Sentiment remains fragile

US equities failed to hold on to gains on Tuesday but they’re taking another stab higher on Wednesday, ahead of the Fed decision later in the day.

Sentiment remains extremely fragile as we approach the end of the year and investors will be hoping that the Fed will bring an end to the sell-off that its Chairman started almost three months ago. While it is harsh to place the blame for the market turbulence solely on Jerome Powell, it was clearly the straw that broke the camel’s back and there is a hope that a dovish announcement today could go some way to undoing the damage of the last few months.

EUR/USD – Euro rally continues as investors expect dovish Fed statement

Can the Fed give us a late Santa surge

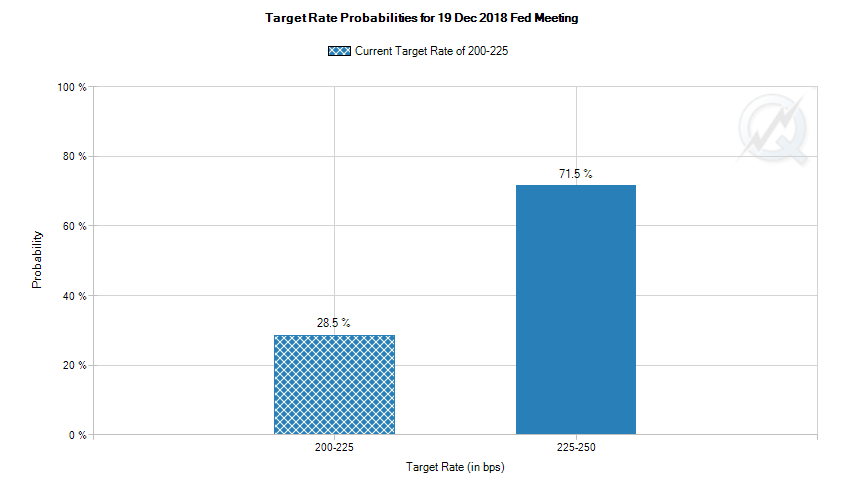

That said, Powell did attempt to clarify his views a few weeks ago but the US yield curve has since become inverted and the sell-off hasn’t abated. Expectations for a rate hike today have since been slipping but investors are still generally confident that the Fed will push ahead with it undeterred and then hold next year. This would represent a huge shift from the September meeting, after which a hike and three more were projected, based on the dot plot.

Source – CME Group

A dovish hike is widely expected today and increases next year reduced to one or two, although I wonder whether they may hold off and surprise the markets. I may not agree with Trump’s constant Fed bashing but he may have a point on this occasion. With the global economy facing lower growth in 2019, including the US, inflation in check and US stocks in correction territory, it may not be the best time to be raising rates.

I don’t think anyone would blame the Fed for taking a break this month and lining up two or three next year, depending on how the economy performs. It may even provide comfort for investors and be the catalyst for a late Santa surge, bringing the year to an end on a more positive not. Of course, this will then naturally attract criticism that the central bank is bowing to pressure from the White House but being independent doesn’t always mean going against the wishes of Trump.

OANDA Business Breakfast with Jazz FM

Plenty of festive cheer in cryto world 12 months after it topped near $20,000

One instrument that is enjoying some festive cheer this year is bitcoin, which is enjoying a third consecutive day of gains, up almost 20% in that time. This time last year, the cryptocurrency was all the hype having just pulled off its high just short of $20,000. What many saw as just another corrective day in an otherwise ruthless rally was in fact the beginning of a miserable 12 months for crypto space. It’s been a wild couple of years for bitcoin, I can only imagine what the next 12 months has in store.

Bitcoin (Bitstamp) Daily Chart

Source – Thomson Reuters Eikon

While the many enthusiasts will be hoping this Christmas will mark the bottom in much the same way that last marked the top, I remain unconvinced. The sell-off has certainly slowed and I wouldn’t be surprised if we see a squeeze higher in the near-term, but I’m not yet convinced that there isn’t still more pain to come in the new year. Bitcoin is still almost 300% higher in the last couple of years which is a quite extraordinary return.

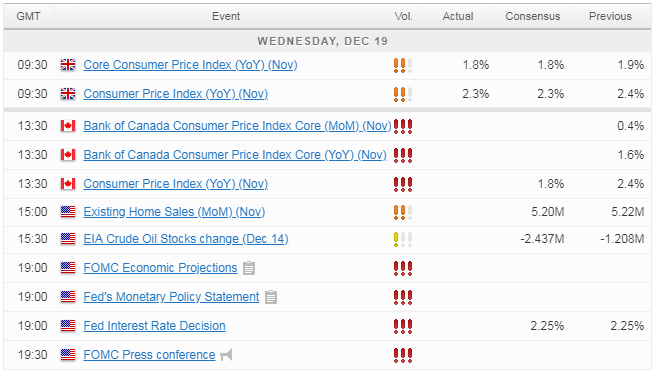

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.