The US Federal Reserve raised interest rates and reduced their rate hike schedule, as widely expected, but they refrained from removing “further gradual increases” from their statement. The statement said, “The Committee judges that some further gradual increases in the target range for the federal funds rate will be consistent with sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee’s symmetric 2% objective over the medium term.”

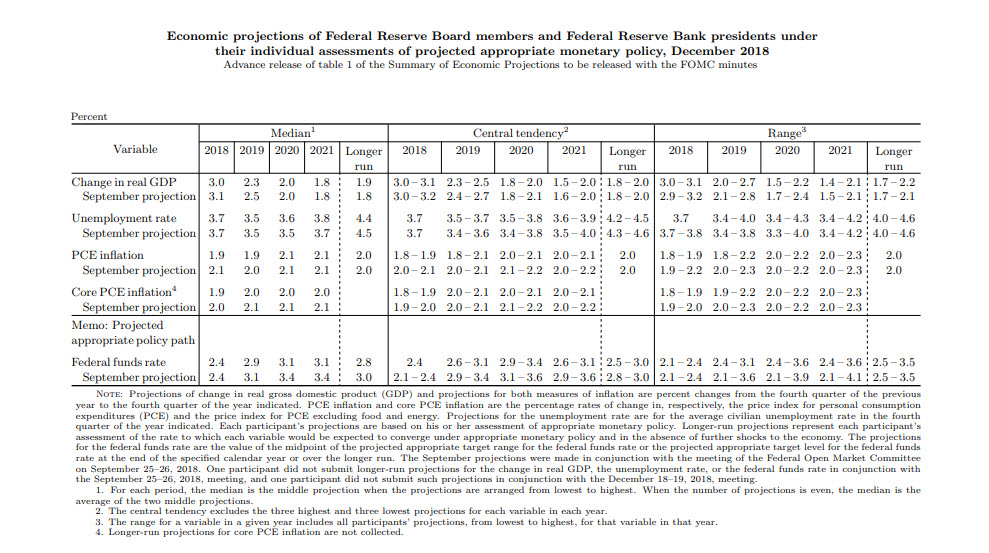

With respect to the dot plots, the Fed delivered. They reduced their 2019 forecast of rate rises from three to two and now see only 4 more hikes through 2021, with one each in 2020 and 2021.The US dollar rallied strongly against its major trading partners after the less-dovish statement.

The euro gave up most of its gains against the greenback and remains back in the middle of the December trading range.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.