The Federal Reserve’s “quantitative tightening” program, designed to incrementally shrink its balance sheet without disrupting financial markets, could end much earlier than what Chairman Jerome Powell has previously signaled, leading Wall Street firms are saying.

Under quantitative tightening, the Fed is letting as much of $50 billion of its Treasury- and mortgage-backed securities holdings mature every month without replacing them. This takes money out of the financial system as Treasury finds new buyers for its debt. The Fed is quick to point out it is not selling assets which would have a bigger impact on markets.

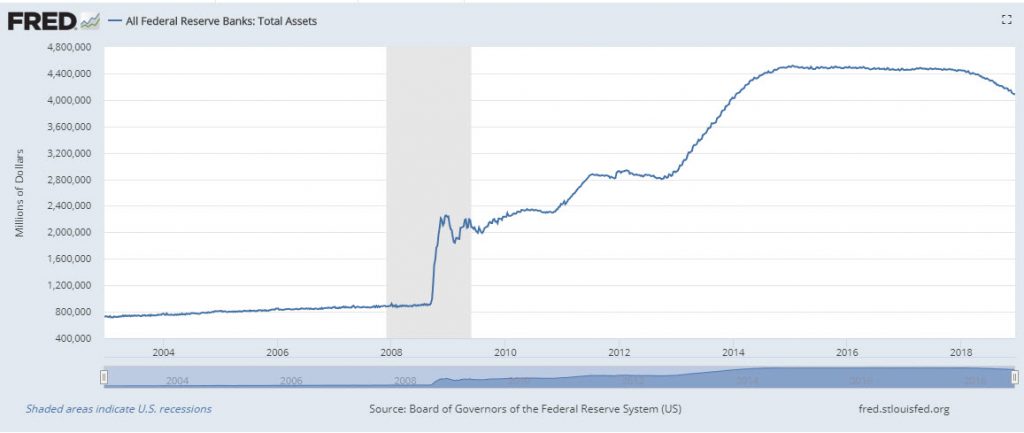

Since beginning the shrinking process in October 2017, the Fed has trimmed its bond portfolio by around $365 billion to $4.14 trillion.

Predictions of an end to the balance sheet shrinkage are coming from economists who work for prestigious Wall Street firms known as primary dealers, or banks who act as market makers for Treasury securities given their ability to buy them directly from the government.

Economists at Morgan Stanley forecast the Fed’s balance sheet will stop shrinking in September., with the balance sheet stabilizing around $3.8 trillion.

Michael Hanson, chief U.S. macro strategist for TD Securities In New York, thinks the Fed will conclude its balance sheet runoff in October, with the balance sheet in a range of $3.6-$3.7 trillion. Barclays sees the program ending in “mid-to-late 2019” with a balance sheet of about $3.8 trillion.

Deutsche Bank’s economic team sees the program concluding at the end of 2019.

To be sure, some Treasury dealers don’t agree.

Economists at UBS see the balance sheet stabilizing in June 2020 at $3.5 trillion.

Brett House, deputy chief economist at Scotiabank in Toronto, said his bank still assumes the Fed’s runoff will last until late 2020 or early 2021.

Fed officials discussed the balance sheet at their November meeting, but the discussion showed there was no consensus “on what a neutral balance sheet is or what it should be,” House said.

Fed officials have never set a for target for the balance sheet. But the end of the balance sheet runoff next year is much sooner than what had been conventional wisdom.

In July, Fed Chairman Jerome Powell said he thought the balance sheet reduction would last until 2020 or 2021, although he said there was a lot of uncertainty about that forecast.

And in his confirmation hearing one year ago, Powell discussed a target range for the balance sheet of $2.5 trillion to $3 trillion. Back then 77% of primary dealers agreed with that forecast.

Now, only a slim majority of primary dealers hold that view.

While it’s tough to say how much recent tighter financial conditions can be blamed on Fed balance sheet reduction, some analysts see the connection.

Markets are pricing in a much more dovish Fed than had been the view at the last Fed policy meeting in November. The yield on the 10-year Treasury, fell below 3% in early December and has stayed there after hitting a 52-week high of 3.23% in November.

At the same time, the Dow Jones Industrial Average DJIA, +0.93% is down 10% from a record close of 26,828 seen in October.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.