Markets flat after trade talks reports

We’re continuing to see caution in the markets on Wednesday, with reports a day earlier regarding trade talks between the US and China only aiding that.

European markets are currently trading slightly in the red while US futures are marginally higher, following a flat session in Asia. Reports on Tuesday that preparatory talks between the US and China ahead of a meeting at the end of the month had been cancelled put a slight dampener on the mood in the markets at a time when we’re already seeing some profit taking, following an impressive four week rally.

This was denied by Larry Kudlow but that appears to have done little to convince, with the stories being reported by what is considered to be reputable media outlets. There’s no smoke without fire seems to be the view in the markets which puts even more focus on the visit of Chinese Vice Premier Liu He at the end of the month.

Promising trade talks has been a key driver of the rebound in markets over the last four weeks and if these talks are stalling and meetings are, in fact, being cancelled, investors may quickly lose confidence. Of course, other factors have also contributed to the improvement in risk appetite, including a more dovish and patient Fed, so I wouldn’t expect a dramatic drop off but the momentum could well be lost.

DAX ticks lower, risk appetite under pressure after IMF forecasts

Gold could drop a little further as USD strengthens on trade reports

The dollar did rise in the aftermath of the reports and while these gains were slightly pared, they weren’t entirely reversed which also suggests traders aren’t entirely convinced by Kudlow’s denial. The dollar has benefited during periods of escalation in the trade war and vice versa, with it peaking around the time of the G20 at the start of December. While this isn’t necessarily an escalation, it is a potential stumbling block which could support the greenback for now.

This is obviously bad news for gold, which has rallied towards $1,300 on the back of a weaker dollar and risk averse trading at the back end of last year. It has temporarily pulled back and while $1,280 has held so far, could drop a little further to $1,260. That said, beyond the near-term price action, I think there are a number of supportive factors for gold which could see $1,300 come under significant pressure again.

Gold (orange) vs USD (purple) Daily Chart

Source – Thomson Reuters Eikon

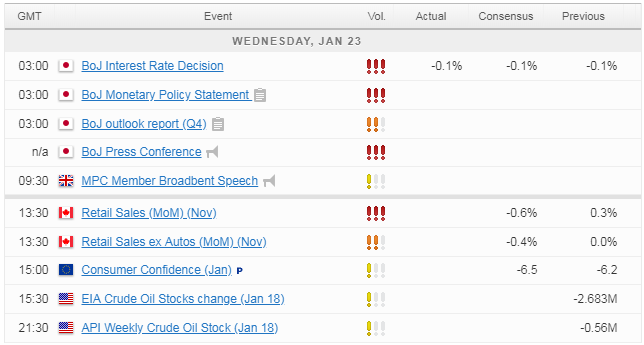

In a week where speculation in driving market sentiment in the absence of any solid news, the economic data and earnings reports could grab a lot of attention. Especially given the more gloomy outlooks people now have for 2019. We’ll get fourth quarter earnings figures from 23 S&P 500 companies today, as well as manufacturing data from the US, consumer sentiment figures from the euro area and retail sales numbers from Canada.

A positive shift in risk in Asia; BOJ adjusts forecasts

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.