The Canadian dollar pared gains against the greenback after the November inflation came under the Bank of Canada’s (BOC) target and at the slowest pace in 10 months. The annual reading fell to 1.7% and was primarily reflecting recent declines in gasoline prices, excluding gasoline, the CPI rose 1.9% in November.

Expectations for the BOC to raise rates at the January 9th meeting has completely changed over the past month. The markets have now completely erased the 25 basis point hike that was fully priced in November. The next hike has been pushed towards the summer.

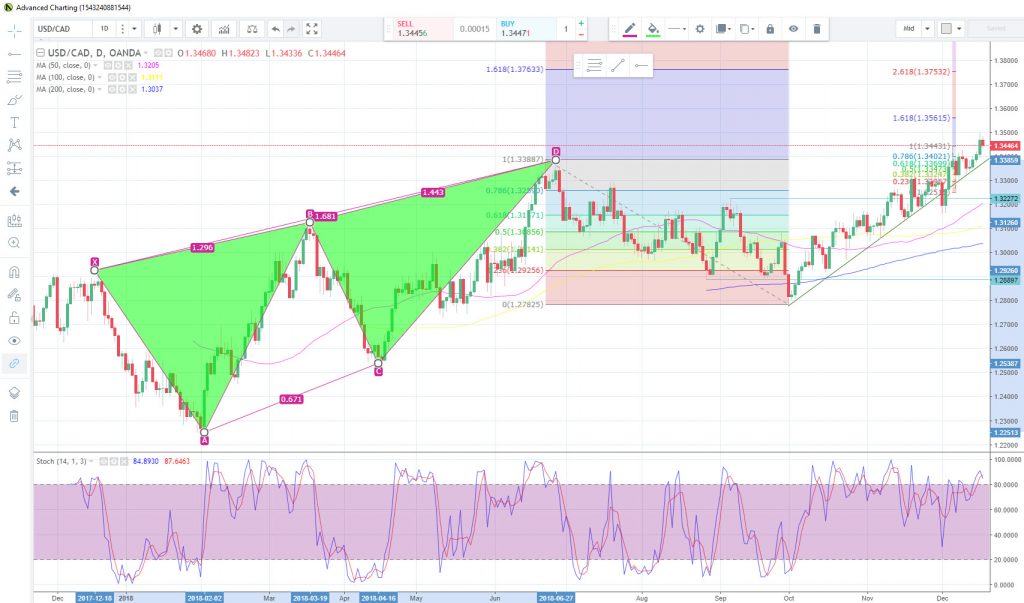

Price action on the USD/CAD daily chart show that 1.3500 level remains critical resistance. If we do see the Fed bring down expectations for future hikes, we could continue to see the loonie extends its gains here. To the downside, 1.3250 remains initial support, followed by 1.3125.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.