Late surge looking increasingly less likely

Another week draws to a close in the markets and as we approach the end of the year, it’s looking increasingly unlikely that a late Santa surge is going to save what has been an otherwise horrible quarter.

Record highs to correction territory and flirting with a bear market – those that aren’t already there that is – it really has been an extraordinary quarter that’s got investors very concerned about the year ahead. The list of headwinds has been growing throughout the year and sentiment finally caved under the pressure of it all, with Powell’s comments early October being the straw that broke the camel’s back.

We’ve gone from undeterred optimism to widespread pessimism in such a short period of time – as is often the case – and there clearly isn’t much appetite just yet to try and catch this particular falling knife. The Trump administration’s continued hard-line approach with China isn’t helping matters and the prospect of a government shutdown isn’t doing the situation much good either.

Markets trend every which way but up

Brexit on leave while Rome agrees budget with Brussels

With Brexit taking holiday over Christmas, we’ve got from headlines popping out thick and fast to trying to make sense of what’s actually going on and how the next few months are likely to pan out. With there being numerous possible routes and some scenarios involving many of them – election, second referendum, no deal etc – predicting the outcome has become harder than ever. The only thing that looks guaranteed is that the pound is in for an extremely volatile first quarter. So no change there then.

Italy has provided us with some festive good cheer after Rome reached an agreement with Brussels on its budget for next year. The compromise removes one important risk factor for Europe and the government has been rewarded with yields on the country’s debt falling sharply over the last month as both sides closed on a deal.

Will China surprise markets with a surprise cut?

Gold rally continues as oil spirals out of control

Gold has been buoyed by another bout of dollar weakness over the last 24 hours, which has seen the yellow metal break through $1,260 before some profit taking kicked in. A more hawkish than expected Fed on Wednesday did little to deter bearish dollar traders – a list that has been growing as we head into 2019 – who still view another hike next year a coin toss, despite the central bank projecting two in the dot plot.

Source – CME Group

Gold Daily Chart

OANDA fxTrade Advanced Charting Platform

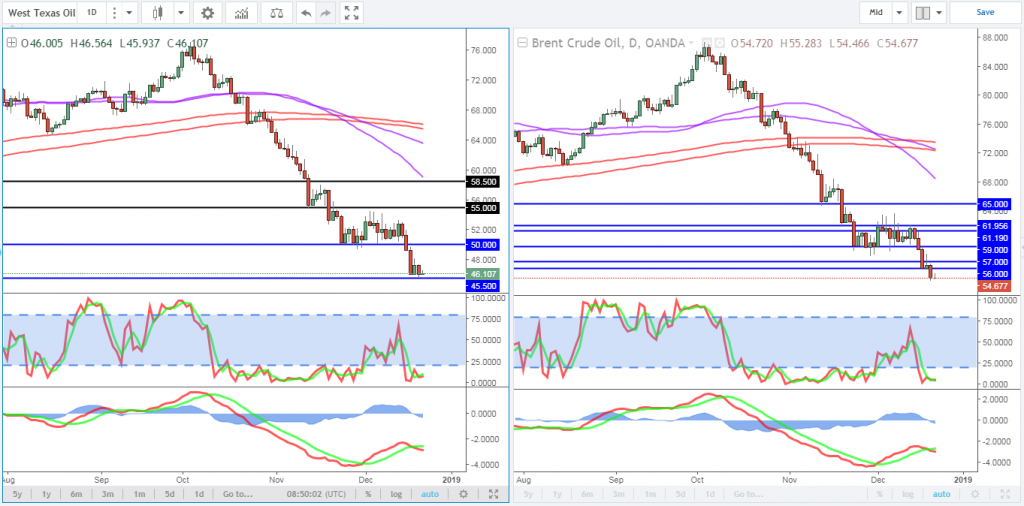

Oil is seeing some relief so far today but continues to suffer from investor gloom on the economy for next year. OPEC and its partners’ efforts to stabilise and boost prices have so far failed miserably, with Brent and WTI remaining stuck in a downward spiral that’s been even more vicious than what we’ve seen in equity markets. The sell-off started around the same time but with oil now off around 40%, it’s been a rough ride for producers.

Oil (WTI and Brent) Daily Chart

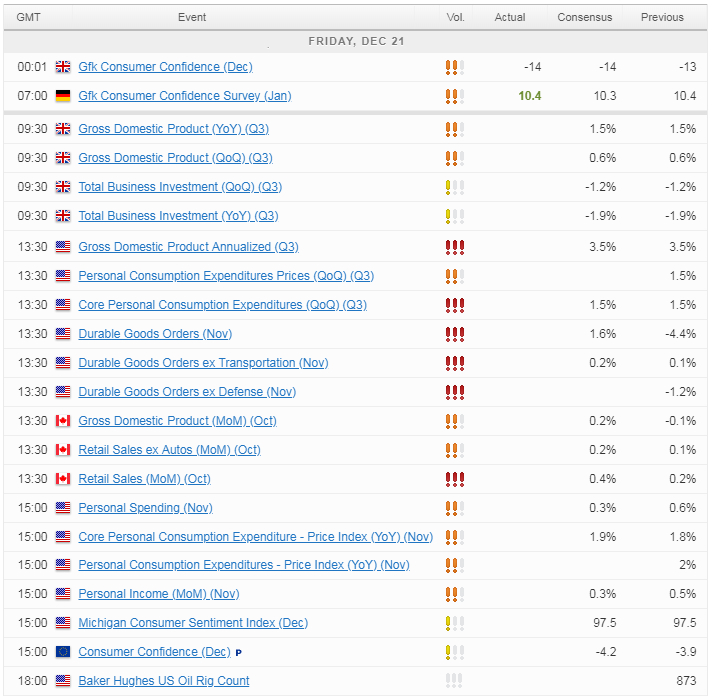

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.