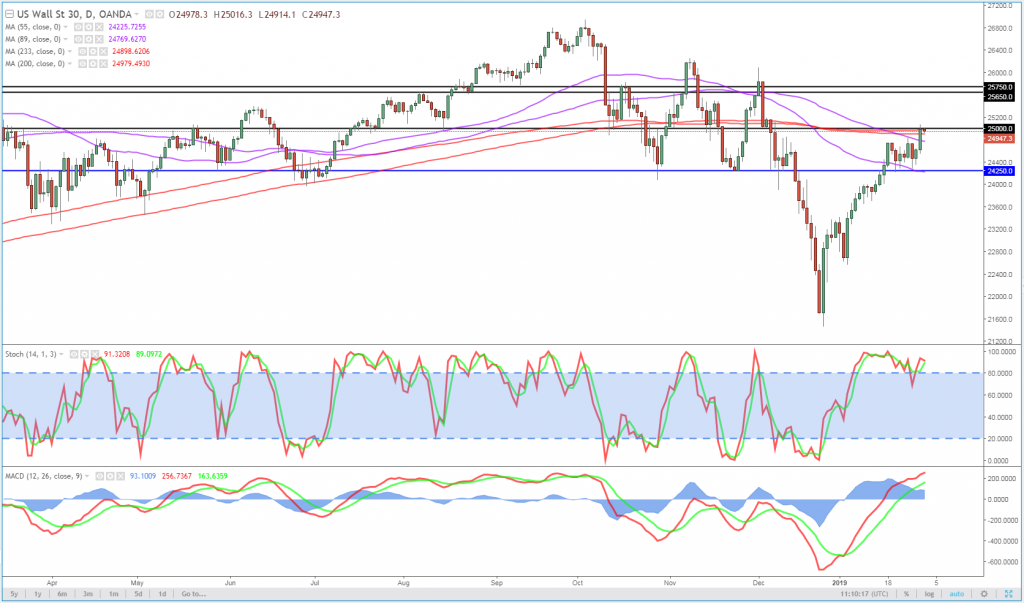

At a time when investors are fretting about the prospects for global growth, there’s going to be extra scrutiny on earnings season for any sign that companies are either experiencing or anticipating a slowdown. The start of the reporting season has gone relatively well, which is offering support to the recovery following a horrendous fourth quarter. The Dow is back above 25,000 which is psychologically very encouraging but we’re still more than 7% – almost 2,000 points – from the highs so there’s still some way to go.

Dow Daily Chart

OANDA fxTrade Advanced Charting Platform

The investor mind-set has very much changed since the Dow and other achieved those record highs but what investors have in their favour now, that they didn’t before, is a more supportive and “patient” central bank and the prospect of improved trade prospects between the US and China. These are important tailwinds at a time when the challenges for companies and the economy are stacking up.

Aussie gains as China PMIs beat estimates

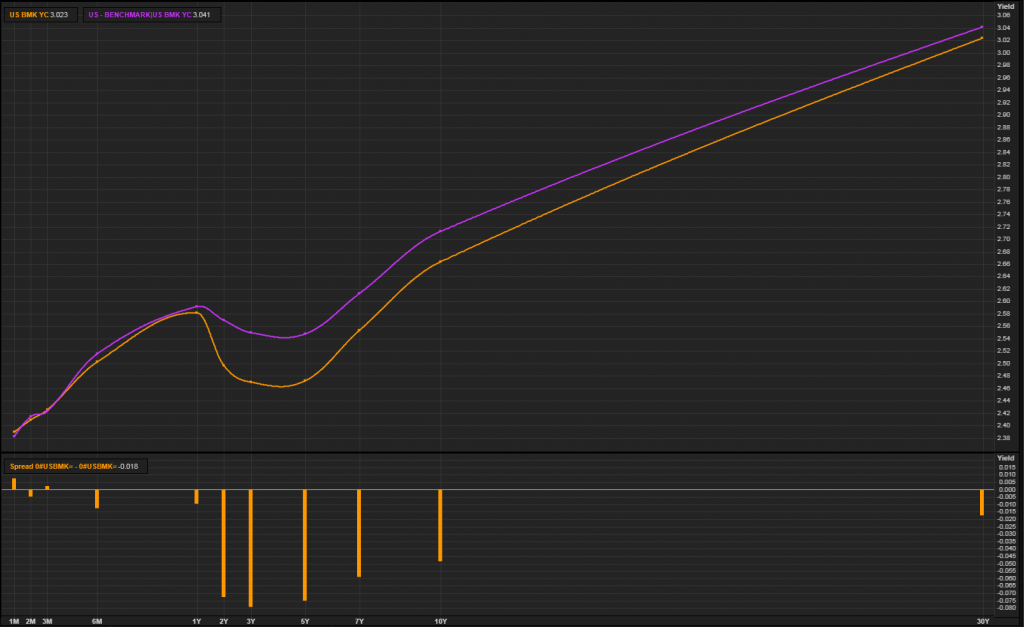

The Fed is a very important factor in keeping investors onside. The central bank has quite clearly become more dovish over the last couple of months and on Wednesday vowed to remain patient on interest rate hikes and flexible with the balance sheet. This may have supported stocks but the yield curve has become increasingly inverted as a result. Investors became very concerned about the inversion in the yield curve in early December due to the recession risk that is typically associated with it.

