Wednesday January 30: Five things the markets are talking about

The next U.S dollar move will depend on a plethora of factors from this week – investors are looking ahead to today’s monetary policy announcement by the Fed (2:00 pm EDT), at which it is expected to leave interest rates unchanged, any signals about the outcome of Sino-U.S. trade talks over the next 48-hours stateside, and Friday’s non-farm payroll (NFP) release.

This afternoon, investors expect the Fed to incorporate a more cautious approach to monetary policy similar to what Fed chair Powell reiterated in early January when he adopted a market-sensitive tone – the Fed would be “patient” and “flexible” and could hold rates steady in the short-term because of recent market volatility, slower global growth and muted inflation.

Note: Fed funds show the probability of a rate increase this year is +18%, up from +13% in December and that chances of a reduction in rates were +7% this week, down from +8% a month ago.

Chinese trade talks are in Washington this week, and signs of anything positive will have an immediate impact across the various asset classes, especially for Asia. As the bi-lateral talks begin, the Chinese yuan is trading at a six-month high outright.

Regional equity bourses have been trading mixed in the overnight session, even U.S futures have pared some of Apple’s supported gains from yesterday – the company’s forecast was showing stability after a tough 2018.

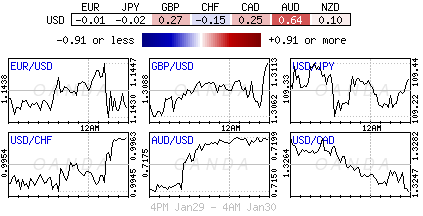

Elsewhere, sterling (£1.3085) is retaining its losses now that PM Theresa May is again tasked with attempting to re-open Brexit negotiations, including a possible delay, with the E.U.

Note: U.K Parliament yesterday backed a proposal to strip out the most difficult part of the divorce package (the hard border) and re-open talks (with people who do not want to chat!) – this stance certainly increases the chances of a messy “no-deal” exit.

On tap: China’s top economic aide, Vice Premier Liu He, will meet with U.S Trade Representative Robert Lighthizer and Treasury Secretary Steven Mnuchin on Wednesday and Thursday. Fed Chair Powell will hold a news conference at 02:20 pm EDT and Microsoft, Facebook and Alibaba announce earnings.

1. Stocks mixed results

In Japan, the Nikkei fell overnight, pressured mostly by ‘big’ pharma plunging after a number of failed clinical trials. Despite Apple’s optimism, the Nikkei share average declined -0.5%, while the broader Topix shed -0.41%.

Down-under, Aussie shares edged higher overnight, supported by mining stocks, however, investors remain cautious ahead of Sino-U.S. trade talks and this afternoon’s Fed announcement. The S&P/ASX 200 index closed +0.2% higher – the benchmark fell -0.5% yesterday. In S. Korea, the Kospi index rallied +1.05%, buoyed mostly by Apple’s earnings.

In China and Hong Kong, stocks were lower overnight amid fresh signs of economic slowdown and as the market questioned authorities’ efforts to boost consumption. Not helping were losses in the tech and media sectors. At the close, the shanghai composite declined -0.72%, while the blue chip CSI300 index lost -0.8%. In Hong Kong, it was a similar story, both the Hang Seng index (+0.2%) and the Hang Seng China Enterprises (+0.03%) ended nearly flat.

In Europe, the FTSE 100 is tipped to open a tad higher after a mildly upbeat session on Wall Street yesterday, and this despite trading in Asia being mixed.

U.S stocks are set to open small in the black (+0.2%). Apple posted Q4 figures that barely beat estimates. The stock is expected to open around +4% higher stateside today.

2. Oil prices unchanged, both Venezuela and growth a problem, gold higher

Oil prices are holding steady ahead of the U.S open, supported by supply disruptions following U.S sanctions on Venezuela’s oil industry, but capped by global growth worries.

Brent crude futures are unchanged at + $61.32 per barrel, while U.S West Texas Intermediate (WTI) crude futures are also unchanged from Tuesday’s close at +$53.30 per barrel.

