(Tempe, Arizona) – Economic activity in the non-manufacturing sector grew in November for the 106th consecutive month, say the nation’s purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

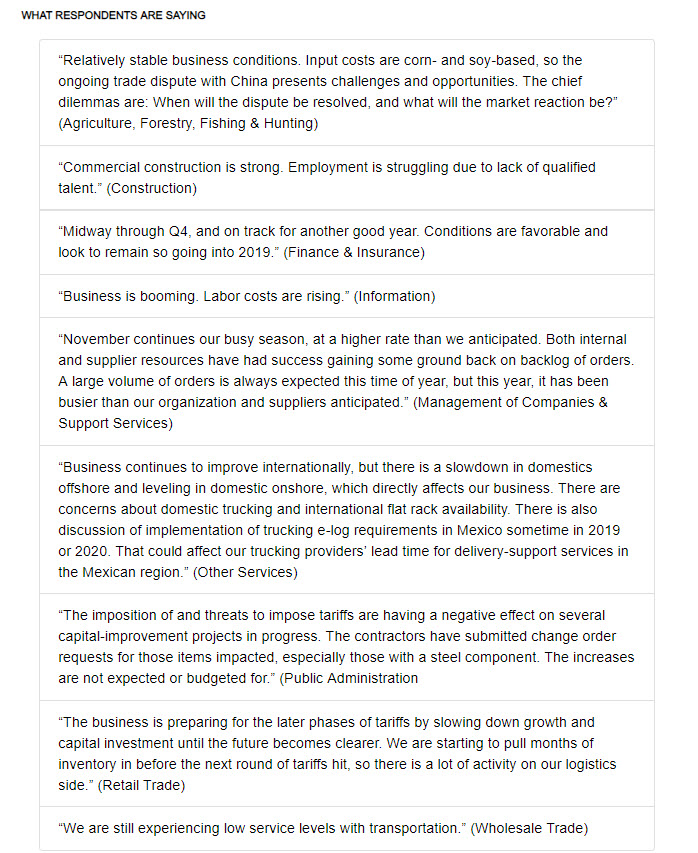

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee: “The NMI® registered 60.7 percent, which is 0.4 percentage point higher than the October reading of 60.3 percent. This represents continued growth in the non-manufacturing sector, at a slightly faster rate. The Non-Manufacturing Business Activity Index increased to 65.2 percent, 2.7 percentage points higher than the October reading of 62.5 percent, reflecting growth for the 112th consecutive month, at a faster rate in November. The New Orders Index registered 62.5 percent, 1 percentage point higher than the reading of 61.5 percent in October. The Employment Index decreased 1.3 percentage points in November to 58.4 percent from the October reading of 59.7 percent. The Prices Index rose 2.6 percentage points from the October reading of 61.7 percent to 64.3 percent, indicating that prices increased in November for the 33rd consecutive month. According to the NMI®, 17 non-manufacturing industries reported growth. The non-manufacturing sector continued to reflect strong growth in November. However, concerns persist about employment resources and the impact of tariffs. Respondents remain positive about current business conditions and the direction of the economy.”

The 17 non-manufacturing industries reporting growth in November — listed in order — are: Educational Services; Professional, Scientific & Technical Services; Health Care & Social Assistance; Transportation & Warehousing; Construction; Wholesale Trade; Real Estate, Rental & Leasing; Management of Companies & Support Services; Information; Finance & Insurance; Retail Trade; Other Services; Mining; Accommodation & Food Services; Public Administration; Arts, Entertainment & Recreation; and Utilities. The only industry reporting a decrease in November is Agriculture, Forestry, Fishing & Hunting.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.