Markets higher ahead of jobs report

It’s shaping up to be a more positive end to what has been another worrying week for investors, with US futures more than 1% higher after recording sharp declines on Thursday.

The rebound is largely being attributed to reports that the US and China are going to resume vice-ministerial level trade talks in Beijing at the start of next week, a move that will hopefully lead to fewer rather than more tariffs and reduce a major headwind for the global economy. Trump has previously claimed that the talks are progressing well, although that may have been said with one eye on the spiraling stock market rather than be a reflection of genuine progress.

It is encouraging that there is real appetite to work towards a solution on both sides though, although whether that will be enough to get a comprehensive agreement over the line is another thing. The Chinese economy is already suffering as a result of the trade war and efforts to support small and private firms this morning with a RRR cut is evidence of that. Markets have been given an extra boost by the news, with the authorities clearly in no mood to be tolerating lower growth even if it goes against their desire to maintain more prudent monetary policy.

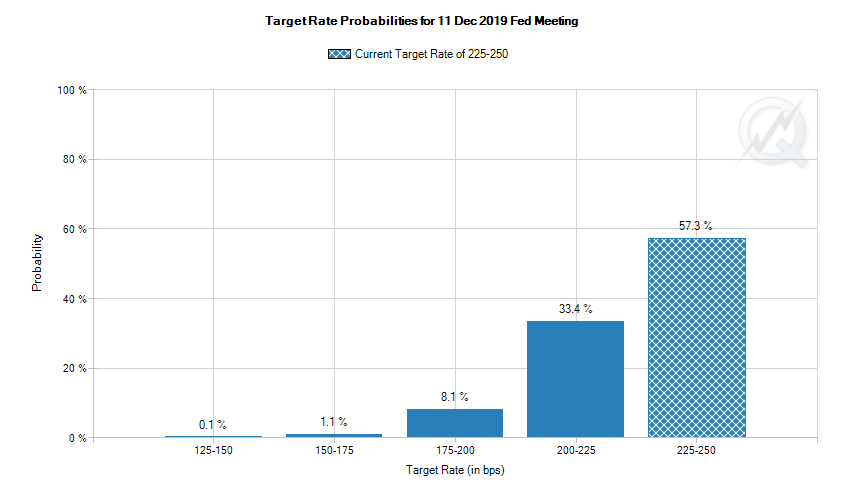

Zero chance of rate hike in 2019

The moves today come ahead of the release of the US jobs report and the first appearance of the year from Jerome Powell, alongside his predecessors in the Fed hot seat, Janet Yellen and Ben Bernanke. At a time when a global growth slowdown is being discussed and Fed interest rate expectations have been significantly pared back – there is now a 0% chance of a rate hike this year according to Fed funds futures – the jobs data has continued to perform well and more of the same is expected today.

Source – CME Group

Should we get another stellar report, with another 177,000 jobs expected to have been added and 3.7% unemployment, is it really the case that three rate cuts is more likely this year than one hike? Especially with the Fed only a couple of weeks ago forecasting two hikes this year. A good jobs report today may not be enough to make a huge different to investor sentiment today but a bad one may fuel further panic that sends stock markets plummeting once again. As ever, a lot of attention will fall on the wages component of the report, although this may be less relevant now with hikes apparently off the table.

Powell’s comments will also be very interesting, given how markets have shifted in recent months. He may see this as an opportunity to drive home the message from the last meeting and try and bring markets more in line with the Fed thinking, although I’m not sure how successful that will be.

DAX jumps on optimism over US-China talks

Profit taking seen in gold

Gold is slightly in the red on the day after falling just shy of the $1,300 level earlier in the session. A weaker dollar and low risk environment are both providing to be very bullish factors for gold but I feel we may have seen some profit taking as we near the next big round number. I don’t see that lasting long though as the risk environment isn’t really improving and the dollar continues to look weak.

Gold Daily Chart

OANDA fxTrade Advanced Charting Platform

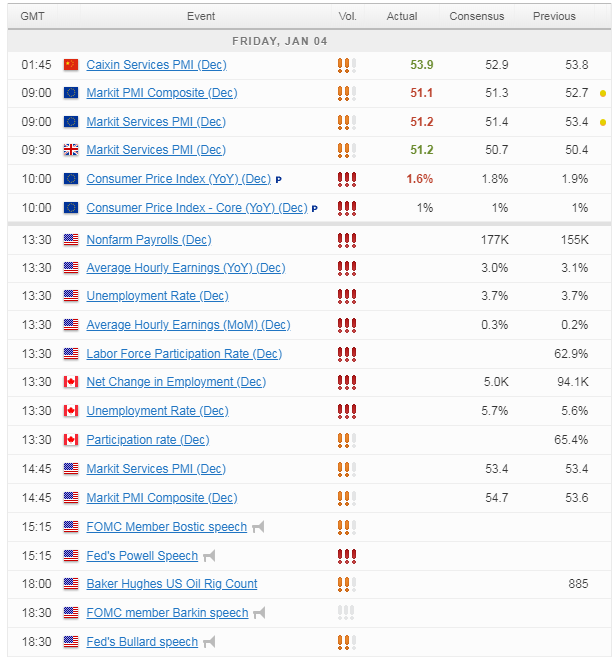

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.