US Yield Curve – Today (Orange) and Two Days Ago (Purple)

Source – Thomson Reuters Eikon

Powell comments weigh on USD and propel gold higher

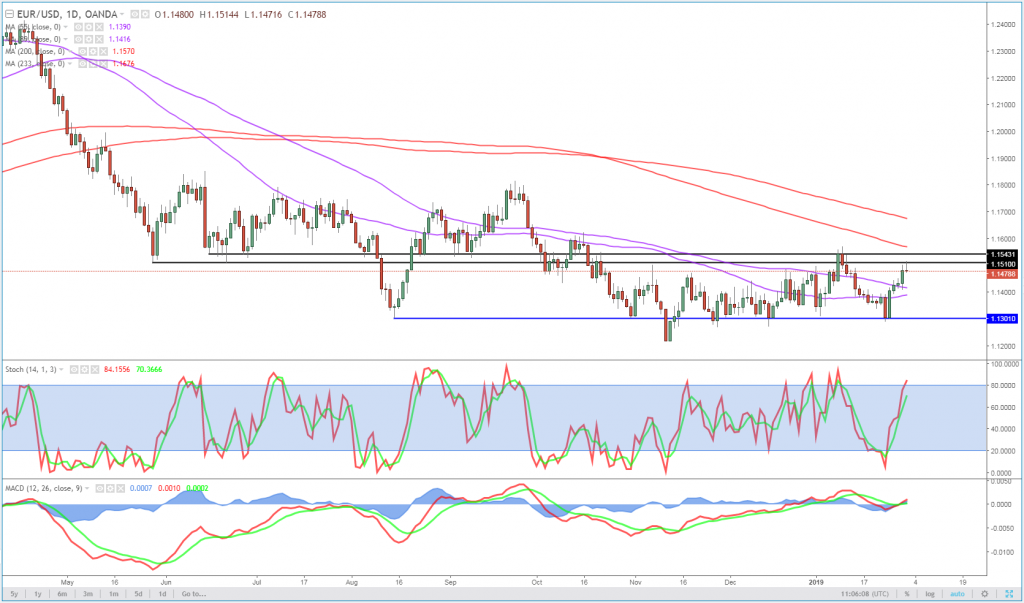

The dollar also softened considerably as a result of Powell’s comments, propelling the euro back above 1.15 in the process. EURUSD has been relatively range bound for the last few months, between 1.13 and 1.15, with both currencies seemingly engaged in a battle to be the weakest. Neither central bank is now expected to be particularly active this year but it seems support for the greenback is dwindling faster.

EURUSD Daily Chart

The weaker dollar is once again providing a bullish case for gold, which is putting pressure on $1,320. This comes only days after it broke through $1,300 following numerous efforts to do so since the start of the year. If $1,320 also falls, then $1,340 becomes the next notable level of resistance, one that may also prove temporary if traders continue to bail on the greenback.

Daily Markets Broadcast 2019-01-31

Oil testing major resistance

A weaker dollar and risk rally on Wednesday was supportive for oil, with WTI and Brent making steady gains to test major resistance. A break through $55 in WTI and $65 in Brent would be a very bullish signal for these and could be the catalyst for more significant upside, with oil having stabilised over the last few weeks following the post-Christmas bounce.

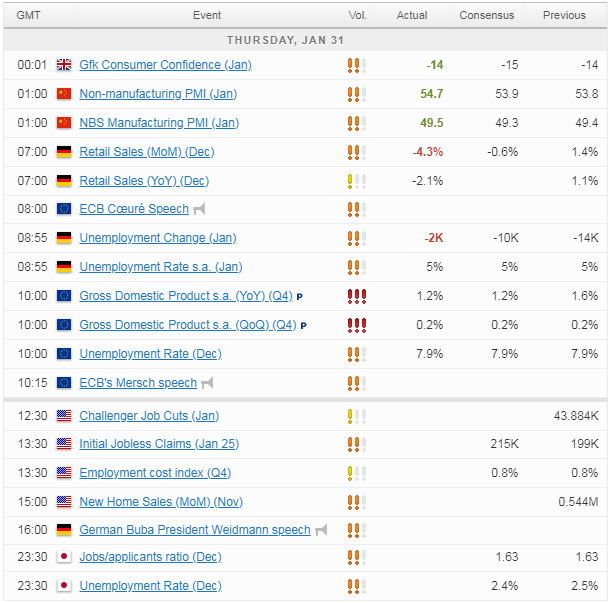

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.