Tuesday January 8: Five things the markets are talking about

European equities have found some support along with U.S stock futures overnight as investors’ await developments on trade talks between the world’s two largest economies. While in Asia, equities traded mixed as a rebounding U.S dollar put some pressure on emerging markets.

The ‘mighty’ dollar has recovered a tad after losing ground Monday, rising against most G10 currency pairs, with some positive signs from the first day of Sino-U.S trade negotiations in Beijing (a two-day trade affair).

Despite stronger job numbers stateside and news that Fed may be turning more “dovish,” investors still have plenty to worry about in the short-term – the outcome of U.S-China trade talks remain precarious, as too does U.S lawmakers reaching an agreement on a budget, leaving parts of the federal government shut down for a third consecutive week, while in Europe, the Brexit outcome consumes almost everyone.

On tap: President Trump plans to deliver a prime-time televised address this evening – topics include his ‘wall’ and the U.S government shutdown. Tomorrow sees the release of minutes from the Fed’s Dec. 18-19 policy meeting, while Fed Chair Powell will speak to the Economic Club of Washington D.C on Thursday. In the U.K, the British Parliament resumes a debate on the Brexit withdrawal bill.

1. Stocks mixed results

In Japan, despite the Nikkei loosing nearly half of its intraday gains in the last hour of trading, it was the best performer in Asia for a second consecutive session. The benchmark finished up +0.8%, while nearly half of the broader Topix (+0.5%) subsections ended lower.

Down-under, Aussie stocks ended higher overnight, tracking Wall Street, on hopes that Sino-U.S trade talks will succeed in ending a trade war. At the close, the S&P/ASX 200 index rose +0.7%. In S. Korea, stocks slumped as Samsung flagged an earnings warning that cooled investor sentiment. The Kospi fell -0.58%.

In China, stocks closed slightly lower overnight amid investor caution as U.S and Chinese officials seek to reach a trade deal in Beijing. The blue-chip CSI300 index fell -0.2%, while the Shanghai Composite Index lost -0.3%.

In Hong Kong, stocks rallied a tad. The Hang Seng index rose +0.2%, while the China Enterprises Index gained +0.1%.

In Europe, bourses have gained ground this morning, boosted by optimism over trade talks between the U.S and China.

U.S stocks are set to open in the ‘black’ (+0.42%).

Indices: Stoxx600 +0.48% at 344.52, FTSE +0.55% at 6,848.12, DAX +0.10% at 10,759.35, CAC-40 +0.50% at 4,743.00, IBEX-35 +0.34% at 8,806.35, FTSE MIB -0.01% at 18,950.50, SMI +0.55% at 8,584.80, S&P 500 Futures +0.42%

2. Oil prices steady on trade talk hopes and OPEC cuts, gold lower

Oil prices are stable ahead of the U.S open, supported by hopes that Sino-U.S talks in Beijing might defuse a trade dispute between the world’s biggest economies, while OPEC-led supply cuts also tightened markets.

Brent crude futures are at +$57.42 per barrel, up +9c, or +0.2% from Monday’s close, while U.S West Texas Intermediate (WTI) crude oil futures are at +$48.56 per barrel, up +4c, or +0.1%.

So far in 2019, crude oil prices have benefited from OPEC+ production cuts and steadying equities markets. However, capping prices for the moment is a surge in U.S oil supply, driven by a steep rise in onshore shale oil drilling and production.

Note: According to EIA data, U.S crude oil production rose by an aggressive +2M bpd in 2018, to a world record +11.7M bpd and with U.S drilling activity to remain high, U.S oil production is expected to grow.

Gold is a tad weaker overnight as bets that the U.S Fed will halt its rate-hike cycle and growing optimism over a Sino-U.S trade deal has pushed the U.S dollar higher, while an improved risk appetite by investors is limiting gains for the safe haven metal. Spot gold is down -0.6% at +$1,281.32, while U.S gold futures are -0.5% lower at +$1,283.10 per ounce.

3. Sovereign yields climb

Hopes of a trade deal between the U.S and China is boosting risk appetite and driving German Bund yields slightly higher in a sign of somewhat less demand for safe havens. The 10-year Bund yield is trading at +0.22%, up +0.6%.

Note: Supply will be a key mover of Bunds this week with auctions in Dutch and Austrian bonds, and in German inflation-linked bonds, while Belgium is expected to go ahead with a 10-year syndication (Tuesday).

Elsewhere, the yield on 10-year Treasuries fell less than -1 bps to +2.70%, while in the U.K, the 10-year Gilt yield has gained +2 bps to +1.275%.

Tomorrow, the Bank of Canada (BoC) delivers its monetary policy announcement (10:00am EDT) – according to Bloomberg the chance of a cut from the BoC is up from +17% last week to +20.5%.

At the end of Nov 2018, the market saw a +66% chance of a BoC hike. However, consensus does not expect Governor Poloz to hike rates any time soon.

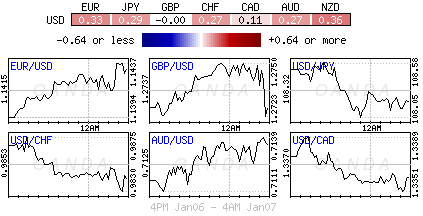

4. U.S dollar reprieve

The U.S dollar is making a recovery after losing ground on Monday; rising against most major currencies this morning, with some positive signs from day one of the U.S-China trade negotiations lifting it particularly against the safe-haven yen (¥108.80).

The EUR is weaker, trading down by -0.3% at $1.1447 outright. The ‘single’ currency also fell after German industrial production showed an unexpected fall for November (see below), although it has pared losses since then.

Sterling continues to trade without a firm direction ahead of the U.S open, with GBP/USD flat at £1.2782 and EUR/GBP falling -0.1% to €0.8966 as the euro is pressured by weak German industrial output data. Exactly one week before the U.K. parliament is due to vote on the Brexit withdrawal bill (Jan 15), the pound remains driven by Brexit developments.

5. German industrial production

Data this morning showed that German industrial production unexpectedly slumped in November, adding to recent evidence that a nine-year recovery in Europe’s largest economy is misfiring.

Production in Germany’s key industrial sector, adjusted for inflation and seasonal swings, fell -1.9% in November m/m. The market had expected a +0.3% gain.

Note: It was the second consecutive monthly fall and comes after data yesterday showed an ongoing decline in new manufacturing orders.

The disappointing data would suggest that trade tensions and weaknesses in EM are putting a brake on Germany’s long running economic upswing, and could delay any move by the ECB to lift short-term interest rates any time soon.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.