US stocks fell for a second consecutive day after Citigroup kicked off earning season and the US government partial shutdown extends for the 23rd consecutive day. The dollar traded mixed and Treasuries were steady. The S&P 500 index ended the day lower by 0.5%, while the Nasdaq fell 0.9%, and the Dow dropped 0.4%.

Earlier in Asia, risk aversion hit global indexes as Chinese trade data highlighted a bigger slowdown with exports and imports. Economic forecasts were high for softer readings as the frontloading effect was fading away, but the data came in much worse than expected.

Before the New York open, US stocks were lead initially lower after Citigroup, the first major company to report, had mixed results with the top and bottom line. Many traders focused initially on a steep decline in fixed income, a key part of their business. Shares eventually turned positive as many focused on their optimism for 2019. Evercore noted Citi’s results were reasonable and that net interest income, loans and deposits grew nicely.

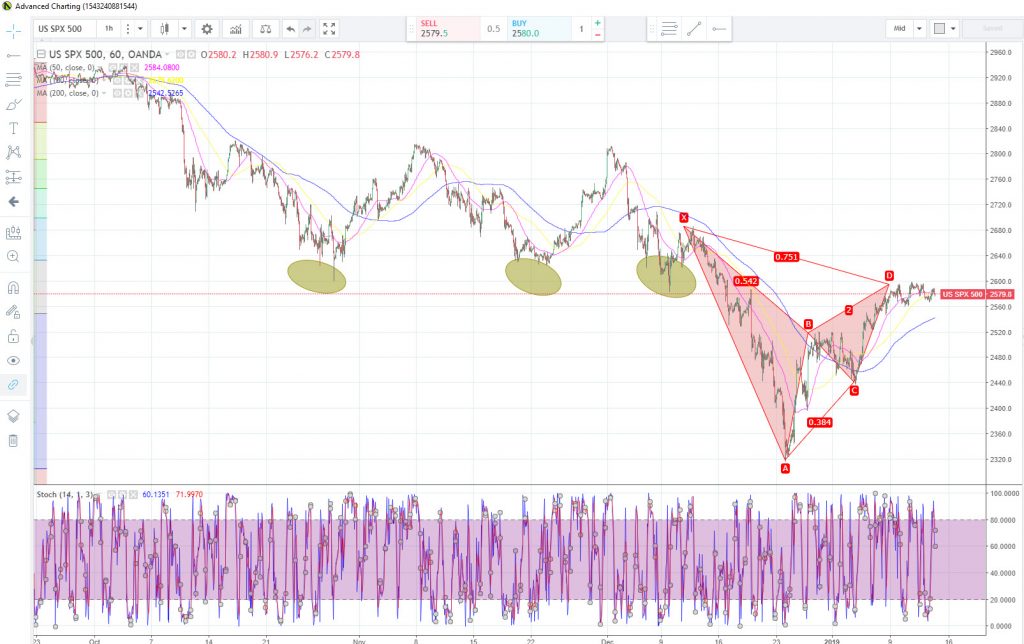

Price action on the S&P 500 index shows that price continues to respect the 2,600 level. This major resistance level also coincides with a potential bearish Gartley pattern. If valid, we could finally see an attempt to test the lows from December. Many analysts have been looking for a retest of the recent lows before we could see another major push higher. If the bearish correction is short-lived, upside could target the 2,680 region. Major resistance lies at the 2,800 level. To the downside, 2,320 remains critical support.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.