Note: On Monday, the U.S administration announced export sanctions against state-owned oil firm Petroleos de Venezuela SA (approx. +500k bpd) – this has led to some disruption for oil refineries on the Gulf coast. They have had to seek alternative heavy crude supplies from Canada.

Analysts believe that U.S sanctions against Venezuela will have a limited impact, as markets remain well supplied.

Before the sanctions, Venezuela had pulled down its crude oil production from a peak of +2.5M bpd in 2016 to +1M bpd in 2018. During the same time period, U.S crude oil output increased by more than +2M bpd in 2018 alone, to a record +11.9M bpd.

Capping crude prices is global economic growth concerns, it’s slowing amid a trade dispute between the world’s two largest economies – U.S and China. China has been trying to stem the slowdown with aggressive fiscal stimulus measures, however, there are worries that these efforts may not have the desired effect as China’s economy is already burdened with massive debt.

Ahead of the U.S open, gold prices trade atop of their eight-month highs, supported by Sino-U.S trade worries and on expectations that the Fed is to stand pat today. Spot gold is up +0.2% at +$1,313.96 per ounce, while U.S gold futures have rallied +0.3% to +$1,312.8 per ounce.

3. Sovereign yields rooted to their lows

Eurozone government bond yields trade slightly lower as Brexit uncertainties are making investors nervous. Also aiding lower rates is the market believing that the ECB will not be raising rates any time soon.

The slowdown in the eurozone’s economic growth is especially supportive of German Bunds – the 10-year Bund yield trades unchanged at +0.19% – coupled with last week’s decline in January PMI’s/Ifo is proof that investors should not be expecting an economic revival in the near-term.

Overnight, Euro political developments have ratcheted up new uncertainty for the British economy in the short-term. This morning, interest rate swaps have cut expectations of a +25 bps hike from the BoE by the end of 2019 to +52%, compared to a yesterday’s +64% expectation.

Elsewhere, the yield on 10-year Treasuries have declined -1 bps to +2.71%, while in the U.K, the 10-year Gilt yield was unchanged at +1.26%.

4. Sterling slumps after Brexit shenanigans

The pound has slumped to below the psychological £1.3100 handle outright as the U.K parliamentary vote yesterday still does not entirely rule out a ‘no-deal’ Brexit – PM May is again tasked with attempting to re-open negotiations (including a possible delay) with the E.U. It looks like the Brexit process will ‘go down to the wire’ – the current deadline for the U.K to leave the E.U is March 29. The E.U has been very forthright in their views and what they are willing to accept and not accept. PM May can expect a hostile greeting from its E.U partners as she attempts reopen closed doors.

Down-under, AUD/USD (A$0.7196) firmed overnight after ‘trimmed’ quarterly inflation data showed a slight acceleration (+0.4% q/q and +1.8% y/y), but the quarterly headline number hit +0.5% q/q, the highest for 2018 and more than the +0.4% economists had forecast.

Elsewhere, the yen is little changed at ¥109.34, while the offshore Chinese yuan rose +0.2% to ¥6.7319 per dollar. The ‘single’ unit is at €1.1440, up +0.1% and is expected to continue to trade between €1.13 and €1.15 in the near term as concerns about the U.S economy and Fed’s policy offset eurozone economic weakness, which should curtail most dollar gains and the EUR’s losses. This afternoon, the Fed is likely to reaffirm “patience on rates and its data dependency.”

5. French GDP growth slows in Q4

Data this morning showed that French growth slowed in Q4 as anti-government protests (yellow vests) hit business activity.

The eurozone’s second-biggest economy grew +0.3% in Q4, 2018, down from +0.4% in Q3.

Analysts note that the French slowdown is a sign of how the eurozone is facing economic headwinds fueled by anti-establishment sentiment.

French President Macron is at risk of pushing France’s deficit above the E.U’s mandated +3% limit of GDP in his effort to appease protesters with public spending.

Other economic hotspots could weaken imports from Eurozone members and this includes the U.K – who could exit the E.U without a deal – and China – who’s economy could slow more sharply than expected if the Sino-U.S trade dispute is not quickly resolved.

Ongoing global concerns could easily push the French economy into a recession.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.