Daily Markets Broadcast

2019-01-18

Wall Street firmer on hopes for trade stance shift

Press reports suggested US Treasury Secretary Mnuchin supported lifting some or all of the China sanctions helped US indices higher yesterday. The report was subsequently denied by the Treasury, but the wheels had been set in motion for an uptick in risk appetite. A strong Philadelphia Fed survey also helped.

US30USD Daily Chart

-

The US30 index climbed to the highest level in more than a month yesterday on hopes for an easing in trade tensions

-

The index tested the 55-day moving average at 24,392 for the first time since December 4, but failed to close above it. It’s at 24,380 today

-

US industrial production for December is due today and is seen slipping to +0.2% m/m from +0.6%. Capacity utilization is expected to hold steady at 78.5%.

DE30EUR Daily Chart

-

The Germany30 index eked out small gains for the third straight day yesterday, with most of the advance coming in the latter part of the trading session, helped by the better sentiment on Wall Street.

-

The 55-day moving average at 11,084 is still in focus. It has capped prices since September 28

-

Euro-zone consumer price data confirmed that the index dipped below the ECB’s target level in December, the first time in seven months.

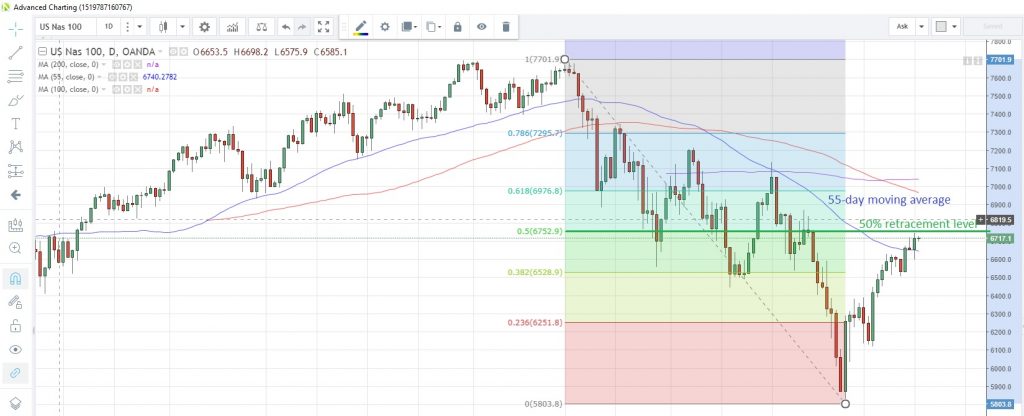

NAS100USD Daily Chart

-

The NAS100 index advance to the highest since December 14 following the conflicting trade tariff press reports

-

The index is looking to test the 50% retracement level of the October-December drop at 6,752.9

-

Fed’s Quarles focused on the strong aspects of the US economy in a speech yesterday, citing December’s “very big number” jobs report.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.