Small bounce expected as shortened week draws to a close

We’re expecting a mild bounce as we approach the European open on Friday, as investors continue to weigh up whether markets look vulnerable or cheap following a volatile start to the year.

This follows another aggressive sell-off a day earlier in the US, which came on the back of the news that Apple has lowered its revenue forecasts due to faster deceleration in China and the impact of a trade war with the US. This naturally feeds into investors deep-rooted fears about the global economy this year and so the impact of the warning stretched well beyond Apple and its suppliers and even, it would seem, into the FX market where the yen was heavily bid.

This has since settled down a little, with Asian markets performing relatively well overnight, the exception being the Nikkei which traded for the first time this year and therefore played catch-up with previous days negativity. It also had to contend with a much stronger yen – which has benefited greatly from this period of risk aversion – which has typically weighed heavily on the index.

More of the same in Asian session

Gold falls just shy of $1,300

Gold continues to perform well in these markets, with its safe haven status shielding it from the broader market declines at the start of the year – and before for that matter. A pullback in the dollar over the last few weeks has also supported gold prices, which fell just short of $1,300 before paring gains as the dollar edged higher. Gold continues to look bullish in the near-term, although we may see some profit taking now after a good run as it approaches an interesting technical level.

Gold Daily Chart

OANDA fxTrade Advanced Charting Platform

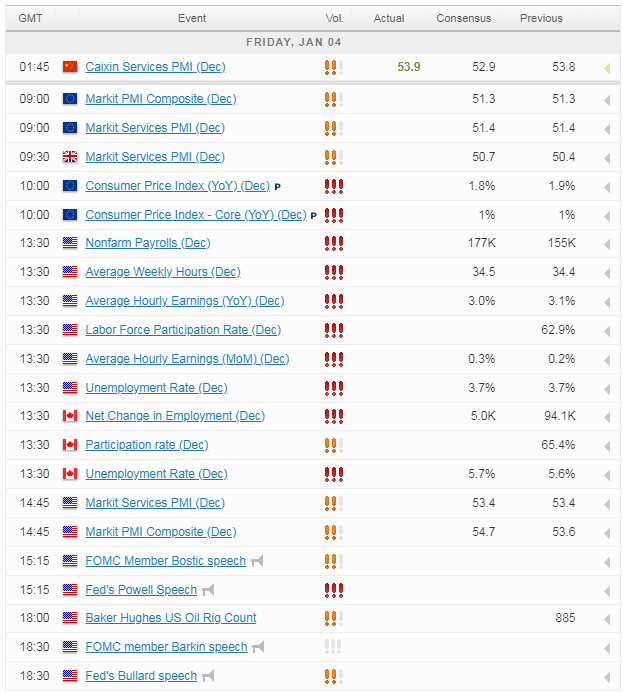

Of course, whether gold surpasses $1,300 today may well depend on the US data and the comments we get from Fed Chair Powell. The US jobs report is widely regarded as the most important economic release each month and offers insight into the world’s largest economy at a time when slowdown fears are heightened. A weaker ISM manufacturing PMI yesterday further fuelled these fears although that could be quickly reversed if we see a strong report today.

Pressure grows for US and China to resolve trade dispute

Jobs report and Powell comments in focus

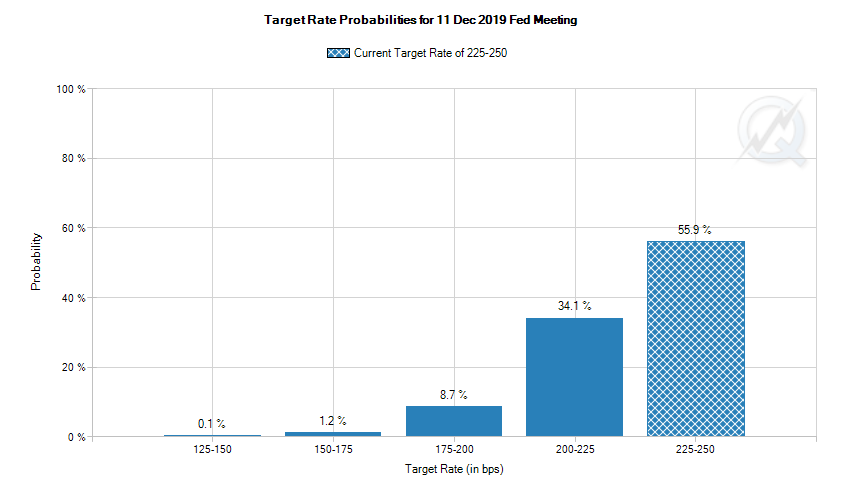

There has been pockets of softness in some US data in recent months, most notably housing, but also retail sales and manufacturing, but the jobs data overall is expected to remain strong. Unemployment is expected to remain at 3.7%, with jobs growth of around 177,000 and wage growth of around 3%. This doesn’t exactly spell panic but I don’t think it will calm investors who are also concerned about the prospect of more rate hikes, having completely priced one out this year.

Source – CME Group

That makes Powell’s comments today all the more interesting, as he appears alongside his predecessors Janet Yellen and Ben Bernanke for a panel discussion. I doubt Powell will use this platform to announce any significant shift in Fed policy but he may address the sizable difference between central bank and market expectations for the coming year.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.